Production technology updates: from mega-scale to distributed ammonia

By Kevin Rouwenhorst on November 11, 2022

Historically ammonia plants have increased in size to benefit from economies of scale. The largest current single train ammonia plant has an ammonia production capacity of 3,670 metric tonnes per day, and is operated by SAFCO in Saudi Arabia. Recently, KBR launched its Ammonia 10,000 technology for newbuild ammonia plants, tripling the available single train ammonia plant capacity to 10,000 metric tonnes per day. In our latest Technology Insights article, we explore the other pieces of the puzzle required for mega-scale ammonia, as well as some updates from the other end of the spectrum: distributed, small-scale ammonia synthesis.

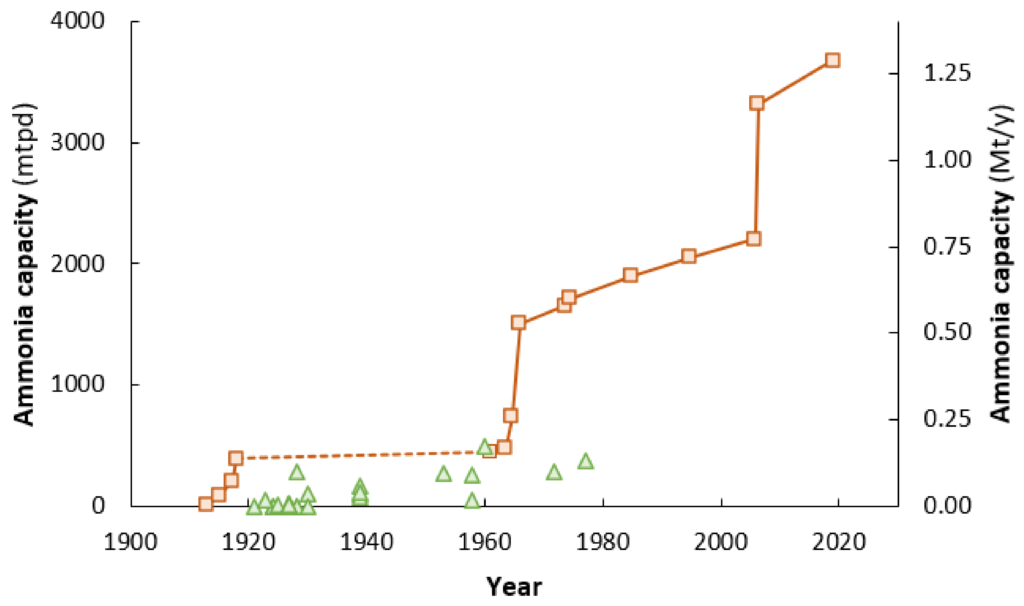

Scale-up of ammonia plants

Historically, scale-up has been facilitated by technological developments, such as the introduction of centrifugal compressors in the 1960s. Global demand for ammonia and fertilizers subsequently increased, confirming that further scale-up was economic. A benefit of scaling up the single train ammonia synthesis capacity is the lower relative capital expenditure (CAPEX) for larger ammonia plants. For example, a size increase by a factor of five typically only results in a CAPEX three times that of the original value.

As mentioned above, the largest operational single train ammonia plant has a capacity of 3,670 metric tonnes per day (ThyssenKrupp Uhde design), equivalent to about 1.3 megatonnes per annum. Various licensors have announced technology for larger capacities, such as Casale’s A6000 technology (5,000 – 6,000 metric tonnes per day), and Topsoe’s SynCOR AmmoniaTM technology (4,000 – 6,000 metric tonnes per day). KBR’s new technology triples the largest operational production capacity, equivalent to up to 3.5 megatonnes of ammonia per annum.

Scaling hydrogen production

Ammonia synthesis also requires scale-up of hydrogen production. Current, fossil-based hydrogen production relies on either steam methane reforming (SMR), or autothermal reforming (ATR) technologies.

ATR benefits more from scale-up than steam methane reforming, and CO2 capture has a lower cost when applied to ATR. Announced ammonia production technologies with a capacity of 4,000 metric tonnes per day and above are exclusively based on hydrogen in an autothermal reformer. Available technology for autothermal reforming would theoretically allow for production of up to 7,000 metric tonnes of ammonia per day. The largest operational ATR-based hydrogen production plant – if utilized for ammonia production – would produce 3,700 metric tonnes per day ammonia equivalent.

Scaling electrolysis & air separation

Renewable ammonia requires separate hydrogen production and nitrogen production. Hydrogen is produced via water splitting in electrolyzers, whereas nitrogen is purified from air via cryogenic distillation in an air separation unit (ASU).

Nitrogen purification via ASU benefits even more from economies of scale than ammonia synthesis loops. A tenfold capacity increase for nitrogen purification only results in a threefold increase of the capital expenditure. Moreover, nitrogen purification is already at the required scale. The largest single ASU was recently announced in China, where Air Liquide will invest around $118 million for its construction. This plant produces enough purified nitrogen to produce 14,925 metric tonnes of ammonia per day.

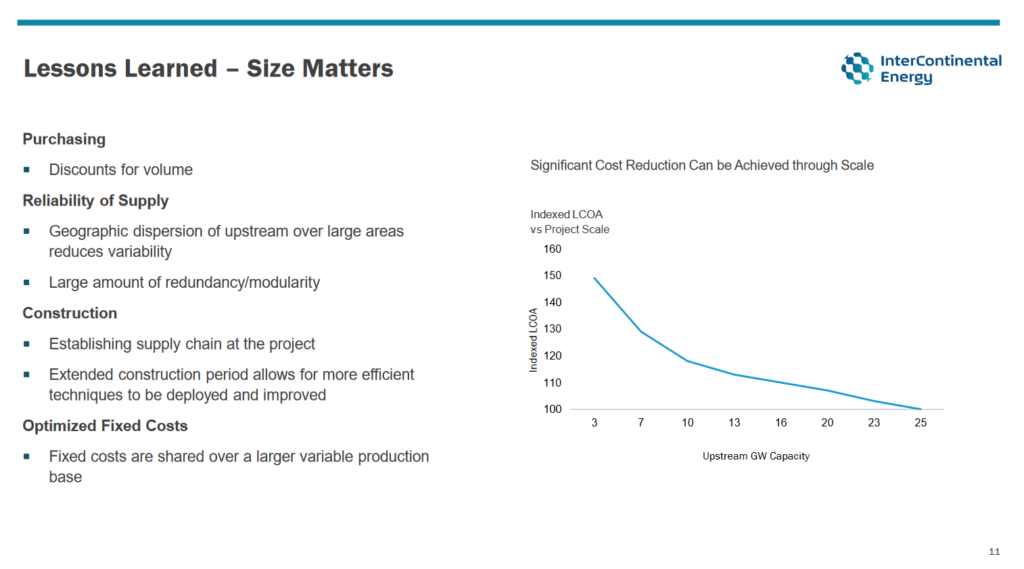

Hydrogen production from electrolysis is modular, just like upstream solar and wind resources. This means that electrolysis systems are not necessarily benefiting from economies of scale. However, project developers for large-scale electrolysis projects may benefit from purchasing discounts, shared utilities and personnel, as well as renewable electricity with a higher overall load factor with reduced variability.

IEA estimates that the global installed electrolyzer capacity will be 1.4 GW by the end of 2022. According to size estimates of Del Pozo et al., a 10,000 metric tonnes per day ammonia plant would require about 5.4 – 7.5 GW of installed electrolyzers. It’s no secret that electrolyzer manufacturing & deployment will need to scale up, and drastically.

Within this decade, the first million tonnes per annum renewable ammonia plants are expected. On the longer term, renewable ammonia “Supergiant” projects have progressed, most notably the Asian Renewable Energy Hub, InterContinental Energy’s extended project portfolio and CWP Global’s projects in Mauritania and Morocco.

From Supergiants to small-scale

At the other end of the scale to the Supergiants, distributed ammonia production systems may prove an essential tool to improve energy & food security, reduce costs for agricultural producers and help deploy ammonia energy solutions in everyday settings. This may be especially relevant for isolated locations without pre-existing ammonia and fertilizer infrastructure nearby, as fertilizer availability and cost are key issues in these locations.

Starfire Energy have just announced completion of a successful, $24 million Series B funding round. Funds will aid the commercialization of their Rapid Ramp© ammonia production system (100 kg per day), which Starfire says requires no hydrogen or energy storage backup to operate. Air, water and renewable energy are the only inputs required.

AmmPower announced successful testing of their Independent Ammonia Making Machine™ (IAMM™) in early November. The demonstration unit produces 50 kg per day of ammonia, which will be scaled to 4 metric tonnes per day for the commercially-available IAMM™ units. Assembly of the first units was due to begin last month in Michigan, USA.

And FuelPositive are in the final stages of validating a demonstration unit for its containerized, point-of-use ammonia production system. Once the tick of approval is given, the system will be installed and commissioned on an 11,000 acre crop farm in Manitoba, Canada for extensive field testing. The 300 kg per day system is set to be “farm-ready” by the end of the year.