Maritime fuel mix could be 25% ammonia by 2050

By Trevor Brown on September 20, 2019

DNV GL published its annual Energy Transition Outlook last week, including an analysis of the shipping industry in its Maritime Forecast to 2050. According to DNV GL, the emission reduction targets set by the International Maritime Organization (IMO) can be met through innovative design using ammonia as an alternative fuel. Widespread commercial adoption of ammonia fuel would begin in 2037; ammonia would the dominant fuel choice for new ships by 2042; and ammonia would represent 25% of the maritime fuel mix by 2050.

This represents new demand for roughly 120 million tons per year of green ammonia by 2050. This outcome greatly depends on how maritime regulations are developed in the coming years, but it would see ammonia-fueled ships represent almost 100% of new vessels (by fuel consumption) from 2044 onwards.

I am not going to summarize the full report here, nor even the maritime section although it includes, among many other topics, a detailed analysis of ammonia’s potential as a fuel and dual-fuel for internal combustion engines. I encourage you to download the reports yourself, which are available at no cost from DNV GL.

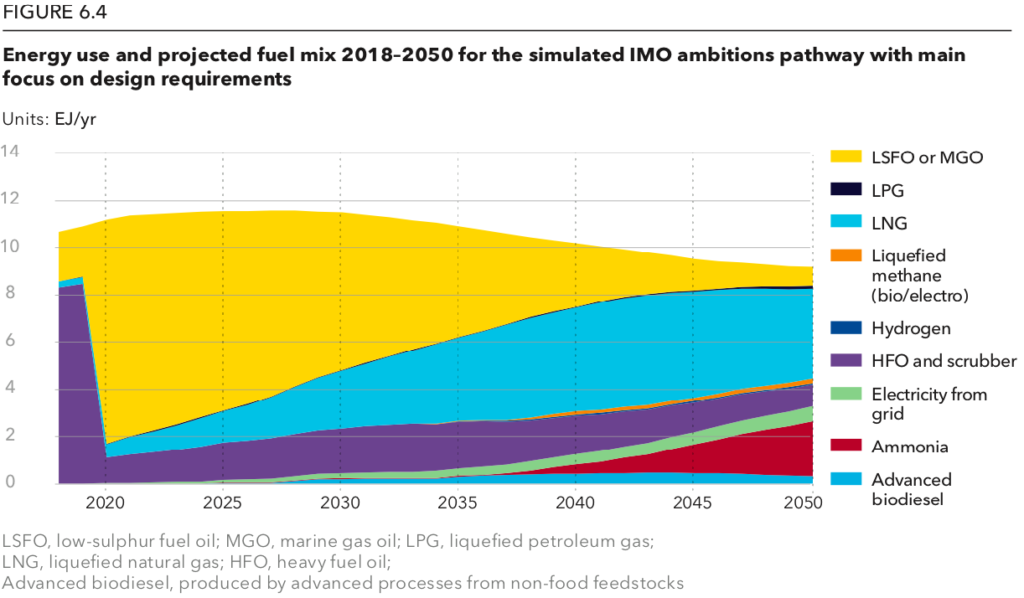

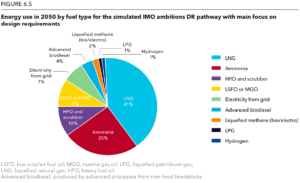

I want to focus this article on a single chart, which shows the evolution of the maritime fuel mix over the next three decades, and the potential market penetration of ammonia in 2050.

25% of the maritime fuel mix in 2050 … how much ammonia is that?

According to this chart, ammonia’s 25% share of the maritime fuel mix in 2050 represents an energy value of around 2.25 exajoules (EJ). DNV GL notes that “1 EJ = 23.9 Mtoe [million tons of oil equivalent] = 278 TWh [terawatt hours].” With an energy density of 5.17 MWh per metric ton (LHV), this 2.25 EJ annual demand would require roughly 120 million tons of ammonia per year.

One of the strong arguments in favor of ammonia as an alternative fuel is that the production and distribution infrastructure is already mature at the relevant scale. These numbers demonstrate the truth of this: no orders-of-magnitude expansion would be required to supply this quantity of carbon-free maritime fuel. 120 million tons is two thirds of today’s global ammonia production. In 1979, global ammonia production was shy of 80 million tons; by 2018 is had risen to 180 million tons (according to my adjustment of USGS statistics). Given that we have expanded global ammonia production by 100 million tons over the last 40 years, it is not hard to imagine expanding global production by another 120 million tons over the next 30 years. (Of course, the existing ammonia industry is still growing; this fuel demand would represent additional growth.)

To achieve this outcome, what regulations will we need?

The report is clear: “Shipping will not meet IMO carbon goals under current policies.”

If the IMO targets are to be met, it is vital that uptake of low- and zero-emission technologies should begin on large ocean-going ships in the near future … With current policy measures only … the ambitions in the IMO GHG strategy are not going to be met.

DNV GL Energy Transition Outlook 2019: Maritime Forecast to 2050, September 2019

This is a statement of the obvious. The IMO only published its Initial GHG Strategy in April 2018, less than 18 months ago, and the regulations that will support its ambitions are still being written. However, what this report makes very clear is that the details of these future regulations will have a huge impact on the future fuel mix.

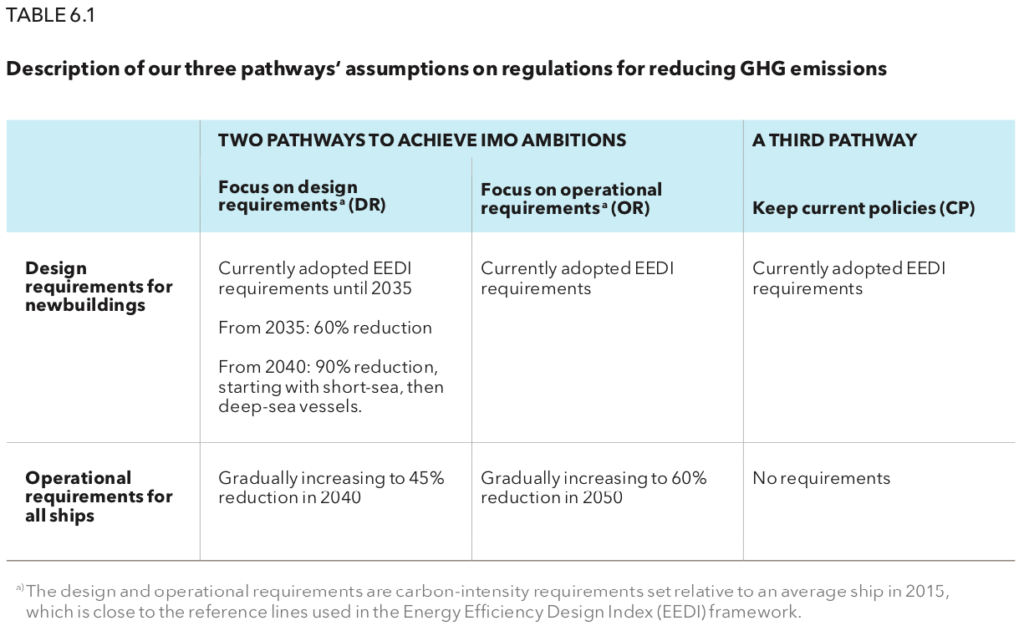

DNV GL models three pathways, two of which achieve the IMO ambitions (defined in the report as “50% GHG-reduction and 70% carbon-intensity reduction in 2050 compared with 2008”). One pathway models the impact of regulations focused on “Design Requirements” (DR), while the other pathway models rules relating to “Operational Requirements” (OR).

In the first of these pathways, the regulatory emphasis is on design requirements, i.e. the requirements placed on the performance of newbuilds. This projection assumes that current ships and those built in the next 20 years will not make a major shift to alternative, carbon-neutral fuels. This will require a complete fuel shift on newbuildings from 2040 to reach the IMO targets. In such a pathway, shipping does not have to consider retrofits and fuels compatible with current converters, and can design newbuildings for the most relevant fuel.

In the second pathway for achieving IMO GHG ambitions, the regulatory emphasis is on the operational requirements, and we explore how a more gradual introduction of alternative fuels on ships in operation could impact differently on the fleet and fuel mix. In this pathway, drop-in fuels such as advanced biodiesel and liquefied biogas (LBG) are preferred to avoid costly retrofits.

DNV GL Energy Transition Outlook 2019: Maritime Forecast to 2050, September 2019

Ammonia captures a 25% share of the maritime fuel mix if regulations focus on ship design (the DR Pathway). If, instead, regulations focus on ship operation (the OR Pathway), ammonia assumes a smaller role, representing the fuel of choice for only around 12% of newbuilds by 2050 and a small fraction of the sector’s global fuel consumption, which is dominated by LNG and its non-fossil counterparts: synthetic renewable methane and biogas (see Section 6.4 and Figure 6.7 in the report). Still, 12% of all newbuilds is a huge number.

The total energy use does not vary much between the pathways modelled, but there are significant differences in the energy mix …

In the IMO ambitions DR pathway (Figure 6.4 and 6.5), the strictest requirements are enforced at a later stage. Initial transition is slower, with lower uptake of LNG. In 2050, the LNG share ends up at more than 40%, with no transition to carbon-neutral methane (Figure 6.5). Instead, due to the stricter newbuild requirements from 2040, the newbuilds run on ammonia (NH3), which in 2050 results in a 25% share of NH3 in the energy mix. Almost 20% of the energy for international shipping in mid-century will come from liquid fossil fuels. The preference for NH3 is due to the lower cost of the converter and storage compared with H2, and the lower price compared with other bio- or electrofuels.

DNV GL Energy Transition Outlook 2019: Maritime Forecast to 2050, September 2019

No matter how these future regulations are designed, however, they will aim to support emission reductions beyond 2050. While the IMO’s Initial GHG Strategy identifies 2050 as the deadline to deliver a 50% reduction in emissions, it doesn’t stop there: the aim is a full 100% emission reduction with a deadline “as soon as possible in this century.” To meet that ambition, a truly carbon-free fuel like ammonia is a prerequisite, and the DNV GL report focuses on two highly relevant concepts for the industry’s transition: “Fuel flexibility as a bridge towards low-carbon shipping,” and “Future-proof ships.”

How can ammonia grow to 25% of global bunker fuels, from less than 1%, in a single decade?

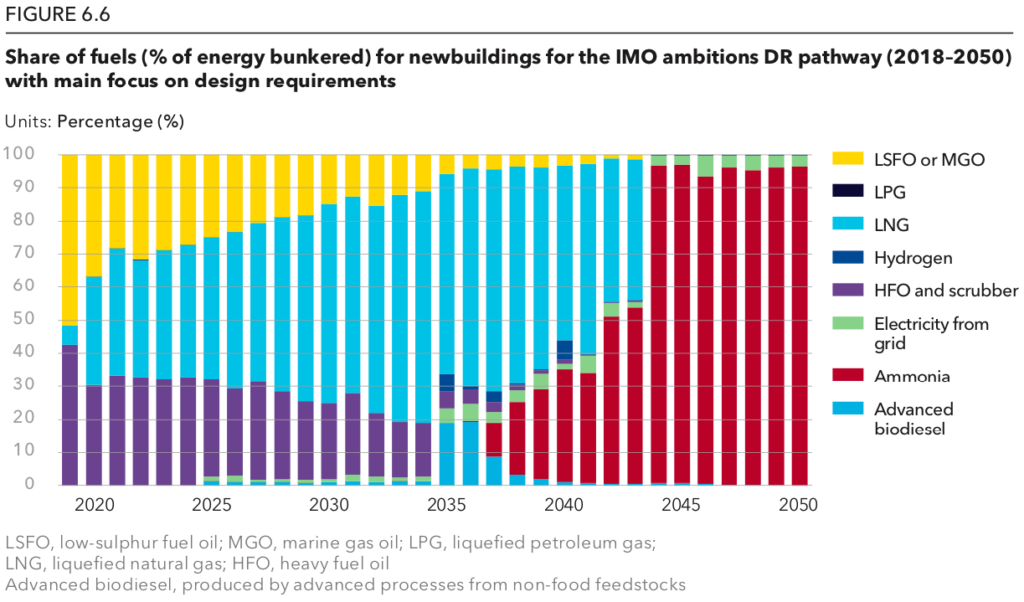

A fascinating supporting chart demonstrates the rate of “newbuildings” (new ships) for each fuel. This is based on the “% of energy bunkered,” which means that, for example, a small number of vast ocean-going freight vessels could dwarf a large number of small battery electric or hydrogen ferries and barges.

According to DNV GL’s analysis of the DR pathway, the fleet of ammonia-fueled ships only begins to be launched at a significant pace in 2037 (prior to that time, presumably, pilot and demonstration projects prove feasibility and drive down technology costs, while tremendous work is afoot to expand supply chains and bunkering infrastructure).

However, the tipping point comes very quickly. Within five years, by 2042, more than 50% of newbuildings use ammonia fuel. Just two years later, by 2044, almost 100% of newbuildings use ammonia.

In the DR pathway focusing on design requirements, the shift in fuel and fuel-converter technology on newbuildings is very abrupt (Figure 6.6). The delayed implementation of LNG leads to the need to shift almost all newbuildings to ammonia from 2040 to 2045.

DNV GL Energy Transition Outlook 2019: Maritime Forecast to 2050, September 2019

Needless to say, in any scenario in which almost 100% of newbuildings use one particular fuel, the industry’s fuel mix must become inexorably dominated by that fuel.

In 2050, nine different fuels claim 1% or more of the fuel mix, demonstrating the tremendous challenges that lie ahead for global bunkering infrastructure. This complexity is part of a transition.

At the end of the transition, according to DNV GL’s DR Pathway, ammonia has come out as the single, dominant bunker fuel. Assuming that the fuel choice for newbuildings continues to be similarly dominated after 2050, ammonia will have perhaps 90% of the maritime fuel mix by 2080 (by which time almost all of the fossil-fueled ships that were operating in 2050 will have become scrap metal).

How steep is the maritime industry’s ‘learning curve’ on ammonia?

This time last year, I wrote about the 2018 Energy Transition Outlook, reporting that DNV GL predicts carbon-neutral fuels, including ammonia, will surpass oil for shipping by 2050. Coming only a few months after the IMO’s Initial GHG Strategy had been announced, scant analysis or understanding about ammonia as a fuel existed within the maritime industry, and DNV GL made no estimate of its share in the future fuel mix, beyond recognizing ammonia as one of many potential “carbon-neutral fuels.”

In the short 12 months since then, a huge amount of analysis has been undertaken on the potential of ammonia to deliver the IMO targets.

In the 2018 edition of this report we estimated that 39% of the energy used by the world fleet should be carbon-neutral by 2050 if the IMO GHG-reduction ambitions are to be met. But we did not specify what types of fuels will be involved. Using an updated model, we now explore this question.

We find that the 2050 fuel mix will be heavily dependent on the specific design of the GHG regulations, and on how fuel prices develop towards 2050. Even minor changes to the underlying assumptions can significantly alter the outcome of our modelling. Consequently, our outlook is an exploration of some potential pathways among many, rather than establishing one main projection.

DNV GL Energy Transition Outlook 2019: Maritime Forecast to 2050, September 2019

Nonetheless, if this much “preference” for ammonia can be found in just one year of analysis, from 2018 to 2019, I believe the future decades hold great promise.

Many of the technologies enabling this transition will be presented at our forthcoming Ammonia Energy Conference, in Orlando, FL, November 12 to 14, 2019. The regulatory issues will be a key focus of the workshops held as part of that event, in a separate session for Industry Members of the Ammonia Energy Association, aptly named the Ammonia Energy Implementation Conference.