Retrofitting vessels for ammonia fuel: new technical study from Grieg Star

By Julian Atchison on March 21, 2023

“Perceived…challenges have turned out not to be barriers”

As part of the Norwegian Green Shipping Program, Grieg Star and a series of high-profile maritime consortium partners have assessed the full feasibility for retrofitting a Grieg Star L-Class vessel to run on ammonia fuel. The retrofitted vessel would run routes between three key shipping locations: the Gulf of Mexico, Brazil, and the Amsterdam-Rotterdam-Antwerp region in Europe. The study is centered on five areas – ammonia fuel availability, safety issues & regulations, potential onboard retrofit solutions, ESG/Finance, and operational impact – and the work streams for each were led by key global stakeholders. Findings included:

…all three relevant port locations have to solve several supply chain challenges before they are ready to provide green ammonia for bunkering…

…the project has not identified any regulatory showstoppers for operating. Until prescriptive requirements for the design of vessels are in place an alternative design approach through the IGF Code may be utilized. The main remaining uncertainty is the potential diverging approaches by national and local authorities…

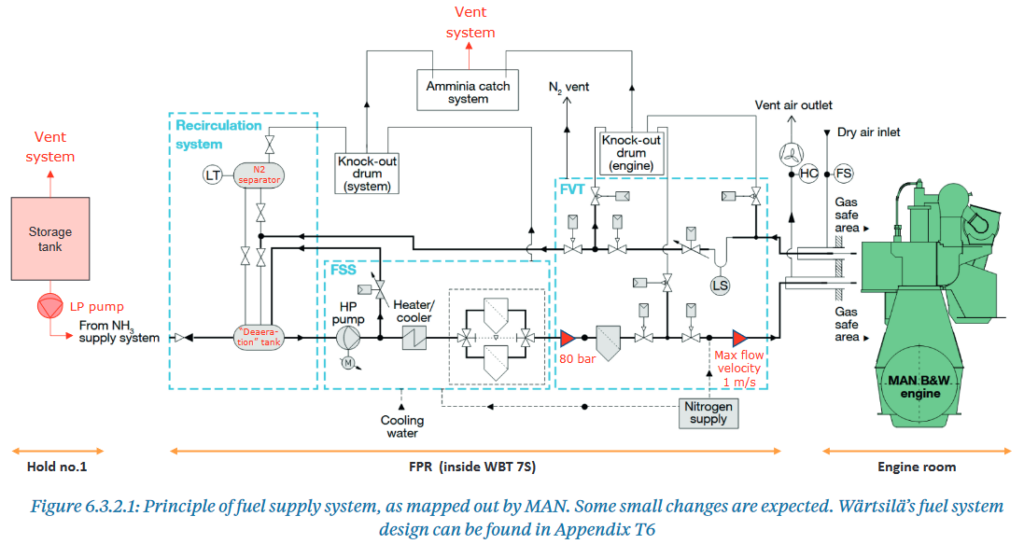

…although the required modifications are more extensive than initially anticipated and the complexity is significant, it is technically feasible to retrofit a Grieg Star L-Class vessel to operate on ammonia within a reasonable timeframe, given a working motor technology solution…

…Results from testing of MAN ammonia engine solution…are crucial to understanding the remaining challenges, risks, and timelines towards a commercial product…

…Retrofitting a vessel to run on green ammonia represents >50% of the vessel’s fair market value…[but] given available competitively priced ammonia and a suitable regulatory framework, there can be substantial benefits [to] retrofitting…

…maintaining fuel flexibility is vital to ensure vessel market value after modification…

…The vessel will be limited to trade where ammonia is available to capitalize on the investment…

Key conclusions from the five work streams, in Green Shipping Program Pilot Report: Ammonia Powered Bulk Carrier (Grieg Star, March 2023)

Similar to the findings of the Mærsk Mc-Kinney Møller Center in their recent report on managing ammonia combustion emissions onboard vessels, it appears that technical considerations for vessels to run ammonia fuel – while expensive & still under-development – will ultimately not be the biggest barriers in the transition.

The new study from Grieg Star also details an under-development safety system design from Wärtsilä. Although nearly all classification societies have determined that an on-board ARMS (ammonia release mitigation system) is a requirement for ammonia fuel, no such systems are commercially available. Wärtsilä’s ARMS system oxidizes ammonia molecules to yield water and nitrogen.

The biggest barrier: uncertainty

The authors conclude that a combination of uncertainties is the biggest barrier to ammonia fuel retrofits:

With a conversion cost of more than 50% of the vessel’s fair market value the financial burden of such an investment is significant. At the time of writing, there is still uncertainty on green ammonia availability, no clear sight of international mechanisms to influence alternative fuel pricing relative to conventional fuels, and no firm indication of market willingness to pay a sufficient premium for vessels operating on low carbon fuels. The main barrier to move forward with the pilot is this combination of high conversion investment costs and the uncertain availability of competitively priced green ammonia.

Barriers to ammonia retrofits of Grieg L-Class vessels, in Green Shipping Program Pilot Report: Ammonia Powered Bulk Carrier (Grieg Star, March 2023)

They also note that the regulation likely to drive the new ammonia fuel market is IMO’s CII framework, which is due for revision and likely modifications in 2026. With fears that the framework in its current state is “vulnerable to gaming”, the outcomes of this future process are hard to predict. The authors also recommend local pricing schemes (such as one based on the EU ETS) and government contracts-for-difference to achieve competitive pricing.