Singapore invests in key green ammonia projects

By Julian Atchison on February 02, 2022

Strategic equity investment in InterContinental Energy

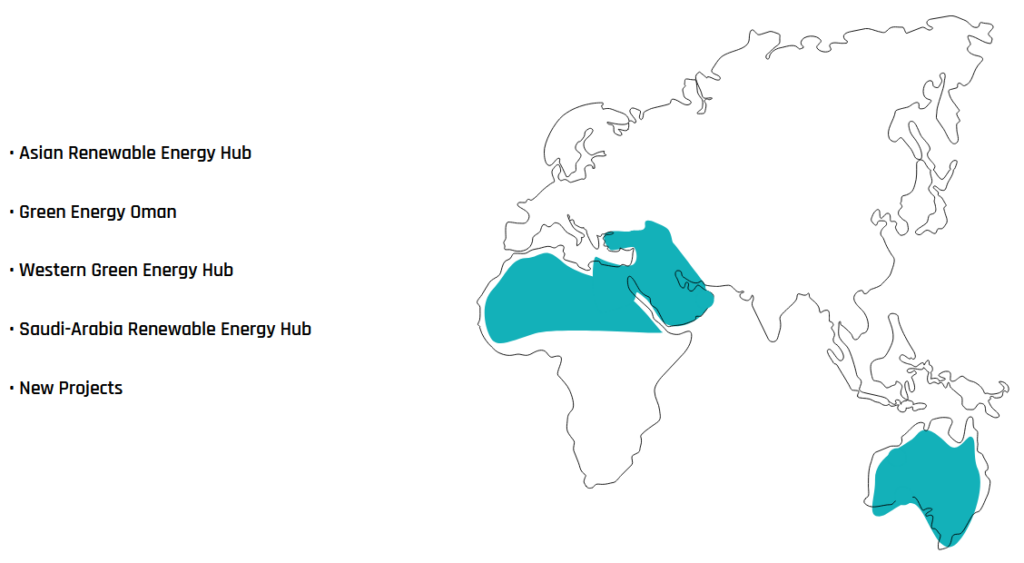

Singapore’s sovereign wealth fund GIC has agreed to a strategic equity investment (size undisclosed) in InterContinental Energy, who are currently developing a number of green ammonia “Supergiants”. InterContinental’s project portfolio in Australia and the Middle East is a regular feature here at Ammonia Energy, and consists of more than 200 GW of wind & solar generating capacity, coupled with a green ammonia production capacity of around 80 million tonnes per year. The investment is subject to approval by the Australian Foreign Investment Review Board.

This is a strategic investment to position GIC early for the emerging hydrogen economy. We believe that in time, hydrogen will play a crucial role in decarbonisation globally and that InterContinental Energy will be a key player in this transformation.

Ang Eng Seng, Chief Investment Officer of Infrastructure at GIC in the official press release, 26 Jan 2022

Indonesian ports

As the Straits Times reports, this month Singapore also announced a significant green investment in Indonesia: $9 billion for a logistics hub in Jakarta’s Tanjung Priok port and a number of renewable energy projects (including on Batam Island, which sits on the opposite side of Singapore Strait). Singapore is currently the largest institutional investor in Indonesia, and the new figure marks an increased investment from previous year. At a recent leader’s retreat, two MoUs between the heads of state (Malaysian Prime Minister Lee Hsien Loong & Indonesian PM Joko Widodo) were signed that cement a new focus on decarbonisation and alternative energies. Currently Singapore relies heavily on gas for electricity generation, but future fuels like hydrogen & ammonia are receiving more attention from the government and other key stakeholders.