The cost of hydrogen: Platts launches Hydrogen Price Assessment

By Trevor Brown on December 19, 2019

What does hydrogen really cost? Apparently, there’s now a good answer to this question. $0.7955 per kg. This is according to the new daily hydrogen price assessment launched yesterday by Platts. Price assessments like this are invaluable for thriving markets, supporting transparency and developing into the benchmarks and indexes that underpin investments, trade, and regulations.

This is a welcome innovation from the universe of financial product development. It will be interesting to see how Platts’s hydrogen prices evolve, in terms of the cost structure of hydrogen production, of course, but also from the perspective of ammonia energy. If the purpose is to support commodity trading, these price assessments must eventually expand to include hydrogen carriers — molecules, like ammonia, that can be stored and transported more economically than hydrogen itself — in other words, commoditized hydrogen.

The $0.7955 per kg price is for today’s “Hydrogen Netherlands SMR (H2 99.9%) w/o CCS MA,” price assessment. This is one of ten that Platts launched. Its suite of published prices includes different regions (Gulf Coast, California, and Netherlands), different technologies (SMR, PEM electrolysis), different regulatory regimes (with or without carbon allowances), and different valuations (only production cost, or also including capex). Platts is also “already considering … other geographies, including Asia.”

Platts (officially, S&P Global Platts) describes itself as “the leading independent provider of information and benchmark prices for the commodities and energy markets.” The purpose of publishing price data is “to deliver greater transparency and efficiency to markets.” Its new hydrogen price assessments are, in many ways, a derivative product, building on top of its existing natural gas and electricity data — this, of course, gives Platts a credible foundation on which to build.

Simon Thorne, global director of generating fuels of S&P Global Platts, said: “The current market for hydrogen is relatively opaque but full of potential. We recognize the importance that hydrogen will play in a clean energy future, and the transformative role the fuel will play in global energy markets. In the interest of providing the transparency that is so critical to market development, the new S&P Global Platts hydrogen price assessments will provide an independent, impartial evaluation of hydrogen as a fuel.”

S&P Global Platts press release, S&P Global Platts Launches World’s First Hydrogen Price Assessments, December 18, 2019

Compared to hydrogen, ammonia already enjoys a far more established role as a tradable global commodity. Each year, ammonia tankers deliver about 16 million tonnes around the world; a large market but a small fraction of the 180 million tonnes produced. In contrast, last week, the world’s first hydrogen tanker was launched.

Decades of price information is already available (at a cost) for a range of regional ammonia trading hubs, most importantly Tampa in Florida, and Yuzhnyy in Ukraine. Because the Haber-Bosch technology has been so stable across the decades, and because regional feedstocks are so ubiquitous (natural gas in the US, coal in China), the production cost structure of ammonia is very well understood.

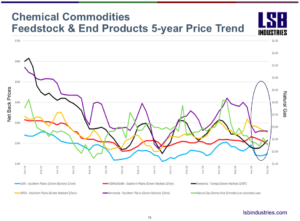

In the US, long-term ammonia contracts are most often priced relative to the Henry Hub Natural Gas Index (note the correlation between Henry Hub (green) and the domestic US ammonia price (purple, “Southern Plains”) in the chart showing 5-year price trends). In other regions of the world, ammonia purchase agreements may still be indexed against crude oil prices.

As we shift our attention, however, from conventional ammonia to green ammonia, produced from renewable hydrogen, the importance of this new hydrogen price benchmark may become apparent, especially as it expands its suite of electrolyzer-based hydrogen prices.

This could become the foundation for new, carbon-free trading hubs, based on green ammonia exports and imports. The “Pilbara Index” or, maybe, the “Valparaíso Hub.”

Alternatively, transparent and trustworthy market mechanisms could enable trading in green ammonia certificates, in addition to but separate from the commodity chemical. In this scenario, while the commodity is traded as before, a new benchmark price would develop for green ammonia certificates. As with any derivatives market, trading in green ammonia certificates would take place at a global level, its price set by the market’s appetite.