Nel Stakes a Claim on Another Key Frontier of Hydrogen Implementation

By Stephen H. Crolius on July 05, 2018

On June 28, Norwegian hydrogen company Nel ASA issued a press release announcing that the company will supply “448 electrolyzers and associated fueling equipment to Nikola Motor Company as part of Nikola’s development of a hydrogen station infrastructure in the U.S. for truck and passenger vehicles.” The Nikola-Nel arrangement is a globally significant step in the process of implementing a full-scale hydrogen energy economy. And although its approach for supplying green energy to hydrogen fueling stations does not involve ammonia, it seems likely it will ultimately help make the case for ammonia as an economically advantaged option for green hydrogen supply.

Nel is an industry member of the NH3 Fuel Association.

As detailed in a 2016 Commercial Carrier Journal article, Nikola was founded in 2014 with the idea of producing class 8 trucks powered by series hybrid drivetrains. The original concept was built around a CNG-powered combustion turbine that would supply power to battery packs and the electric drive motors. In 2016, the company executed a partial pivot from CNG to hydrogen with the announcement that its North American vehicles would be equipped with proton-exchange membrane / polymer electrolyte fuel cells rather than combustion turbines.

After the pivot, Nikola blended back into the crowd of companies that were known to be pursuing reduced or zero-emission offerings for the heavy-duty vehicle market. In the fall of 2017, prominent motor industry players, including Daimler and Tesla, seized the spotlight by unveiling a series of battery-electric trucks. Nikola appeared to be the odd company out with its fuel cell architecture until a game-changing announcement appeared this spring. On May 3, Anheuser-Busch, “America’s leading brewer,” announced that it would purchase “up to” 800 Nikola trucks as an expedient toward the company’s 2025 target for reduced CO2 emissions.

According to its website, Nikola’s sales policy is to include “free fuel” for the first million miles (1,609,000 km) of travel per truck. Current plans call for the development of 28 fueling stations that will “cover over 2,000 miles” (3,220 km). Based on figures in the Nel press release, the electrolyzer count per station will average 16. The figures also suggest that the devices will be A-485s, the company’s highest-capacity units. Nel’s arrangement with Nikola calls for Nel to provide all elements of the fueling station. In addition to electrolyzers, this will include equipment for compression, storage, and dispensing.

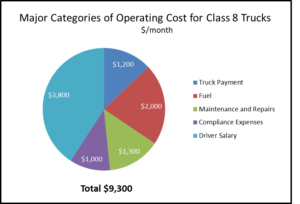

The value proposition for alternative-technology heavy-duty vehicles is simple. As a story on Nikola in the Los Angeles Times put it, “Beyond appealing to environmental concerns, electric truck makers must prove that total cost of ownership will be lower than for diesel-powered trucks, even if electric versions are more expensive upfront.” Zeroing in on this formula, Nikola’s founder, Trevor Milton, made a striking assertion in his 2016 interview with the Commercial Carrier Journal: “It comes down to your bottom line – what does it cost to operate a diesel per month. For a full-time driver it’s about $8,000 to $10,000 dollars a month . . . With our truck, you’re about $5,000 to $6,000 a month.”

Milton’s range for the status-quo cost per month aligns with industry figures for total cost of truck ownership in the U.S. Major cost elements include acquisition of the vehicle; maintenance and repairs; compliance expenses (insurance, permits, etc.); driver salary; and fuel. (See How to Calculate Cost per Mile for Your Trucking Company at right.) For a truck that travels 4,000 miles (6,440 km) per month; realizes average class-8 fuel economy of 6.4 miles per gallon (2.7 km/l); and buys diesel fuel at the U.S.’s current on-road average price of $3.24 per gallon, the monthly fuel bill is $2,000. If hydrogen could be dispensed at $2.00 per kg and consumed with 50% energy efficiency, fuel savings would amount to approximately $1,000 per month.

In electric vehicles, the entirety of the up-front price premium (projected by Nikola in 2016 to be $150,000-$200,000 over the price of a conventional truck) is not typically offset with maintenance savings over the vehicle’s useful life. Given this, it is not clear where the balance of Milton’s $3,000-$4,000 in asserted cost savings would come from. (The Nikola Web site does brag about “nearly 2,000 pounds in weight savings” that could increase vehicle payloads, but it does not indicate how much of this is a sustainable advantage based on a notionally less massive drivetrain.)

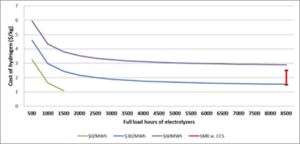

Cedric Philibert of the International Energy Agency has modeled the economics of power-to-hydrogen systems. (This work was described by Ammonia Energy posts on April 21, 2017 and April 27, 2017.) His analysis highlights three important cost drivers: the price of electricity, the utilization rate of plant capacity, and the capital cost per unit of plant capacity. The Nel press release indicates that the all-in capital cost for the Nikola fueling stations will be about $550,000 per installed MW of electrolytic capacity. This is consistent with previously communicated Nel price targets and puts the focus on the lower of Philibert’s two modeled cap-ex scenarios. In his graphed results, the impacts of the other two factors can be seen. On the one hand, there is the potential for aggressive capacity utilization once the full 800-truck fleet is in operation. On the other hand, the price of electricity is apt to be higher than that used to generate Philibert’s curves.

According to the Los Angeles Times article, “Nikola plans to process its own hydrogen fuel at each station with on-site solar power, wind power or by buying electricity created through renewable sources such as hydropower.” The first two options may be difficult to implement in the practical reality of sites along interstate highways or major thoroughfares. A station with 16 electrolyzers will require approximately 35 MW of power. Producing this much electricity from on-site renewables would entail an energy development project that is more substantial than construction of the fueling station itself, starting with the project’s physical footprint. A 35 MW photovoltaic installation, for example, would involve acquiring ownership or rights to 200-300 acres (81-121 hectares) of land. And neither wind nor solar would yield a levelized cost per MWh in the $30-$60 per MWh range shown on Philibert’s graph.

Most likely, Nikola will buy its electricity through the grid in the conventional manner and then turn it green via the procurement of instruments such as renewable energy certificates (RECs). Electricity prices vary from state to state in the U.S., but in no state do the prices for commercial customers go below $75 per MWh. REC prices are also highly variable but in the majority of states that have them, prices range from $10 to $25 per MWh. Nikola’s apparent best-case price for green electricity, then — $85 per MWh – is 40% higher than the value embedded within the top line on Philibert’s graph. It will yield a hydrogen price that approaches $4.00 per kg. This would wipe out Milton’s notional savings from the fuel category.

This point is the crux of the matter for Nikola’s hydrogen fueling strategy. To win A-B’s business, it appears, Nikola took complete ownership, literally and metaphorically, of the fueling component of A-B’s trucking operations. Nikola agreed to site fueling stations at A-B’s stipulated locations, to pay for them, and to build them. And, via their “free fuel” policy, they will take on 100% of the fuel price risk.

With delivery of the trucks scheduled to begin in 2020, Nikola needed a solution with immediate technical feasibility. Ammonia as a hydrogen carrier does not yet fit in that category, given the lack of a commercial ammonia-to-hydrogen high-purity conversion device. Not surprisingly, the company appears to have chosen the solution that is at hand today, not the solution that will deliver the best economics at a point in the future. But given the central role played by economics in Nikola’s value proposition, the company will be under unrelenting and likely existential pressure to reduce costs throughout its value chain, including and perhaps especially in the provision of fuel.

The power-to-ammonia concept may then get a serious look. As articulated by various parties around the world, including but not limited to Philibert, the idea would be to integrate hydrogen production with renewable electricity generation in a way that allows price per MWh, plant scale, and rate of capacity utilization to be co-optimized (e.g., a certain level of power to be supplied for a set number of hours per year at the lowest possible price per MWh). While this will be the likeliest way to realize hydrogen economics in the range shown on Philibert’s graph, it will add one more element to the cost equation: transport of the hydrogen from the production site to the fueling station. And here ammonia appears to be the solution of choice.

If Nikola is indeed on the path to success, the technology chosen for the first 28 fueling stations will not matter very much. In the A-B press release, Milton projects an aggressive roll-out: “By 2028, we anticipate having over 700 hydrogen stations across the USA and Canada.” This is a prospect that should galvanize all of the groups working on high-purity ammonia-to-hydrogen conversion.