Successful finance pathways for the NoGAPS vessel

By Julian Atchison on September 05, 2023

Commercially viable by 2026

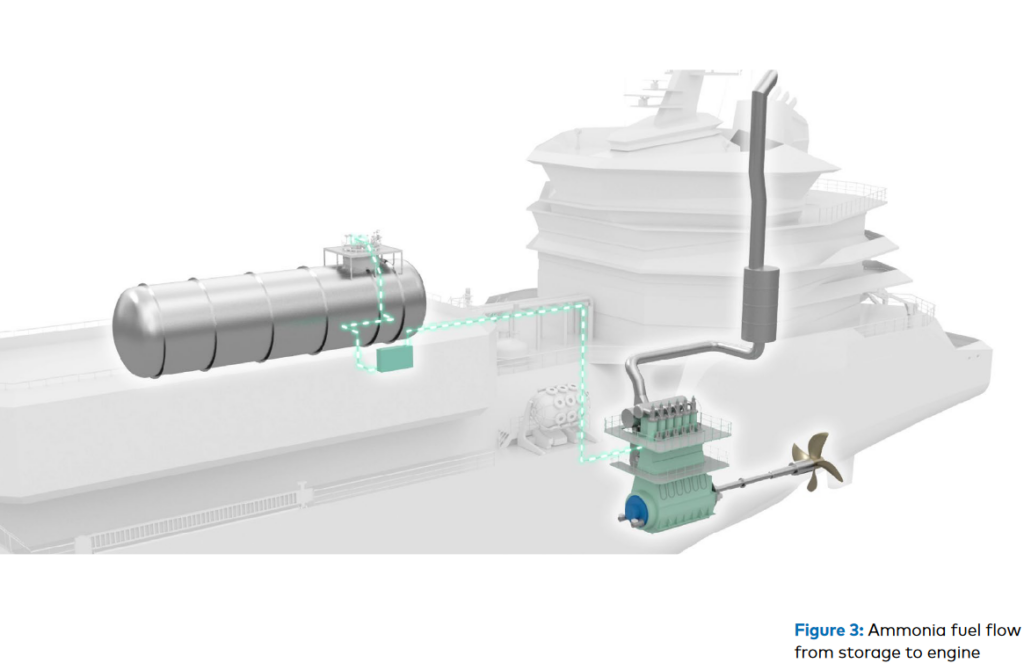

New analysis from the Global Maritime Forum has found that the cost gap between operating vessels similar to the MS NoGAPS on ammonia fuel versus conventional fuel could be closed before 2030, and possibly as early as 2026. The vessel has been designed to operate on a commercial gas-carrying route between the US Gulf Coast and northern Europe. Ammonia fuel will cover the full round-trip (~11,000 nautical miles), with secondary fuel capabilities also included in the vessel design. NoGAPS will also be able to be used as a bunker vessel. A detailed technical design was released this April.

With the completion of this latest project phase, we not only have a detailed ship design that could be used for a shipyard tender but also a feasible commercialisation pathways. We hope this boosts confidence amongst charter parties and investors to take steps towards the realisation of M/S NoGAPS and other ammonia-powered vessels.

Jesse Fahnestock, Project Director at the Global Maritime Forum in his organisation’s official press release, 31 Aug 2023

Finance: measures & pathways for success

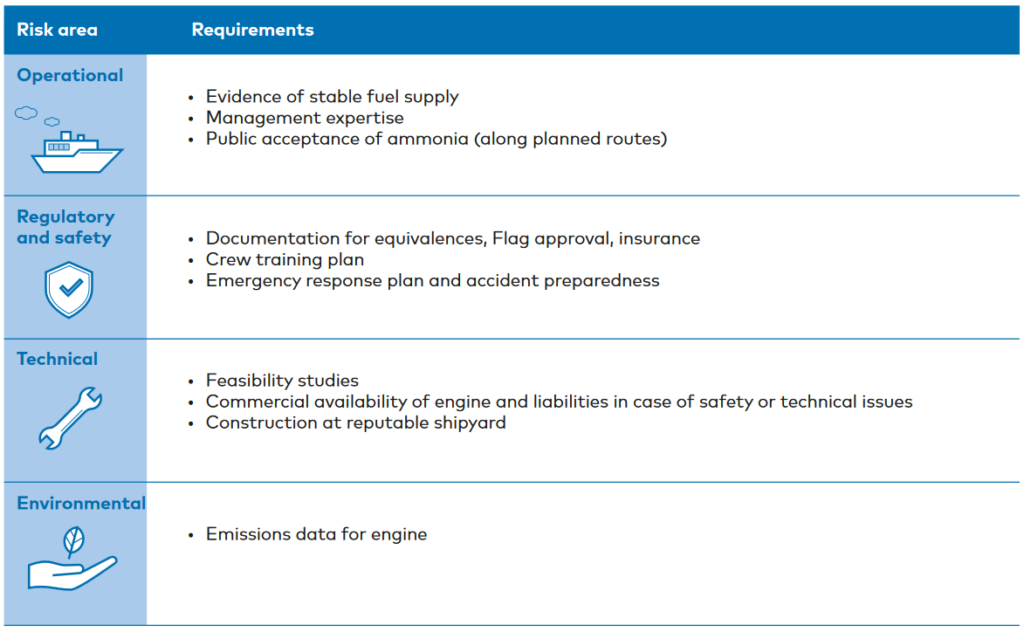

The new analysis also includes detailed interviews with key stakeholders in the ship finance sector, plus an outline of three potential pathways forward to fully finance the NoGAPS vessel. Crucially, financiers believe that the elevated cost (specifically, VOYEX or fuel costs) for an ammonia-powered vessel represents the biggest barrier to investment – not technical, operational or safety concerns:

While financiers acknowledge there are technical, operational and safety risks for early ammonia-powered vessels, these are not seen as a major barrier to investment. Rather, the key challenge is likely to be reducing the vessels’ elevated costs and related commercial risks to acceptable levels. Without intervention, an ammonia-powered gas carrier is expected to be between 50-130% more expensive than an equivalent gas carrier over the coming years. This creates significant commercial risks for both shipowners and lenders.

Executive summary from Phase 2 report: Commercialising early ammonia-powered vessels (GMF, Aug 2023)

Multiple levers can be pulled in a variety of combinations for successful vessel financing. After design, securing a competitive financing arrangement is key. Again, based on interview responses from the ship finance sector, the report authors believe that cost-effective, “vanilla” deals that are already commonplace in the shipping world will be readily available to vessel developers:

Two options are viewed as relevant for M/S NoGAPS, either a so-called “plain vanilla” deal consisting of a bank loan and portion of equity or a leasing arrangement in which the shipowner “rents” the ship from a third party…both options should not only be available, but be available on good terms, without a significant risk premium.

Executive summary from Phase 2 report: Commercialising early ammonia-powered vessels (GMF, Aug 2023)

Further levers to lock-in finance include government-led, de-risking mechanisms like export credit agency support or CAPEX grants. The final, key lever is securing a “premium, long-term charter with a reputable charterer”, providing revenue and certainty for the vessel owner.

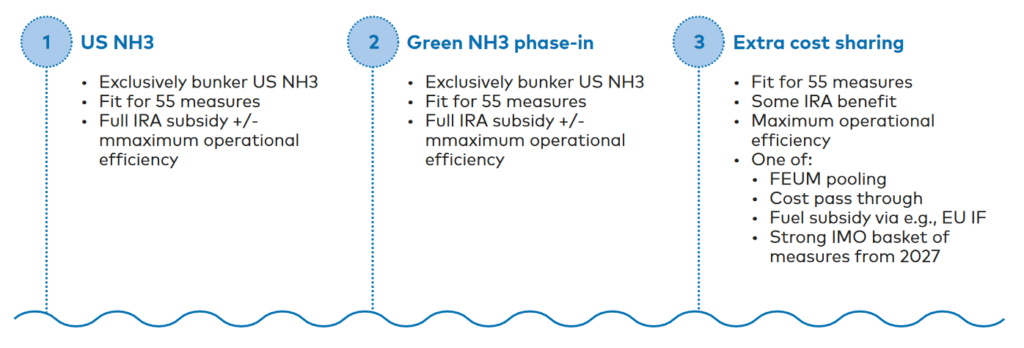

The report authors see three distinct pathways forward for commercial operations for the MS NoGAPS. The simplest pathway is for the vessel to “bunker exclusively in the US”, where the IRA will result in highly cost-competitive ammonia (both renewable and CCS-based). As shown above, the vessel has been designed to make the Gulf Coast-Europe round trip powered completely by ammonia fuel, with a secondary fuel backup available. To also bunker in Europe (pathway two), all cost reduction levers detailed above would need to be pulled, and comparatively cheaper CCS-based ammonia would need to be used in the initial years of operation. In a bid to reduce the cost of renewable ammonia fuel faster, pathway three goes another step. It layers on fuel subsidies (such as contracts for difference), green premiums for end customers, and further EU and IMO policies entering into force before 2027.