The most efficient way to decarbonise the shipping sector

By Trevor Brown on December 07, 2018

A new report, Roadmap to Decarbonising European Shipping, identifies a mix of three technologies – batteries, hydrogen, and ammonia – as being “by far the most efficient way to decarbonise the sector.” Even so, to satisfy demand from EU’s carbon-free shipping sector in 2050, this technology mix will require the installation of huge amounts of additional renewable power generation, equivalent to 25% of the EU’s total electricity production.

The study, published in November 2018 by Transport & Environment, a sustainable transportation think-tank, compares technology pathways to answer the question “How much additional renewable electricity would be needed to cater for the needs of EU related shipping in 2050?”

This report assesses potential technology pathways for decarbonising EU related shipping through a shift to zero carbon technologies and the impact such a move could have on renewable electricity demand in Europe. It also identifies key policy and sustainability issues that should be considered when analysing and supporting different technology options to decarbonise the maritime sector.

Transport & Environment, Roadmap to Decarbonising European Shipping, November 2018

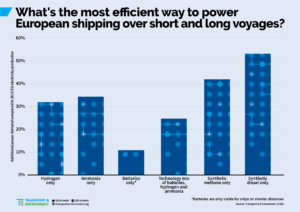

Batteries represent the most efficient propulsion technology and, therefore, direct electrification should be used where possible: short journeys, close to shore. However, large quantities of electrofuels – synthetic fuels produced from electricity – will still be necessary for long distances, like ocean freight. The most energy efficient electrofuels are hydrogen and ammonia, taking into account production, storage and transportation, and power generation in both internal combustion engines and fuel cells.

We recommend to prioritise battery-electric and hydrogen (pure and/or in the form of ammonia) technologies from sustainable renewable sources to decarbonise shipping. Although battery-electric propulsion appears to be the most efficient use of primary energy, a tech mix – battery, hydrogen, ammonia – is a more likely pathway for the different segments of EU shipping – domestic, intra-EU and extra-EU.

Transport & Environment, Roadmap to Decarbonising European Shipping, November 2018

Expanding renewable electricity capacity to satisfy synthetic fuel demand

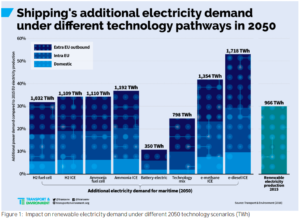

Although this technology mix is identified as the most energy efficient, the decarbonized shipping sector in 2050 would still consume a huge amount of additional renewable electricity, equivalent to 25% of today’s total electricity production. The investments required in generation assets and delivery infrastructure will be considerable, and yet the combination of battery, hydrogen, and ammonia technologies would require “only half the amount of renewable electricity that less efficient solutions like synthetic methane or synthetic diesel will need.”

Moving from a fossil fuel economy to an electrofuel economy is no small transition and “the impact on the future EU renewable electricity production should not be underestimated.”

In absolute terms, the electricity demand by the EU’s shipping sector for this optimal technology mix in 2050 would equal 798 TWh. This represents additional, newly-built renewable power generation, not existing carbon-intensive grid electricity.

A very considerable level of additional investment will be required not only in the renewables sector, but also in electricity transmission grids, shore-side charging stations, hydrogen/ammonia production plants, new ship propulsion and energy storage designs and the widespread provision of new port bunkering infrastructure. This speaks to the absolute necessity of including maritime transport in the development of an EU 2050 economy-wide decarbonisation strategy and the subsequent financial, investment and regulatory decisions that will be needed.

Transport & Environment, Roadmap to Decarbonising European Shipping, November 2018

In relative terms, the decarbonized shipping sector’s projected 798 TWh demand in 2050 is more than 80% of the 996 TWh of renewable electricity produced in 2015, according to the data presented in the report. An additional 80% sounds like a big number, but it is entirely achievable, especially given the thirty year horizon.

These figures refer to shipping and electricity sectors in the EU. For global context, the International Energy Agency’s latest Renewable Energy Market Report estimates that an additional 1 TW of renewable capacity will be installed by 2023, generating more than 2,000 TWh per year. “Renewable power generation is anticipated to expand 37% over the forecast period [2017-2023], with solar PV accounting for the largest growth among all sources, including fossil fuels, for the first time.”

Building an 80% capacity expansion over thirty years to decarbonize shipping is eminently achievable in a sector that is already growing at 37% over six years. This is not a question of using “surplus” or “stranded” energy, but of building dedicated renewable energy generating assets to power electrofuel production plants.

Electrofuels are better without carbon

The report concurs with analyses published recently in various journals, and reported here, that compare carbon-based synthetic fuels against nitrogen-based synthetic fuels. They conclude that ammonia is a more energy efficient synthetic fuel than any carbon-based synthetic fuel. Among other reasons, it is easier to collect nitrogen from the air (780,000 ppm) than carbon dioxide (400 ppm, and rising).

We found the least energy efficient technology pathways to decarbonise shipping to be those based on synthetic hydrocarbons – electro-methane and electro-diesel, using CO2 from air capture. These pathways would require around 42% and 53% respectively of additional renewable electricity generation in the EU28 over 2015 levels.

Transport & Environment, Roadmap to Decarbonising European Shipping, November 2018

This is an extremely important finding because of its impact on investment decisions, being made today, on expanding LNG bunkering infrastructure. The argument is that fossil LNG is a good bridge solution, delivering short-term but small reductions in emissions (only 25%, far short of the 50% reduction required by the IMO), but also creating a new bunkering infrastructure that is compatible with future synthetic fuels. Unfortunately, LNG infrastructure would only be compatible with future carbon-based synthetic fuels, which this report clearly identifies as “the least sustainable and enforceable technology pathways” available to the sector.

The theoretical climate neutrality of synthetic methane would not be achieved if, as with LNG, methane leakage and slip were to take place during the transportation, bunkering and on-board combustion of the fuel. Technology pathways delivering zero GHG emissions at the vessel level would seem to be preferable.

There are also implications for the current investment in fossil LNG bunkering infrastructure for ships, which it is claimed could be used in the future for synthetic methane bunkering. Since synthetic methane is one of the least sustainable and enforceable technology pathways for shipping, this report also warns against public investment in LNG bunkering infrastructure with the hope that it would underpin synthetic methane uptake in the future.

Transport & Environment, Roadmap to Decarbonising European Shipping, November 2018

Further reading

For those interested in the techno-economic data underpinning these conclusions, I want to highlight the analysis commissioned by Transport & Environment, and published in June 2018 as a standalone report, What role for electromethane and electroammonia technologies in European transport’s low carbon future?

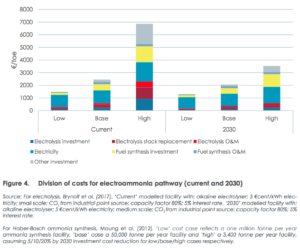

Figure 4 presents a cost analysis of electroammonia production, both now and in 2030, for three sizes of ammonia plant: world-scale (1 million tons per year, “Low”), small-scale (50,000 tons per year, “Base”), and mini (3,400 tons per year, “High”). Economies of scale cause the range in costs, from “Low” to “High” (the underlying data from 2012 fails to capture the recent impressive cost reductions in small-scale ammonia plants), and therefore “Low” figures represent the likely case for large-scale fuel production plants.

For comparison to today’s markets, the prices given in this chart are in units of toe (tons of oil equivalent), with a conversion factor of 2.25 tons ammonia per toe. The current cost of electroammonia would be roughly €1,500 per toe, which converts to €666 (about US$750) per metric ton. While this cost is approximately twice today’s (fossil) ammonia prices, given that the cost difference was orders of magnitude in recent years, it demonstrates how close to competitive carbon-free ammonia is becoming.