World Bank: new roadmap for scaling project finance

By Julian Atchison on April 07, 2024

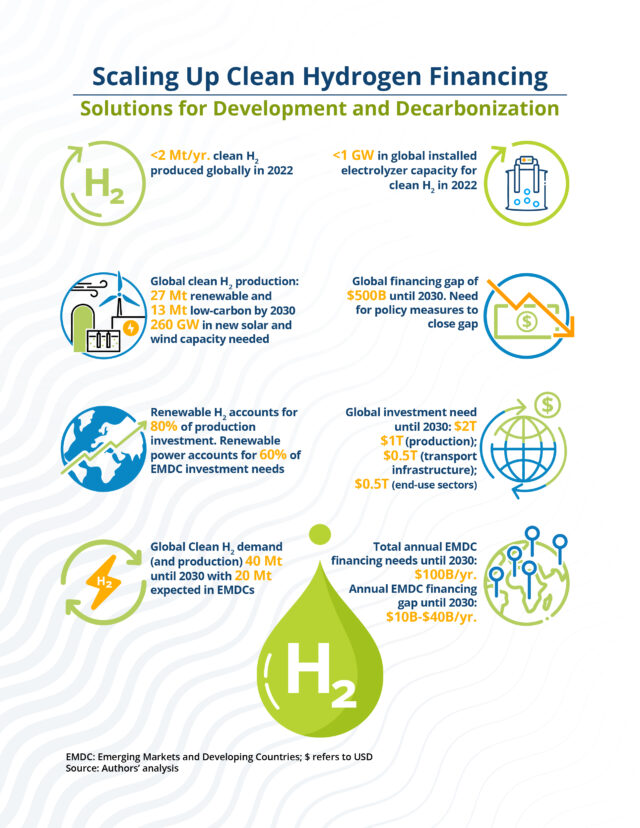

Click to enlarge. Outlook and key gaps for scaling the global clean hydrogen industry. Source: World Bank.

A new report from the World Bank and partners proposes a series of levers to help bridge the funding gap for clean hydrogen production projects. $1.65 billion in World Bank funding has been approved for green/renewable hydrogen loans to date, principally for ammonia projects. Nearly 40% of all global clean hydrogen projects under development are in emerging markets and developing countries (EMDCs), presenting a unique opportunity. However, only six “large” projects (>100 MW electrolysis capacity) in EMDCs have reached FID to date. Attendees at last year’s AEA annual conference got a preview of the report from World Bank Senior Economist Dolf Gielen, who highlighted the significant number of clean ammonia projects in the early stages of finance scale-up.

Mind the (project finance) gap

The report estimates that clean hydrogen projects in EMDCs could attract up to $100 billion of investments each year. But, external financing support is required to secure these investments: between $10 and $40 billion each year between now and 2030. The authors note that this finance gap is particularly stark, given that total development finance worldwide sits at $200 billion per year. Mobilising enough finance to meet this shortfall is critical, and the report suggests a series of levers to be pulled:

Effective government policies can lessen the need for public financial support by creating the right enabling environment for investments, increasing pricing transparency, and reducing risk.

Developed countries have already launched extensive mission-oriented strategies, with more than $100 billion in announced subsidies. EMDCs do not have the same financing power. However, careful selection of early hydrogen applications or an export-oriented strategy benefiting from partnerships with countries offering end-user incentives can substantially reduce financing needs…

[Multilateral development banks] and [Development Finance Institutions] are well positioned to support so-called lighthouse production projects designed to encourage further investment in EMDCs. This type of support includes (1) prioritizing and enhancing the quality of project proposals; (2) supporting the initial stages of project development; (3) pooling international development funding for investments to lower financing costs and raise investor confidence; (4) participating in blended finance arrangements; (5) offering risk-mitigation instruments; and (6) monitoring and quantifying the climate change and development benefits of clean hydrogen projects.

From Executive Summary, Scaling Hydrogen Financing for Development (World Bank et al., 2024)

Addressing risk in Emerging Markets and Developing Countries

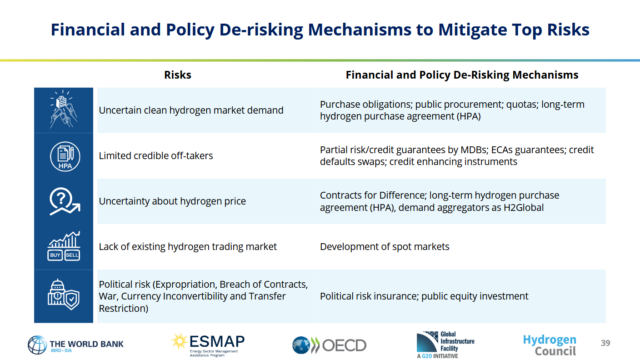

Click to enlarge. Risk mitigation mechanisms for the top risks mentioned by project developers. Source: World Bank.

Almost 40% of the current project pipeline is in EMDCs. However, the report authors estimate that projects in EMDCs account for only 7% of the total currently at the FEED stage (compared to 93% in developed countries). Current investments are also highly concentrated in a few mega-scale projects (eg. NEOM in Saudi Arabia). Risk mitigation measures are needed to push these projects to FEED and beyond.

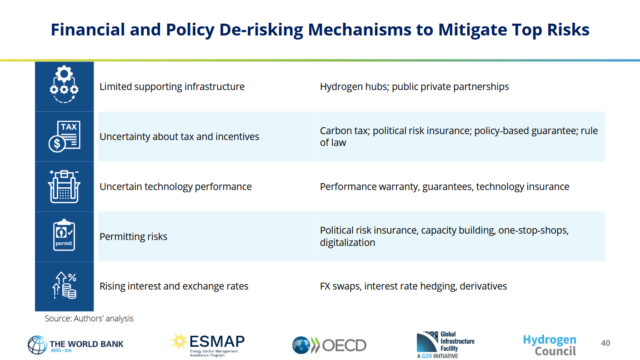

Click to enlarge. Risk mitigation mechanisms for the top risks mentioned by project developers, continued. Source: World Bank.

From an analysis of most often-mentioned risks for project development in EMDCs, the authors revealed that offtake was the key overarching category. Uncertainties about market development, hydrogen price, limited credible offtakers and lack of an existing trading market were all the most-mentioned, even more than geopolitical risk and lack of funding for new infrastructure. These risks are concentrated in the pre-FID phase of a project, creating an opportunity for pre-certification to mitigate a number of concerns and encourage offtakers to commit. A host of other financial and policy-based mechanisms are proposed in the report, including long-term purchase agreements, contract-for-difference, partial risk/credit guarantees, and a hub-based approach for projects.