Norway’s Aker ASA Takes Aim at Low-Carbon Hydrogen and Ammonia Opportunities

By Stephen H. Crolius on April 21, 2021

In February the Norwegian company Aker ASA joined the elite group of companies with plans to develop multi-GW portfolios of low-carbon hydrogen and ammonia production. In Aker’s case, the goal is to implement projects with cumulative power capacity of 5.0 GW by 2030.

Aker describes itself as an “industrial investment company with ownership interests concentrated in oil and gas, renewable energy and green technologies, maritime assets, marine biotechnology, and industrial software.” At the end of 2020 the total value of these ownership interests was NOK 56.8 billion (USD $6.8 billion). Almost two thirds of this value resides in Aker’s four companies focused on the oil and gas sector: Aker BP, Aker Solutions, Akastor, and Aker Energy. Its maritime asset company (ship charterer Ocean Yield); “marine biotechnology” company (krill harvester Aker BioMarine); and industrial software company (Cognite) between them account for almost a quarter of the value. The remainder (13%) resides in the newest addition to the Aker portfolio, Aker Horizons.

At first glance, Aker ASA seems to be an old-line member of Norway’s industrial establishment. Its shares are traded on the Oslo stock exchange. Its website proclaims that the company “has been a driving force for the development of knowledge-based industry since 1841.” This is all true, but it does not capture the full story. To do that, it is necessary to introduce Kjell Inge Røkke, the individual who owns two thirds of Aker ASA.

Much has been written about Røkke’s rise from fishing boat crew member to Norway’s wealthiest citizen. It is certainly the case that Røkke’s career has involved dozens of investments, asset redeployments, and entrepreneurial initiatives – and a quotient of controversial moments. (A biographical Wikipedia entry includes many colorful passages.) Then, in a 2017 interview with Norwegian newspaper Aftenposten, Røkke announced that he planned to give away most of his fortune. The Wikipedia entry includes an account of steps in this direction undertaken in 2017 and 2018.

All of which sets the stage for the burst of entrepreneurial energy that started in late 2019. Three companies were launched in quick succession. Two were spin-offs of activities already being conducted within Aker Solutions. The first, Aker Carbon Capture, draws on “more than two decades of experience and technology development through our legacy as part of the Aker group” to provide “solutions, services and technologies [that] range from capture, conditioning, transport and utilization through to storage of CO2 and enhanced oil recovery (EOR).” The second, Aker Offshore Wind, “is an offshore wind developer headquartered in Norway with focus on assets in deep waters. With global operations, the current portfolio consists of development projects and prospects located in Asia, North America and Europe.”

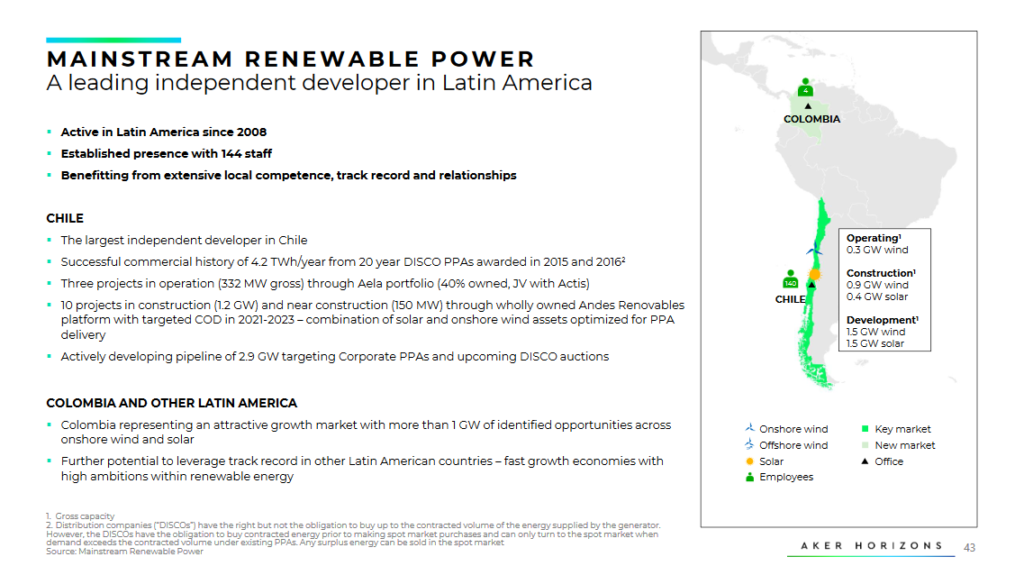

The third company, Aker Horizons, was launched as a “wholly-owned entity of Aker ASA” whose mission is to build “leading companies that can meaningfully reduce CO2 emissions while providing substantial value creation over time.” Aker Carbon Capture and Aker Offshore Wind were the first two companies in Aker Horizons’ portfolio. A third and fourth were quickly added. In January of this year, Aker Horizons acquired a 75% share in Mainstream Renewable Power. Mainstream is a multinational company with Irish roots who develops wind and solar electricity generation projects. The terms of purchase put Mainstream’s value at about €1 billion (USD $1.2 billion). Also in January, Aker Horizons acquired Norwegian hydropower equipment and systems company Rainpower Holding AS.

The business formation juggernaut continued in February with Aker Horizons’ launch of Aker Clean Hydrogen. According to the company’s press release, “With the launch of Aker Clean Hydrogen, Aker Horizons is creating the first pure-play operator within industrial-scale clean hydrogen production, addressing a massive market poised for global growth.”

At the time of launch, Aker Clean Hydrogen already had a portfolio of “nine clean hydrogen projects and prospects with a total net capacity of 1.3 GW under development, and additional pipeline and opportunities of 4.7 GW.” The company’s 2030 “net installed capacity” target of 5.0 GW will support the elimination of “more than 9 million tonnes of CO2 [emissions] per year.”

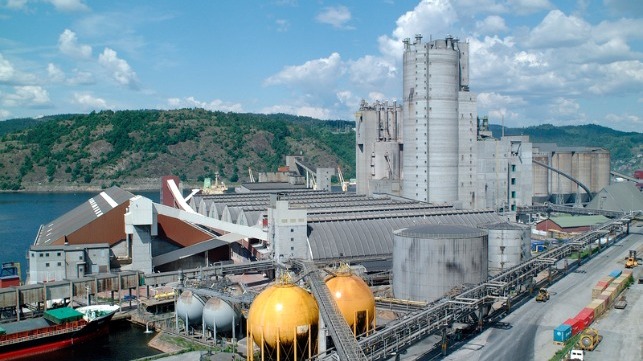

Making up a significant proportion of the capacity under development is a joint undertaking with Yara and Norway’s state-owned hydropower company Statkraft to convert Yara’s ammonia plant in Porsgrunn, Norway to “Europe’s first large-scale green ammonia project.” In a company press release, Yara President and CEO Svein Tore Holsether described the rationale for the partnership: “Yara is a world leader in ammonia, with long experience and leading position within global ammonia production, logistics and trade. With Statkraft and Aker Horizons on board we gain key expertise within renewable electricity, power markets, industrial development and project execution.”

The press release states that the project’s goal is to “fully remove CO2 emissions from ammonia production.” End-use markets that will be targeted with the low-carbon product include “emission-free fuel for shipping, carbon-free fertilizer and ammonia for industrial applications.” The Aker Horizons’ press release also notes that the project “has potential to remove about 800,000 tonnes of annual greenhouse gas (GHG) emissions, representing what could be the largest climate initiative in Norwegian industrial history.”

Two other projects in Aker Clean Hydrogen’s initial portfolio are also worthy of note. Both are in the Southern Cone region of South America. One consists of a collaboration between Aker Clean Hydrogen and Mainstream Renewable Power to “explore the development of green hydrogen and low-cost ammonia production in Chile, combining Aker Clean Hydrogen’s hydrogen project development capabilities and Mainstream Renewable Power’s position as a leading renewable energy developer in the South American country,” according to a February 19 story in Energy Global magazine.

The other builds on Aker BioMarine’s existing presence in Uruguay, where its Montevideo logistics hub is the source of one of the country’s largest export streams. In this project the two Aker companies will work toward “development of a new green ammonia facility … as an enabler for a future zero-emission value chain for Aker BioMarine. The project is also aiming at the wider shipping market in that region.” The maritime application of green ammonia is included in the scope of the Uruguayan government’s recently announced H2U Pilot Project.