Namibia Green Industrialisation Blueprint

By Geofrey Njovu on December 09, 2024

As ammonia adoption as a low carbon fuel and renewable energy vector gathers steam globally, we have reported multiple developments on the African continent. Previous features include Angola, Morocco, Egypt and Kenya.

Here, we look closely at Namibia, where the national government announced the “Green Industrialisation Blueprint” in August this year. The blueprint details the southwest African country’s vision to develop a renewable hydrogen & ammonia industry, leveraging its coastal location and strong wind and solar energy potential. The comprehensive thesis also highlights auxiliary industries that would emerge as a result, unlocking economic growth, skills development and employment opportunities.

The ambition: a green manufacturing hub

Namibia plans to develop an integrated renewable energy ecosystem encompassing energy generation, storage, “green molecule” manufacturing (including ammonia), port infrastructure development and upscaling, and supporting industries. These supporting industries include renewable hydrogen derivatives (ammonia, synthetic fuel & green iron/steel), mineral refinery (rare earth refinery and lithium refinery), and renewable energy hardware (solar panels, wind turbines and electrolysers).

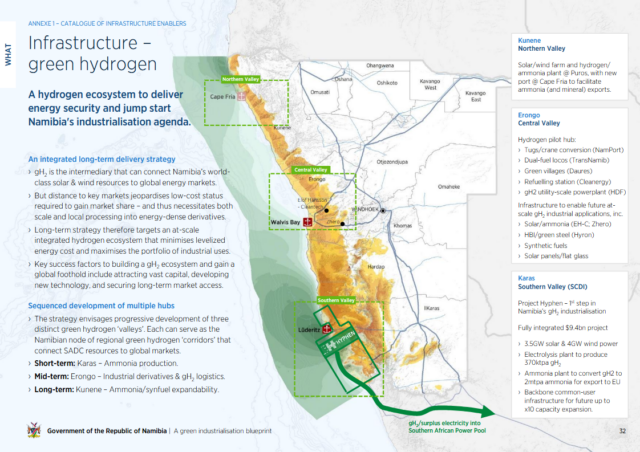

Click to enlarge. Three regions on Namibia’s coast have been earmarked for development as ‘green hydrogen’ clusters. From Namibia Green Industrialisation Blueprint (Aug 2024).

With the overall aim of becoming a renewable energy and green manufacturing powerhouse, targeting markets on the continent and beyond, Namibia has sights on supplying overseas markets in Europe and Asia, where the bulk of renewable hydrogen and ammonia demand is largely expected to be met through imports.

Three clusters on the country’s Atlantic coast have been earmarked as development valleys around which the wider ecosystem is to be built: Lüderitz (south valley), Walvis Bay (central valley) and Cape Fria (north valley). The blueprint features plans to develop deepwater ports with ammonia handling and bulk cargo export capabilities.

The Blueprint estimates that by 2050, the supporting industries would lead to “value creation” of around $7.8 billion. The developments are expected to have significant economic benefits by 2040, including ~$10bn growth in GDP, a total of 250,000 jobs created (185,000 direct & 70,000 from green manufacturing), a quadrupling of national exports to about $20 billion ($12bn from the green hydrogen industry alone) and a growth of FDI to around $55bn. A total of about 75 million tons per year of CO2 emissions would also be abated by 2050.

Renewable energy potential

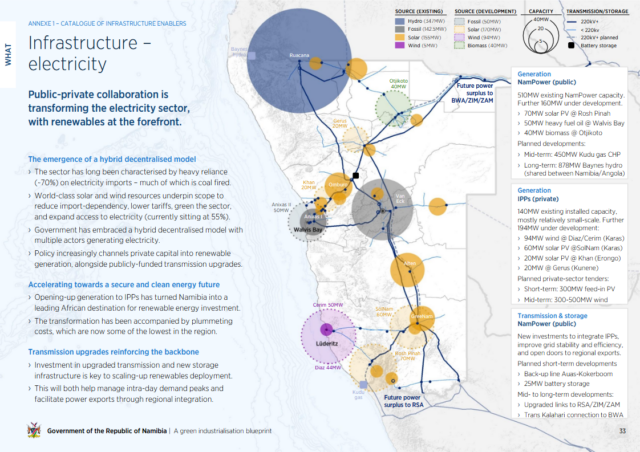

Click to enlarge. Namibia’s decentralised hybrid power generation model will provide incentives to IPPs, complemented by publicly funded transmission infrastructure. From Namibia Green Industrialisation Blueprint (Aug 2024).

Namibia’s average wind speed is over 5 m/s, with the coastal region averaging about 7 m/s. In Lüderitz where the Hyphen Hydrogen project is located, wind speeds as high as 13 m/s are recorded. These numbers are all considered world-class. The country has a similarly high solar energy potential, with sunshine reaching as high as 3000 KWh per m2 in some areas. Combined, Namibia’s wind and solar energy potential is one of the best globally. To realise this potential and scale its renewable energy generation, Namibia has adopted a hybrid model in which generation incentives are given to IPPs, while transmission infrastructure is developed and upgraded through public funding.

State of play: select projects

In line with the vision set out in the blueprint, pilot projects and partnerships are underway as part of the Namibia Green Hydrogen Programme. Below are a few highlights.

Hyphen Hydrogen: Featured in a recent Project Features webinar and located in Lüderitz, in the southern valley of the country’s west coast, Hyphen plans to develop 7.5 GW of renewable energy (4 GW wind and 3.5 GW solar) to power the production of about 370,000 tons per year of renewable hydrogen and 2 million tons per year of renewable ammonia for the European market (RFNBO-compliant). The ammonia from the project is expected to come online by 2028 or early 2029. The project will be accompanied by common user infrastructure including ammonia-capable ports (3 planned across the country’s Atlantic coast), rail and road infrastructure, allowing scope for an up to 10 times capacity expansion in the future.

Click to enlarge. The Cleanergy project is developing a pilot solar park and renewable hydrogen plant in Walvis Bay, Namibia. Source: Namibia Green Hydrogen Project.

Cleanergy Namibia: A joint venture between Ohlthaver & List and CMB.TECH, Cleanergy has a renewable hydrogen pilot hub underway in the Erongo region. The pilot features the development of a 10-hectare solar park and a 5 MWh battery. The generated solar energy will power a 5 MW electrolyser to produce renewable hydrogen. The hydrogen will then be used to service a refuelling station which will be used by transportation company TransNamib to trial a hydrogen dual-fuel locomotive. Cleanergy has also set up a Hydrogen Academy to build capacity among the local population for new jobs expected to arise from the hydrogen economy. The pilot project is intended to precede a larger, commercial scale project featuring an ammonia factory at the Port of Walvis Bay.

Click to enlarge. The Daures Clean Hydrogen project aims to produce over 1 million tons of renewable ammonia powered by over 5 GW of wind and solar energy from 2027. Source: Daures Clean Hydrogen Consortium.

Daures Green Hydrogen Village: Set for launch by Q1 2025, the Daures Green Hydrogen Village small-scale pilot project intends to produce 18 tons and 100 tons of renewable hydrogen and ammonia per year, respectively. The Daures Green Hydrogen Consortium has also conducted feasibility studies for their commercial scale project and intend to commence pre-FEED. The project aims to massively scale, developing 5.5 GW of wind and solar energy to power 2.5 GW electrolyser capacity and produce upwards of 180,000 tons of renewable hydrogen and 1 million tons of renewable ammonia per year from 2027.

Potential challenges

A key challenge in Namibia will be any increased water stress. Large patches of land in the country are arid, especially on the west coast, making freshwater access a challenge. As this is expected to worsen with climate change, a renewable ammonia value chain in Namibia will require reliable ocean water desalination, and for hydrogen production to not compete with local communities for water sources. The water stress also means the country’s hydropower generation capacity is negligible.

According to the blueprint, relevant common user infrastructure development such as transmission upgrades and port development will be part-funded through public funds. The scale of required investments mean that this may stress the public purse, slowing progress in the overall industry.

Further, the new industries will require mass upskilling of local talent to meet demands. The success of the skills capacity building in the country will play an important role in the realisation of the national blueprint.