Renewable ammonia exports from Brazil: Project Iracema

By Kevin Rouwenhorst on January 14, 2024

In our November 2023 episode of Ammonia Project Features, Jonas Rechreche (Proton Ventures), Matheus Kleming (Casa dos Ventos) and Ricardo Gedra (CCEE) discussed grid-connected renewable ammonia production in Pecem, Brazil. The recording is available on the AEA’s Vimeo channel, and you can download the speaker presentations here.

Brazil currently produces about 1.5 million tonnes of ammonia per year over four manufacturing locations, accounting for about 1% of global ammonia production. Among these, Unigel operates a 480,000 tonnes per year plant in Camaçari. Recently, it was announced that 60 MW of grid-connected alkaline electrolyzers supplied by ThyssenKrupp Nucera, for 60,000 tonnes of ammonia per year.

Brazil’s unique electricity profile

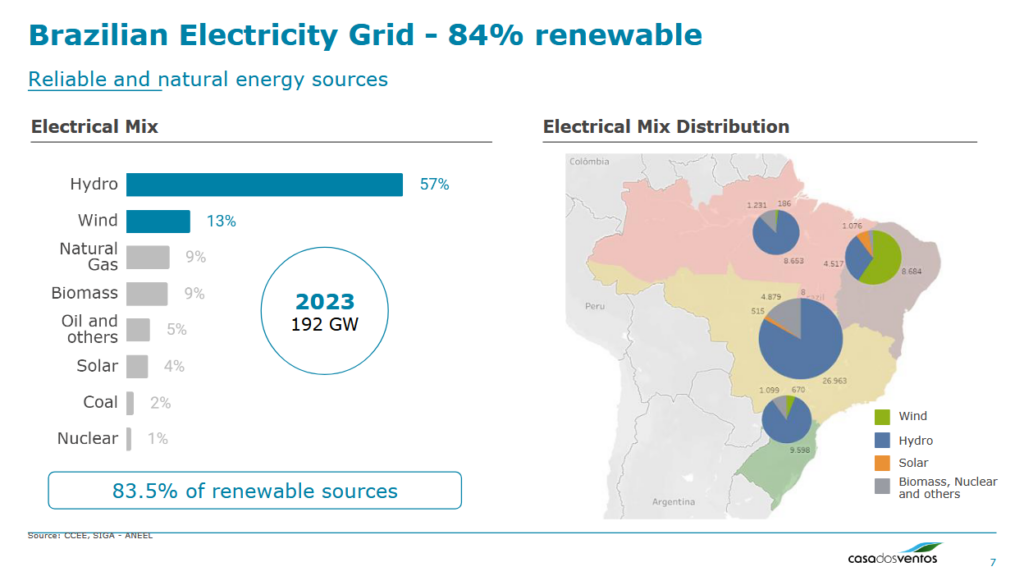

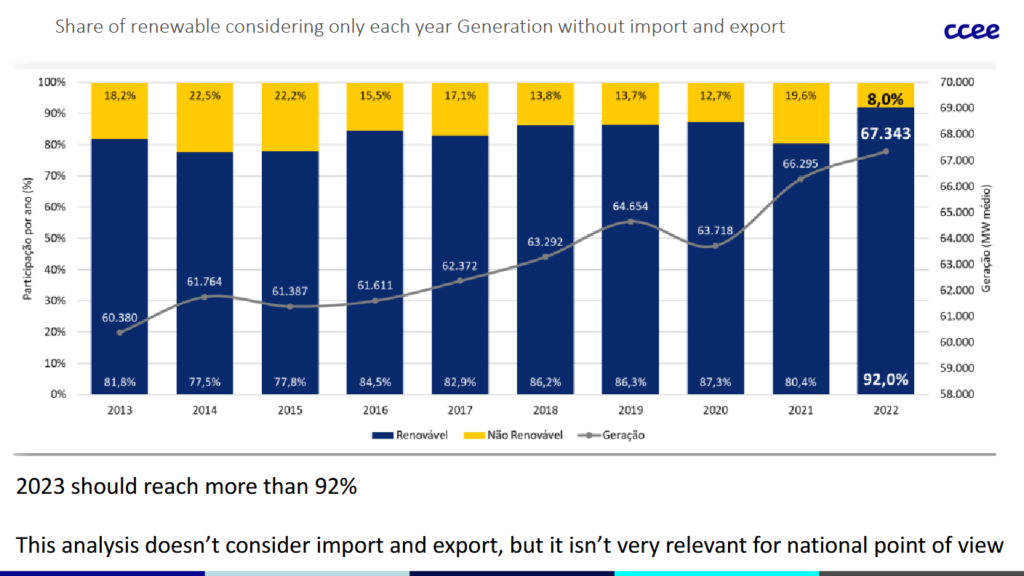

Brazil has a high penetration of low-carbon electricity generation in its national grid, with nearly 90% of its annual electricity generated from renewables (hydropower, wind, solar), biomass, and nuclear. The Brazilian electricity grid is divided into four regional “submarkets”, with Pecem located in the north-east. The submarkets are highly interconnected, and there is a direct connection from northern Brazil to Southern Brazil via a high voltage direct current (HV DC) connection. Within the north-east submarket, wind accounts for the majority of electricity production.

The high renewables penetration in the Brazilian grid may allow for grid-connected electrolyzers to operate continuously and remain compliant with renewable hydrogen requirements from the EU. This considerably decreases the investment cost of the renewable ammonia plant.

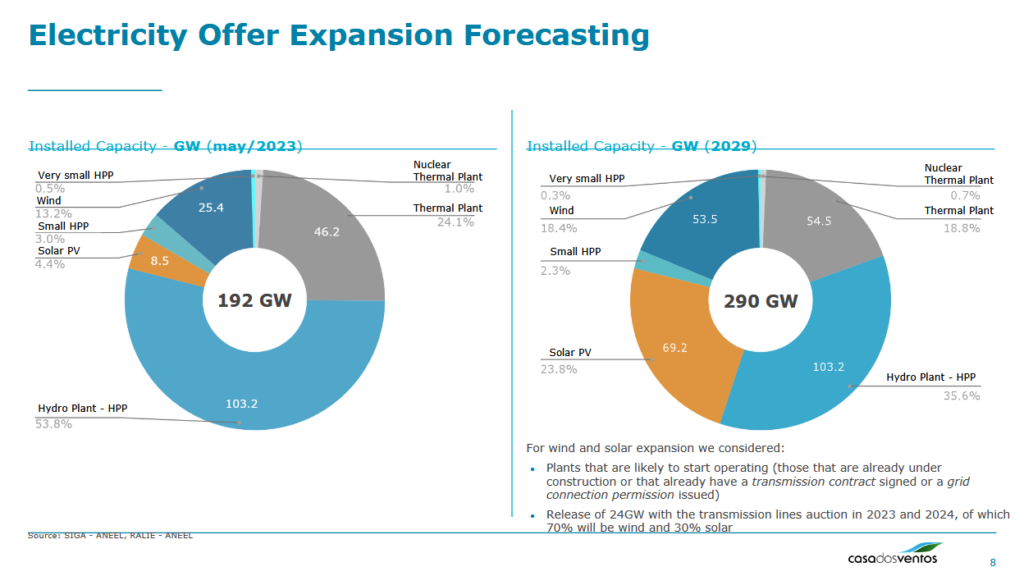

As of 2023, the Brazilian grid has 192 GW of installed electricity generation capacity. This is set to increase to 290 GW by 2029, mainly driven by growth in solar PV and wind energy. The average electricity demand was 73.3 GW in 2022, which is set to grow to 106 GW due to new markets, such as electrification of industry (including aluminum and ammonia production), as well as electric mobility. Additional capacity for large-scale hydropower is not likely, due to environmental restrictions on new projects.

Electricity prices are set on an hourly basis in Brazil. This is based on the demand, power plant operational restrictions, hydropower inflows, reservoir levels (dependent on El Nino-La Nina cycles; major factor in electricity prices), renewable power generation (known as “net load”), electricity generation availability, and transmission availability. The spot price is called the “Settlement Price for Differences (PLD)”.

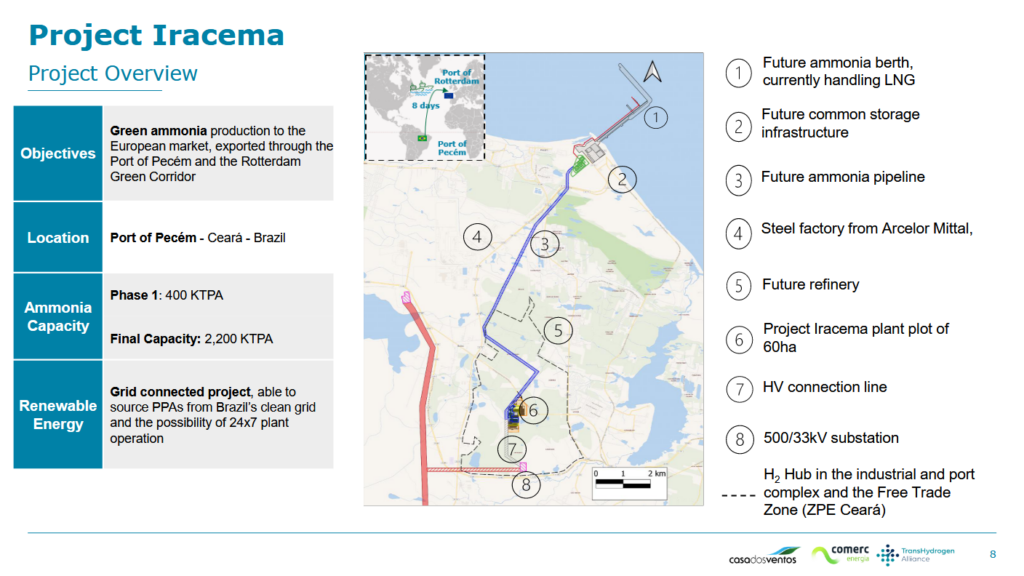

Project Iracema

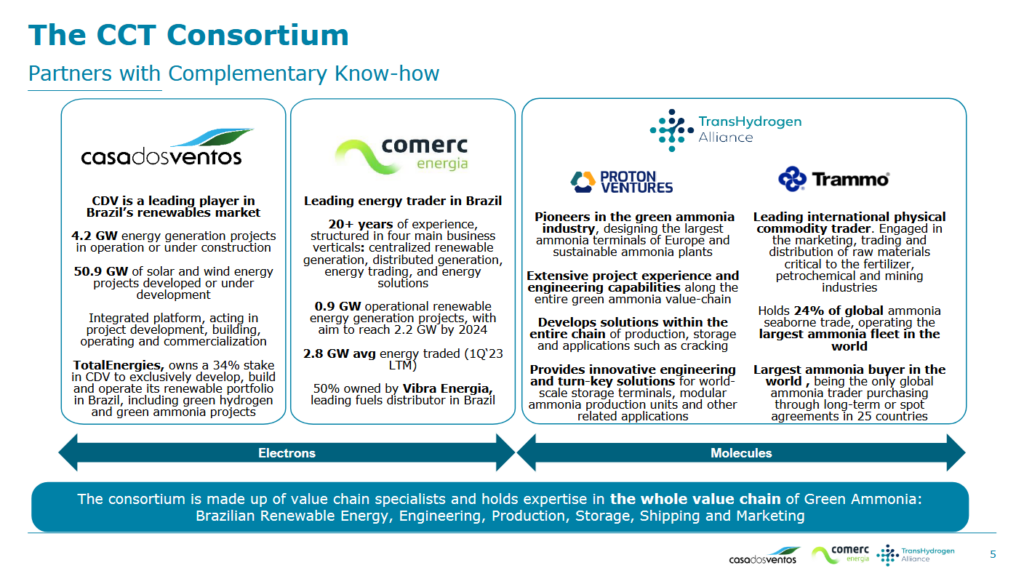

The port of Pecem in the north-east of Brazil is a special economic zone. Pecem already features a container port, an LNG terminal, and co-located steel production. The Port of Rotterdam has a 30% share in the Port of Pecem, and a green hydrogen corridor between the two has already been proposed. Combined with favourable solar & wind conditions and supported by baseload hydropower, Pecem is a very attractive location for renewable ammonia production. Numerous organisations are developing renewable ammonia projects in Pecem, including the consortium of Casa dos Ventos, Comerc, and the TransHydrogen Alliance (“Project Iracema”).

Project Iracema aims to produce a total of 2.2 million tonnes of grid-connected renewable ammonia per year. The consortium includes various companies all the way along the renewable ammonia production value chain – from the renewable electrons to the delivered ammonia at its end destination. This includes local experts Casa dos Ventos (electricity generation) and Comerc (electricity trading), as well as Netherlands-based Proton Ventures (ammonia production) . A pre-FEED MoU was signed in the Dutch embassy in Brasilia in February 2023, and the project had the chance to be presented as a flagship project for the Green Port Partnership signing ceremony during the World Hydrogen Summit in May 2023. This ceremony was attended by Mark Rutte, the Prime Minister of the Netherlands.

Casa dos Ventos is the largest renewable developer and generator in Brazil (TotalEnergies is a major shareholder). Over 50 GW of projects are under development, with 4.2 GW built or under construction. Comerc is the largest electricity trader in Brazil. Proton Ventures is an engineering and design company focused on ammonia, with expertise along the ammonia value chain.

The first phase of the project will produce 400,000 tonnes of renewable ammonia from grid-connected power, with a total power requirement of about 540 MW, of which 450 MW is required for electrolysis. The ammonia plant will have a daily capacity of 1140 metric tonnes per day. The pre-FEED will be finalized by 2024 Q1, and the FEED phase will commence thereafter, until early 2025. The plant will commence operation toward the end of 2027.

The produced ammonia will meet certification requirements for the EU’s RFNBO (renewable fuels of non-biological origin) legislation. The project will also contribute directly to the REPower EU objectives to import 10 million tonnes per year of hydrogen equivalent RFNBOs by 2030. The grid-connected, continuous production implies little fluctuations in production and low technical risk, and therefore volume guarantees. Various options are being considered for the electrolysis technology type.

Power supply strategy

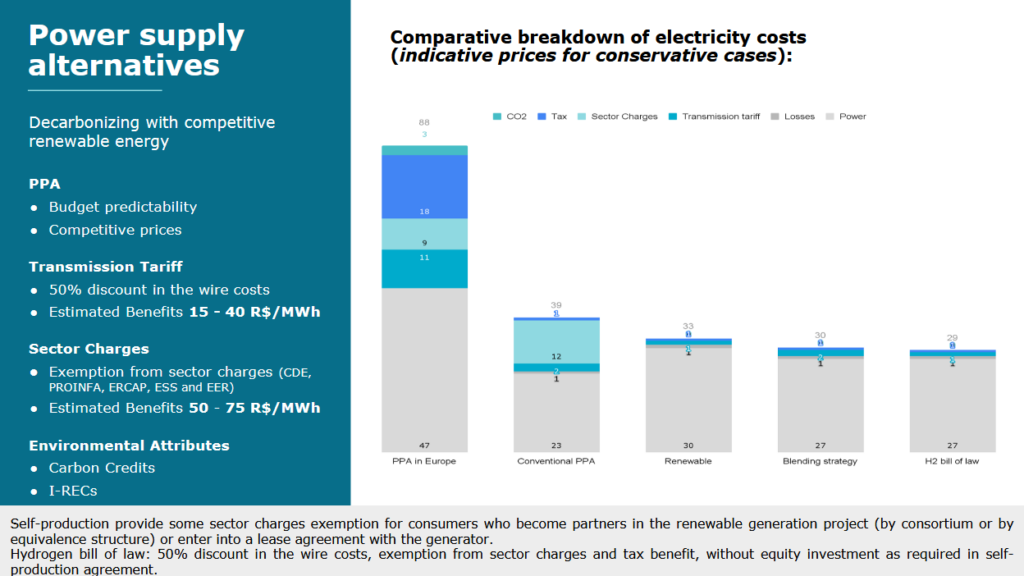

The Project Iracema consortium is considering two power sourcing strategies:

- 100% renewable (solar & wind), with self-production by equivalence.

- Blending renewable & existing hydrogenation, reducing the risk on price & volatility.

The speakers noted that the Hydrogen Bill of Law is currently under discussion at the Congress in the Brazilian parliament, which will influence the choice of strategy.

The benefit of producing electrolysis-based ammonia in Brazil rather than in the EU is obvious from the power price. In the 100% renewable strategy based on solar PV and wind, the electricity cost is about 32 USD/MWh (a roughly equivalent PPA would cost an estimated 88 USD/MWh in the EU). A blended strategy reduces this to 30 USD/MWh, while the Hydrogen Bill of Law can decrease the cost further to 29 USD/MWh. For reference, every 10 USD/MWh increase is likely to add around 100 USD to the cost per tonne of ammonia.

Hydrogen certification

CCEE is the market operator within the Brazilian electric sector, which is engaged in various certification initiatives and working groups, such as CIGRE, the Green Hydrogen Organisation, and the World Bank (Hydrogen for Development). Certification of hydrogen production in Brazil is intended to be aligned with RED II in Europe, and a second version of the certification scheme will be based on RED III, including ammonia. The steps toward certification are: (1) above 90% renewable generation, (2) electricity emissions below 18 gram CO2 equivalents per MJ, (3) constrain off, and (4) PPAs with additionality, temporal correlation on an hourly basis, and geographical correlation. If the first rule is met, this means the other rules do not need to be checked, and the certification is then valid for 5 years.

As mentioned before, Brazil is divided into different submarkets, with the renewability determined per bidding zone. In the North-east submarket, 97% of the electricity was renewable in 2022, which could grow to 140% by 2030. Import and export of electricity between submarkets is thus important for allocation of the carbon intensity. Brazil is one of the few countries with such a high renewable electricity share. Another example is Norway, but Brazil is unique due to its large size, and high interconnectedness between regions.

Given this extremely high penetration of renewable energy, certification is a key item for realizing renewable ammonia projects in Brazil. Both Brazil and the receiving country (or jurisdiction) will have to harmonize their approach to hydrogen & ammonia certification, and both provide support.

Where project finance is concerned, Project Iracema (with players along the entire ammonia value chain & increased engagement with local stakeholders) hopes to demonstrate enough credibility to avoid a chicken and egg situation for offtake. This combination – demonstrated credibility, local engagement, harmonized certification approaches, a mandate for renewable fuels in the target market – should provide clarity and direction toward FID for Iracema and similar projects.