Technology status: ammonia production from electrolysis-based hydrogen

By Kevin Rouwenhorst on January 31, 2023

A brief history of electrolysis-based ammonia production

The first electrolysis-based ammonia plant started operation in Terni (Italy) in 1921, based on Casale technology. Numerous electrolysis-based ammonia plants were installed in the years to follow, making electrolysis-based ammonia production the second most used technology (after coal gasification) by 1930. But after 1970, the installed capacity for electrolysis-based ammonia production started to decline from a peak of about 0.7 million tonnes per year. Improvements in Haber Bosch technologies led to the proliferation of world-scale plants, and the availability of gas feedstock became cheap & widespread. Simply put, the economics of scale put smaller, electrolysis-based plants at a disadvantage.

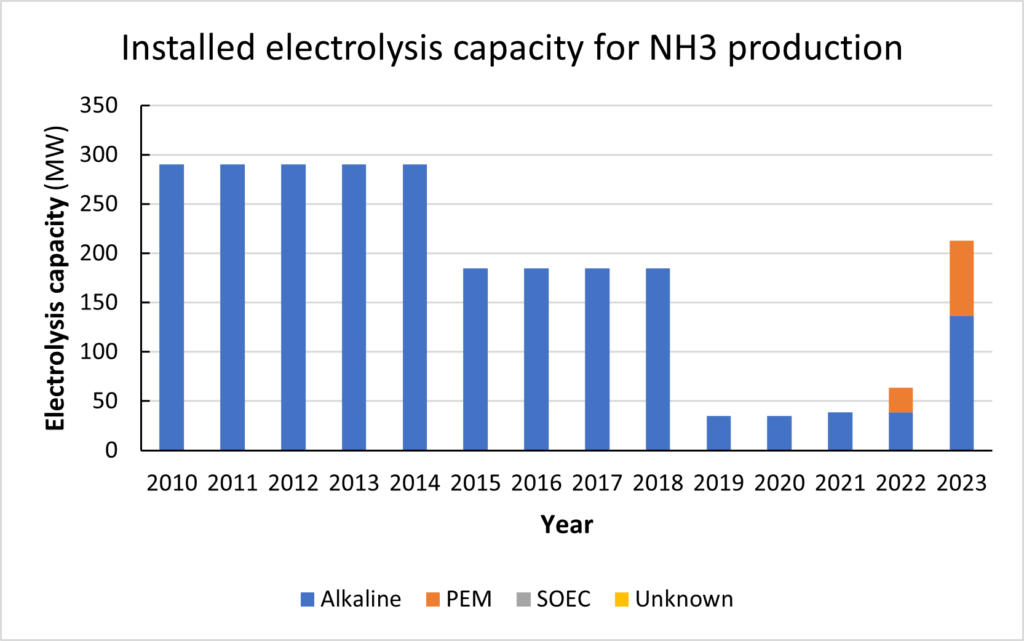

In 2010, three electrolysis-based ammonia plants were still operational with a combined production capacity of 240,000 tonnes per year: the KIMA plant in Aswan (Egypt), the Sable Chemicals plant in Kwekwe (Zimbabwe), and the Industrias Cachimayo plant in Cuzco (Peru). These three plants operated based on hydroelectric power and had a combined installed electrolysis capacity of 290 MW.

Sable Chemicals shut down its electrolysis-based ammonia production in 2015. Among other things, this was due to an increased demand for electricity in other sectors and consequently higher electricity prices, as well as sustained droughts. Electrolysis-based ammonia production in Aswan (Egypt) was decommissioned in 2019, and the gas-based KIMA 2 plant was built in its place. This leaves the Industrias Cachimayo plant as the last “classical” electrolysis-based ammonia production facility in operation. ENGIE and Enaex recently agreed to a new power purchase agreement (PPA), allowing Industrias Cachimayo to run on 100% renewable energy.

2020 and beyond: MWs to GWs

With the rapid decline in the cost of renewable electricity from solar PV and wind, electrolysis-based ammonia production has re-emerged as an alternative to fossil pathways. To assess the effects of fluctuating renewable energy generation, various kW-scale demonstrators were introduced in the 2010s, such as in Japan, the United Kingdom, and the United States.

More recently, multi-MW electrolysis projects have been announced, with some already operational. A non-exhaustive list of examples includes:

- ACME Group, which is de-risking large-scale renewable ammonia production with a 4 MW alkaline electrolysis pilot plant in Bikaner (India), estimated to produce about 1,500 tonnes of ammonia per year. The plant started operation in November 2021.

- H2F, a project in Puertollano (Spain) with 100 MW solar PV, 5 MW battery storage, 20 MW PEM electrolysis, and 11 high pressure hydrogen storage tanks. Iberdrola started operating the green hydrogen plant in 2022, allowing Fertiberia to produce about 17,000 tonnes of ammonia per year at its neighboring plant.

- Fertiglobe, which commissioned 5 MW PEM electrolysis for ‘Egypt Green’ in Ain Sokhna (Egypt) in November 2022. The hydrogen will be fed to the neighboring ammonia plant operated by EBIC, producing about 4,500 tonnes of ammonia per year.

- Unigel, which aims to begin decarbonizing ammonia production at its plant in Camaçari (Brazil) by installing 60 MW alkaline electrolysis capacity, starting this year. The grid-connected electrolyzers are expected to produce about 60,000 tonnes of ammonia per year (Brazil’s national grid already has a high penetration of renewable energy generation).

- Yara, which will partially decarbonize its Porsgrunn (Norway) ammonia plant with 24 MW PEM electrolysis capacity. Starting later this year, the grid-connected electrolyzers are expected to produce about 25,000 of ammonia per year (nearly all of Norway’s grid electricity is generated by renewable energy).

- Yara and ENGIE, with FID reached last year on Project Yuri in Karratha (Australia). Yuri’s pilot phase features 10 MW electrolyzers and 18 MW of combined solar PV & battery storage, feeding production of 3,600 tonnes of ammonia per year at the neighbouring Yara Pilbara Fertilisers plant.

- CF Industries, which aims to begin decarbonizing production at its 4 million tonnes per year facility in Donaldsonville (USA). by installing 20 MW alkaline electrolysis capacity, planned to start operation in 2023. The grid-connected electrolyzers are expected to produce about 20,000 of ammonia per year, with a renewable electricity PPA secured.

- LSB Industries and Bloom Energy, which will install 30 MW of electrolyzers (10 MW solid oxide and 20 MW alkaline) at LSB’s ammonia plant in Oklahoma (USA). Electrolytic hydrogen will feed production of around 30,000 tonnes of ammonia per year, or about 12% of the plant’s ammonia production capacity.

Beyond this, there’s a growing list of multi-GW projects. World-scale, electrolysis-based ammonia plants will require multiple GWs of working electrolyzers to produce enough hydrogen feedstock for one million tonnes per year of ammonia. Examples include the NEOM project in Saudi Arabia (where a contract has already been signed with thyssenkrupp for the supply of at least 2 GW of alkaline electrolyzers), and the Australian Renewable Energy Hub (designed with at least 14 GW of installed electrolyzer capacity).

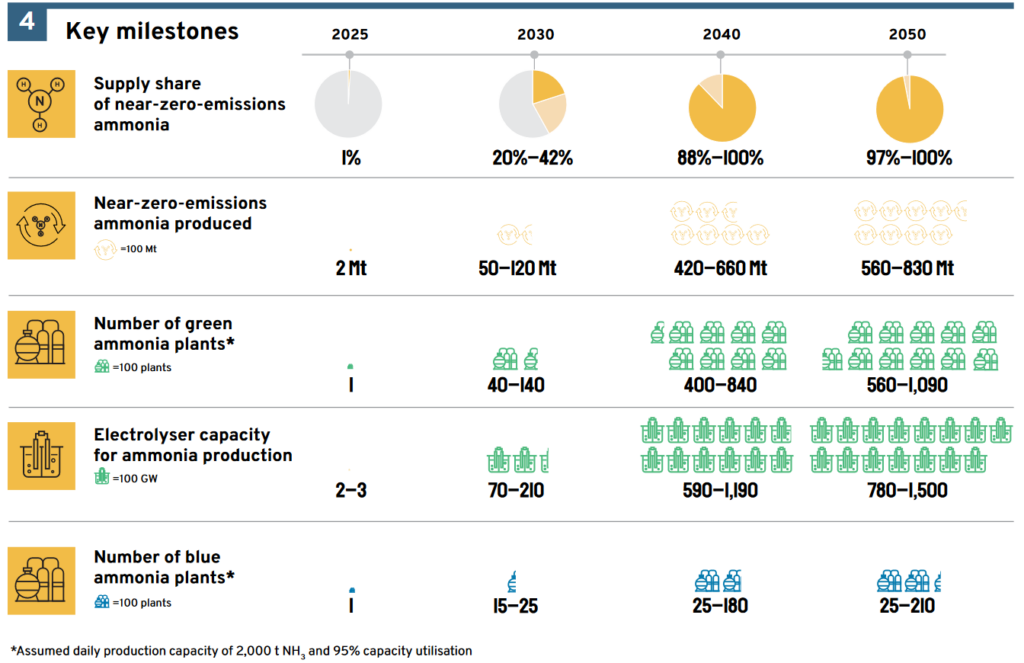

According to the Mission Possible Partnership, 13 – 42 GW of electrolyzers dedicated to ammonia production will have to be installed every year between 2026 and 2030 for the ammonia industry to reach net-zero emissions by 2050. This equates to between 40 and 140 operational, large-scale “green” (electrolysis-based) ammonia plants by 2030, producing between 30 and 100 million tonnes of electrolysis-based ammonia per year. So, while our focus may still be on MW-sized installations, it’s not long until GW-scale deployment needs to occur for the ammonia industry to meet climate-neutral targets.

Diversifying electrolyzer technologies

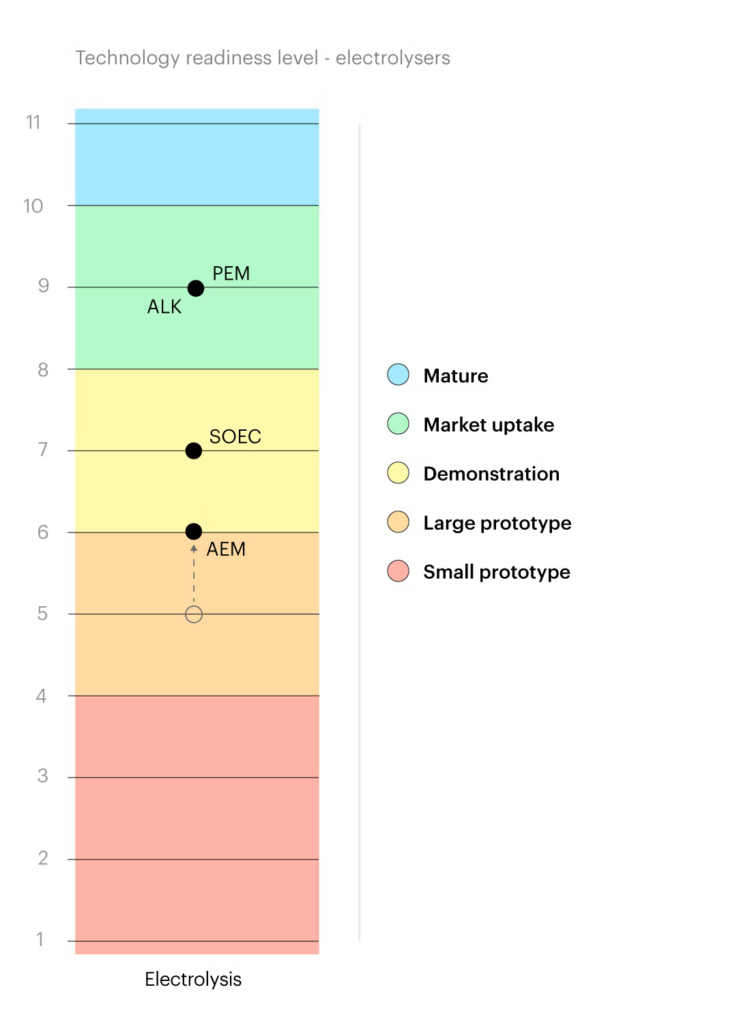

As you can see above, both alkaline electrolysis and PEM electrolysis is used. The cost gap between alkaline electrolysis and PEM electrolysis has reduced in recent years, especially for small-scale projects up to tens of MWs, and for projects located in Europe or North America. The preferred technology depends on local requirements, such as plant footprint, grid connection, renewable energy profiles, etc.

Other electrolyzer technologies will also be introduced beyond 2023. Mentioned above is the 10 MW solid oxide electrolysis system that will be installed by Bloom Energy at LSB Industries’ ammonia plant in Oklahoma, USA in 2024. Currently, no ammonia projects have been reported based on AEM (anion exchange membrane) electrolysis. However, AEM technology demonstrations at the MW scale may be expected in the coming years, according to a technology readiness assessment of the IEA.

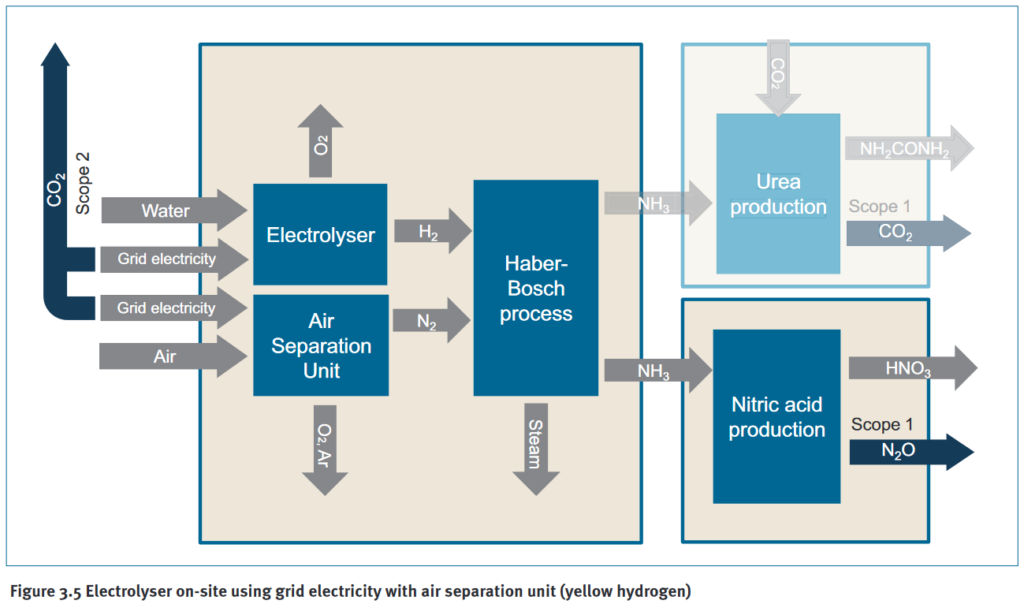

Carbon footprint

Scope 1 emissions from electrolysis-based ammonia production are essentially zero. Scope 2 emissions strongly depend on the carbon intensity of the input electricity. Zero carbon sources for electricity include solar PV, wind, hydropower, geothermal, and nuclear power, among others. On the other hand, electrolytic ammonia production using electricity derived from natural gas and coal may result in a higher carbon footprint as compared to using natural gas and coal directly as feedstock for ammonia production.

Looking ahead: the next few years

In 2020, global electrolysis-based ammonia production had an operational capacity of about 10,000 tonnes per year. By the end of this year, electrolysis-based ammonia production is estimated to account for 185,000 tonnes per year. As new technologies emerge and a dramatic ramp-up in installed electrolyzer capacity occurs, as much as 1 million tonnes of electrolysis-based ammonia could be produced globally by the end of 2024 (much of which will be pilot-scale projects). That’s a 100-fold increase in just four years!

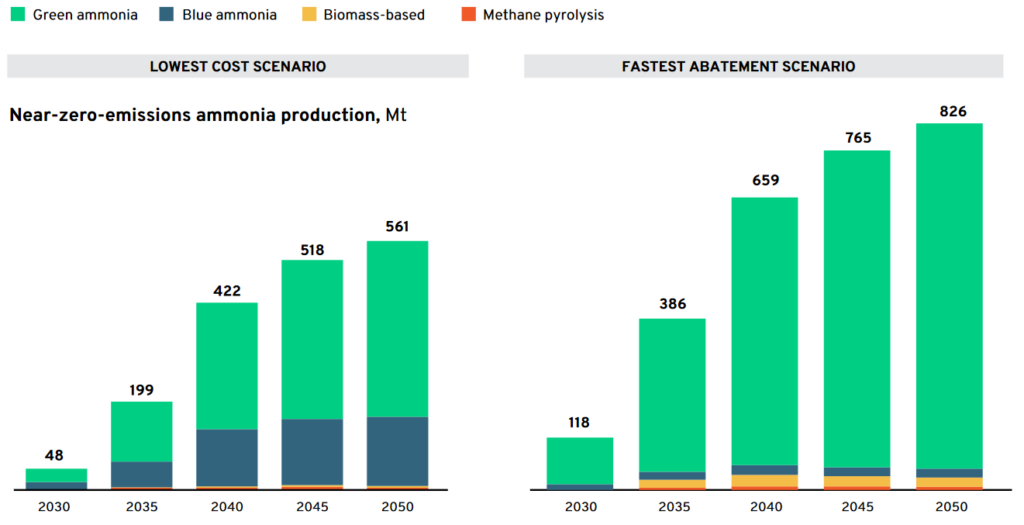

By 2026, we could see this ramp-up dwarfed again, as the first of many million-tonne-per-year, electrolysis-based ammonia plants begin operation. At the end of this decade, Mission Possible Partnership forecasts that as much as one hundred million tonnes of electrolysis-based ammonia will be required for the overall industry to hit net-zero by 2050. Come 2050, MPP predicts the production of nearly 800 million tonnes per year of electrolysis-based ammonia.