Renewable Fertilizers in Europe

By Kevin Rouwenhorst on September 21, 2022

The fourth webinar of our series Ammonia Project Features focused on renewable fertilizer production in Europe. Birgitte Holter (Head of Green and Low carbon Fertilizers at Yara International) and Theo Paquet (Regulatory and Green Ammonia Officer at Fertilizers Europe) discussed the potential in Europe, food security, and regulatory aspects of renewable fertilizers. The recording is publicly available via our Vimeo channel (you can also download Theo Paquet’s presentation).

Current situation in Europe

Ammonia is almost exclusively produced from natural gas in Europe. Given the current high natural gas prices, ammonia production is uncompetitive and many plants have been curtailed or shut down completely.

This disruption presents an opportunity for renewable ammonia production – especially given that European fertilizer production is dominated by ammonium nitrate production, which could potentially be produced without any carbon feedstock. Such is the spiraling cost of the gas prices, that the cost gap between fossil-based fertilizers and renewable fertilizers in Europe has decreased markedly, and in some cases renewable fertilizers are already cost-competitive (though this is likely a short-term phenomenon). Various European fertilizer producers have announced partial decarbonization of their assets. Among these, Fertiberia already produces 17 tonnes of renewable ammonia per day from solar PV with electrolysis.

Yara is Europe’s largest ammonia producer with a total ammonia production capacity of 7.8 million tonnes per year. Yara is also the world’s largest ammonia transporter, transporting 2 million tonnes around the globe each year. The company has announced its commitment to net zero emissions along the value chain by 2050. Yara has announced various low-carbon ammonia projects in Australia, the Netherlands, and Norway. As early as 2023, part of the Porsgrunn, Norway facility will be close to emissions and fossil-free with electrolysis-based ammonia production to come online. Yara already has an agreement with Lantmannen, the largest agricultural cooperative in Northern Europe, to buy fossil-free fertilizers.

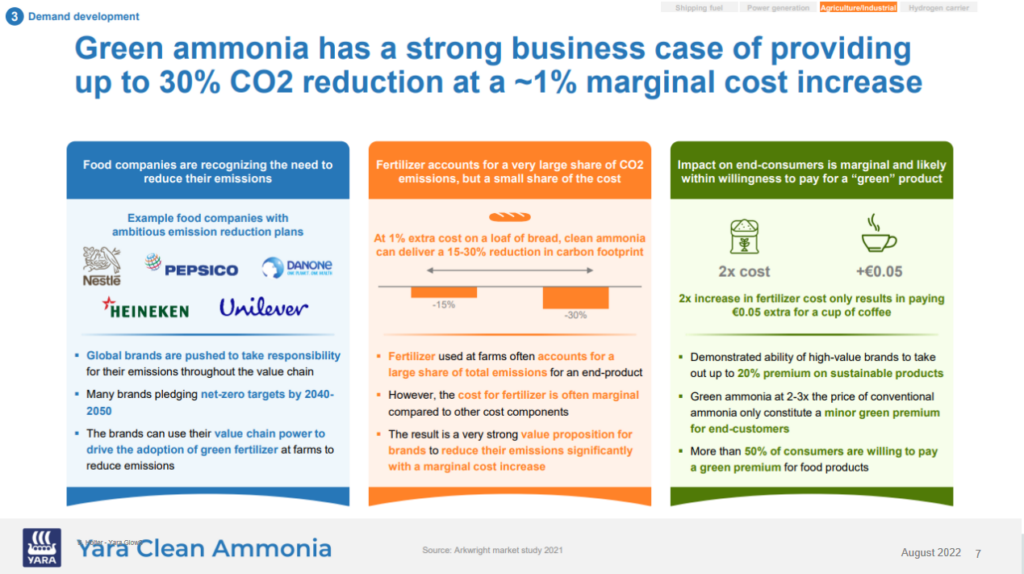

Value chain coupling is key

Collaboration along the food value chain is key. Lantmannen estimates that as much as 33% of total emissions for wheat flour production comes from fertilizer production. All of these emissions from fertilizer production can be eliminated by changing the hydrogen feedstock from natural gas to renewables coupled with water electrolysis, which is a low-hanging fruit for decarbonizing food production. Yara estimates that clean ammonia can deliver up to 20% decrease in carbon footprint for a cost increase of 1% on a loaf of bread, without changing the fertilizer practice for the farmer.

Reducing emissions in the plant & on the farm

The majority of emissions originate from the farm, which can be mainly attributed to nitrous oxide emissions leaching from farm land. Nitrous oxide (N2O) is a very potent greenhouse gas, with a global warming potential 298 times that of carbon dioxide. Nitrous oxide emissions from nitrate fertilizer plants in Europe have been reduced dramatically over the past two decades through effective legislation combined with deNOx technology development. Current nitrous oxide emissions from nitrate fertilizer plants in Europe are down to 0.1 tonne CO2 equivalent emission per tonne nitric acid production (>1 tonne in other significant producer countries).

Emissions from the farmland can be reduced by applying the right mineral fertilizer at the right time, in the right place, and in the right quantity. Digital tools with remote sensors and automated fertilizer release specific to the acre of land can aid. This can result in higher yields per acre of land, resulting in low land use required for food production. Given that land use change is an important CO2 emitter (in excess of 3 billion tonnes per year), improved yields result in more land available for other uses, potentially improving biodiversity. Furthermore, carbon farming can be combined with nitrogen fertilizers to sequester biomass.

The collaboration between fertilizer producers and agricultural cooperatives is only part of the full food products value chain. Various food companies have set targets to decarbonize their food value chain by 2040-2050, which can only be achieved through decarbonization of fertilizer production, agricultural activities, transport, and food processing. Global food production currently accounts for about 25% of global CO2 equivalent emissions.

The regulatory perspective: many levers to pull

There is clearly a market to decarbonize. The only question is how fast, and this is where regulations may aid. It should be recognized that different regions and countries have their own contexts, and national food & energy security are key drivers that may accelerate regulatory change. The Brussels-based Fertilizers Europe represents about 75-80% of fertilizer producers in Europe (90% of nitrogen fertilizer producers). It is active in translating EU legislation into concrete consequences for the European fertilizer industry, is developing its own certification scheme, and publishes key industry reports.

The European Commission has put carbon neutrality by 2050 in law. Furthermore, it aims for a 55% reduction in carbon emissions by 2030 versus 2005 levels. This is led by policy, such as the EU Green deal, which also impacts the fertilizer sector. Important regulatory drivers for decarbonization are the carbon emission trading system (ETS) and the carbon border adjustment mechanism (CBAM). Part of the carbon emissions have been allocated by sector (free allocation), while the remainder is traded in the ETS, currently traded at around 80 Euros per tonne CO2.

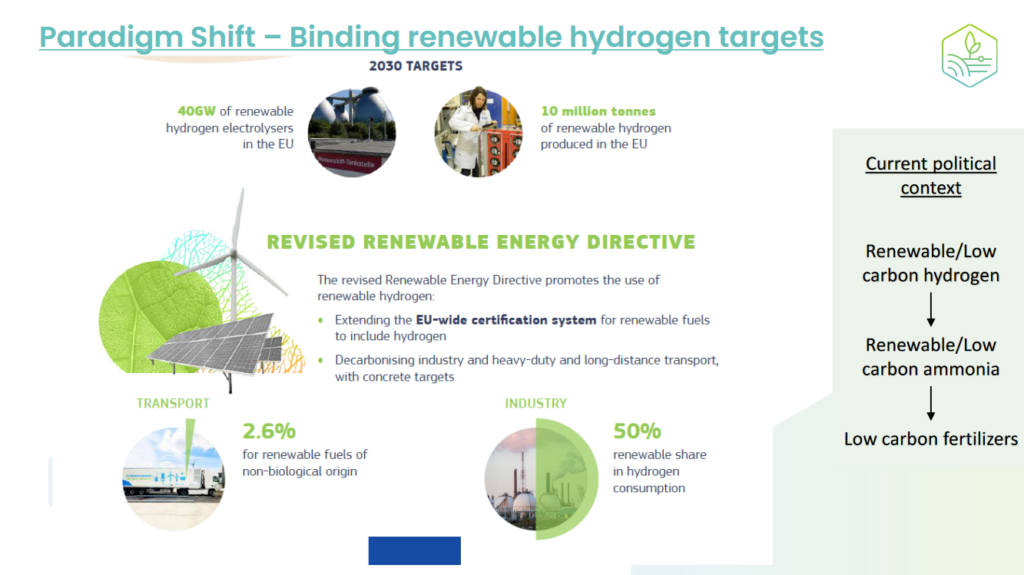

The Renewable Energy Directive (RED) aims to extend an EU-wide certification system to produce renewable hydrogen, as well as decarbonizing industry, heavy-duty and long-distance transport. By 2030, the aim is to have a 50% renewables share for hydrogen production. Renewable ammonia could decarbonize part of the transportation sector, as it is one of the best options to decarbonize the maritime sector, according to the AmmonFuel report.

Fast-growing targets

The Fit for 55 package to reach the 55%, economy-wide emissions reduction by 2030 requires 1.3 million tonnes of renewable hydrogen for petrochemicals (which includes ammonia). This has already been superseded by the REPowerEU package, which – following the war in Ukraine – has increased the renewable hydrogen target for petrochemicals to 3.2 million tonnes by 2030. This renewable hydrogen target is thus equivalent to the total, current fossil-based hydrogen demand for ammonia in Europe!

Beyond ammonia production, the European Commission targets 40 GW of deployed electrolyzers in the EU by 2030, to produce about 10 million tonnes of renewable hydrogen, mostly for energy applications. To qualify as renewable hydrogen, various criteria must be met: geographical correlation by bidding zone, temporal correlation, additionality, and a carbon footprint below 3.38 tonne CO2 equivalent per tonne hydrogen. The REPowerEU targets also include 4 million tonnes of hydrogen to be imported as ammonia (and in most cases, cracked to produce hydrogen).

Energy & food security

There is a big push from the policy side in the EU towards hydrogen for energy applications, given the current opportunity to decarbonize the European economy. However, increased use of hydrogen for other sectors should not strain hydrogen currently used for fertilizer production, and consequently food production.

There is a market pull from food companies to decarbonize fertilizer production and agricultural activities, while regulations in the EU also target emissions reduction. A paradigm shift to identifying emissions along the entire supply chain of products is required, rather than just focusing on separate activities of stakeholders along a particular chain. A focused effort is required to decarbonize hydrogen production in the EU, without jeopardizing fertilizer production & straining food security.

Next month

Next up in the Ammonia Project Features webinar series is Renewable ammonia in operation. We discuss water electrolysis-based decarbonization in fertilizer plants with Marc van Doorn (Grupo Fertiberia), and Imanol Arrizabalaga Prado (NEL ASA). Join us on the 27th of September at 2PM CEST for a great discussion. You can register for the session here.