Yara and BASF open their brand-new, world-scale plant, producing low-carbon ammonia

By Trevor Brown on April 27, 2018

The newest ammonia plant on the planet has opened in Freeport, Texas.

A joint venture between Yara and BASF, this world-scale ammonia plant uses no fossil fuel feed stock. Instead, it will produce 750,000 metric tons of ammonia per year using hydrogen and nitrogen delivered directly by pipeline. The plant’s hydrogen contract is structured so that the primary supply is byproduct hydrogen, rather than hydrogen produced from fossil fuels, and therefore the Freeport plant can claim that its ammonia has a significantly reduced carbon footprint.

This new ammonia plant demonstrates three truths. First, low-carbon merchant ammonia is available for purchase in industrial quantities today: this is not just technically feasible but also economically competitive. Second, carbon intensity is measured in shades of grey, not black and white. Ammonia is not necessarily carbon-free or carbon-full, but it has a carbon intensity that can quantified and, in a carbon-constrained economy, less carbon content equates to higher premium pricing. Third, the ammonia industry must improve its carbon foot printing before it can hope to be rewarded for producing green ammonia.

Low-carbon merchant ammonia: available at scale today

“Together with our partners at BASF, we built a world-scale ammonia plant that not only raises the bar in terms of safety, efficiency and quality but also applies the principles of industrial symbiosis by using a by-product as feedstock for ammonia production,” says Yara President and CEO, Svein Tore Holsether …

Conventional ammonia plants use natural gas to produce the hydrogen needed during ammonia production. Yara Freeport’s hydrogen-based technology allows the plant to forego this initial production step, leading to lower capital expenditure and maintenance costs. By using hydrogen, which originates from the production processes of various petrochemical plants nearby, Yara Freeport safeguards resources and mitigates environmental impact.

Yara press release: Yara and BASF open world-scale ammonia plant in Freeport, Texas, 04/11/2018

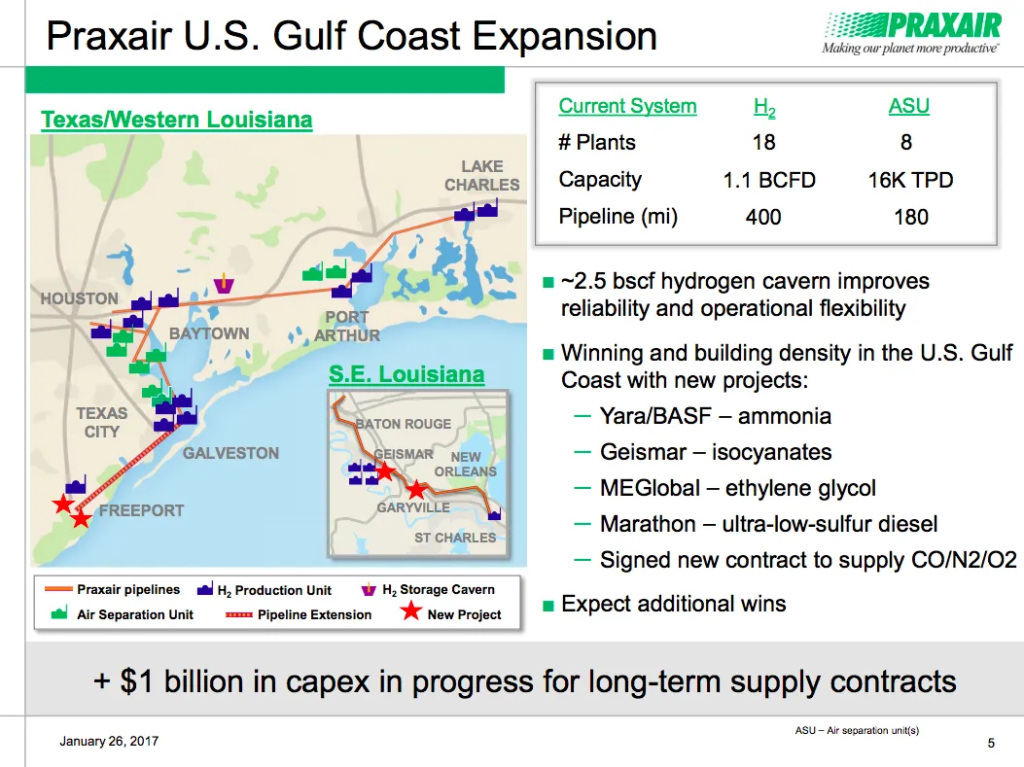

Praxair is supplying hydrogen and nitrogen to the Freeport plant through its hydrogen grid. Its recent Gulf Coast expansion included a $400 million investment in new hydrogen generating capacity and an extension of its hydrogen pipeline system that would stretch “46 miles from Texas City to the Freeport area.”

An important part of this hydrogen infrastructure is the cavern storage that allows Praxair to store 2.5 billion standard cubic feet (scf) of hydrogen. For context, 2.5 billion scf is roughly two weeks worth of hydrogen supply for the Freeport plant, which will consume 170 million scf per day, to produce 2,200 metric tons per day of ammonia at full capacity.

Most of Praxair’s Gulf Coast hydrogen is produced from natural gas in conventional steam methane reformation (SMR) units but, since 2015 when the contract was first announced, the Freeport plant intended to use “by-product hydrogen generated by multiple crackers that are being installed in the Gulf Coast.” Praxair’s SMR hydrogen is available as back-up, supported by cavern storage, “to reliably deliver high-purity hydrogen” for constant operation of the ammonia plant.

Specifically, this byproduct hydrogen is coming from Dow’s new ethylene cracker, which started up in September 2017, also in Freeport. Dow’s ethylene plant has “an initial nameplate capacity of 1.5 million metric tons” but, assuming Dow completes its announced expansion, it will soon be the “the world’s largest ethylene facility,” with a 2 million ton capacity. All this investment is driven by “cheap” shale gas economics, which also means that the low-carbon byproduct hydrogen delivered to the Freeport ammonia plant originates from fossil fuels after all.

If we care about carbon emissions, the question becomes, therefore, how low-carbon is this low-carbon ammonia?

Carbon intensity is measured in shades of grey, not black and white

The US Department of Energy has answered this exact question as part of its H2@Scale program, which looks at the potential technologies and investments that would establish broad hydrogen production, use, and infrastructure in the US.

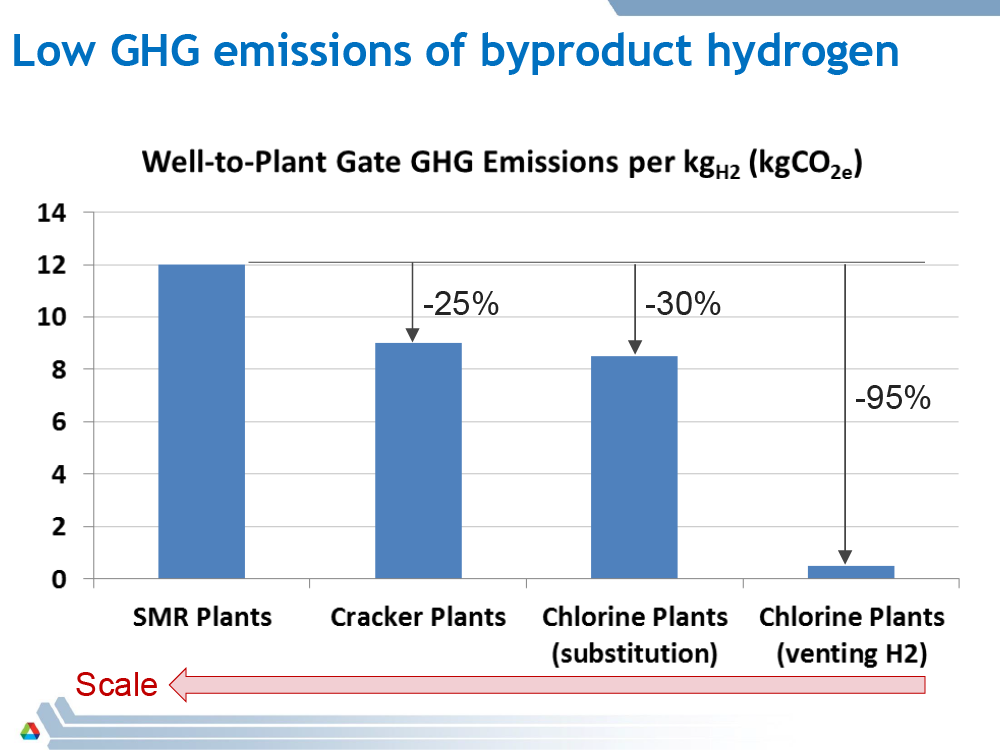

In a presentation last year, Amgad Elgowainy of Argonne National Laboratory carefully articulated the answer as a 25% reduction in carbon intensity (measured as carbon dioxide equivalent, CO2e) achieved by using byproduct hydrogen from crackers relative to conventional SMR production. His presentation also detailed the national availability (scale) of this and other byproduct hydrogen sources.

(I hope Agrium Nutrien is paying attention, so that it can prepare to position its Joffre ammonia plant in Alberta, which also uses byproduct hydrogen, as the most cost-competitive ammonia plant in Canada despite, or because of, the impending federal carbon tax being imposed across Canada.)

For the purposes of the Freeport plant, it isn’t enough simply to know that byproduct hydrogen is entering a pipeline, and the same pipeline is delivering hydrogen to you. To claim that this ammonia is low-carbon, the Freeport plant must be able to demonstrate that its hydrogen came from the Dow ethylene crackers; otherwise, every customer on Praxair’s hydrogen grid could claim to consume the same byproduct hydrogen molecules.

An analogy to renewable power is apt: if you sign a contract to receive green electricity, the exact electrons delivered by the grid may not have been generated from renewables, but the amount of renewable generating capacity feeding the grid has increased to match your contract. If two customers want to receive green electrons, twice as much renewable generating capacity must be built. Likewise, while the exact molecules of hydrogen delivered to the Freeport plant gate may have come from one of Praxair’s SMR units or its storage cavern, the hydrogen contract defines the new Dow cracker as the primary supply for the new ammonia plant. Verifying this source is absolutely crucial if the carbon footprint of the product is to be reliable.

During normal operations the Yara/BASF ammonia plant would utilize the hydrogen available from the DOW ethylene cracker units. This hydrogen will be supplied through an existing and modified grid …

The supply contract is structured such that the primary hydrogen supply is from ethylene cracking. In the event that this stranded hydrogen is unavailable, the pre-existing Praxair infrastructure will be utilized and any additional hydrogen will be supplied. The ethylene producer must replace hydrogen with natural gas on a heat value basis, as the hydrogen would have been burned to generate heat to crack the ethane. For that reason, the ammonia production is not CO2 free. However, recycling this hydrogen “waste” product represents a considerable reduction in CO2 emissions in the region, as a conventional ammonia plant would have emitted much more CO2 than what is now generated at the cracker by burning the replacement natural gas.

Correspondence from Yara’s Corporate Communications Department, 04/17/2018

I have barely mentioned Yara’s joint venture partner, BASF, in this discussion. However, it is no surprise that the originator of the Haber-Bosch process for ammonia synthesis, which BASF commercialized over 100 years ago, should drive the greening of the ammonia technology, given its Verbund strategy.

Carbon foot printing must improve before the market will reward green ammonia

The following comments should be taken in the spirit of encouraging the best in class to continue exceeding expectations.

Yara in the last month published its 2017 Annual Report, publicly stating for the first time its intention to establish “a leading position on de-carbonized ammonia production.” In the last six months, I’ve reported Yara’s announcements of two renewable ammonia synthesis demonstration plants, a solar-ammonia plant in the Pilbara, Western Australia, and a wind/tidal-ammonia plant in the Netherlands.

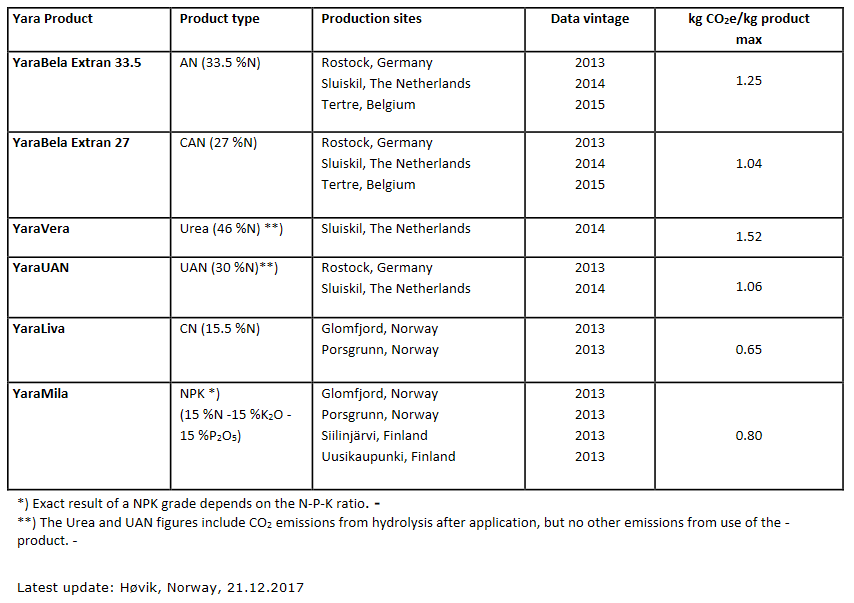

And yet there is much room, even within Yara, for improvement in measuring and reporting the carbon footprint of its products. Yara’s latest sustainability reporting, published in December 2017, quantifies the carbon footprint of most of its end products by production site, although it only focuses on European production sites and primarily uses data from 2013. It excludes ammonia as an end product, so there is no public data to quantify the carbon footprint of ammonia.

The opportunity here is to develop an internationally-accepted methodology and verification process to determine the carbon footprint of green ammonia.

For this to function as a pricing mechanism, rewarding low-carbon ammonia producers with a premium price for their “green” product, consumers will demand that this carbon measurement process be much more robust than existing models. As with other global standards, ammonia’s carbon footprint must be consistent, transparent, and independently verified. Fertilizers Europe has launched a carbon footprint tool. However, I’m not aware that the work has yet begun to provide ammonia buyers with the information and trust that would motivate them to pay a premium price.

Nonetheless, the product is now in the marketplace: the Freeport plant is producing and selling low-carbon ammonia. It might not be exactly “green” but certainly it is somewhere on the spectrum, better than “brown” ammonia from natural gas, and much better than “black” ammonia from coal. Now, we need the industry’s quantitative tools to evolve so that the business model for green ammonia can be realised.

You can also read the full article at AmmoniaIndustry.com.