Bunker Ammonia: new report quantifies ammonia as “the most competitive” fuel for zero-emission maritime vessels in 2030

By Trevor Brown on December 15, 2017

This week, Lloyd’s Register published the most significant comparative assessment so far of ammonia’s potential as a zero-emission maritime fuel.

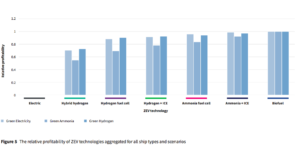

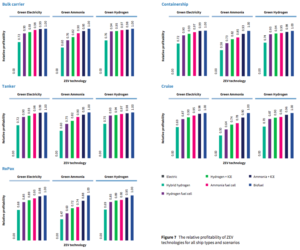

The new report compares ammonia, used in either internal combustion engines (ICE) or fuel cells, to other low-carbon technologies, including hydrogen, batteries, and biofuels, estimating costs for 2030. It concludes that, of all the sustainable, available options, ammonia “appears the most competitive.”

By assessing different decarbonisation options for different ship types, our objective is to deliver a roadmap … to demonstrate that there is a pathway, as well as the opportunity, to ensure the successful and low-cost decarbonisation of the shipping industry …

“This study is the first step to understanding the drivers, benefits and challenges of the most promising technologies. The shipping industry now has a unique opportunity to contribute to the large potential for improvements of such technologies and aim for a profitable zero-emission service.” Carlo Raucci, Principal Consultant, UMAS

Lloyd’s Register, Zero-Emission Vessels 2030, December 2017

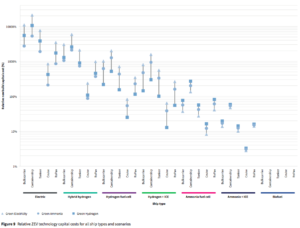

The report rates these zero-emission vessels (ZEV) against a benchmark vessel fueled with heavy fuel oil (HFO). Green ammonia may already be cost-competitive with fossil ammonia in certain scenarios, and ammonia fuel may already be cost-competitive with fossil fuels in other energy markets. However, the maritime industry presents a special challenge to advocates of cost-competitive low-carbon energy because HFO is the cheapest, dirtiest, most energy-dense fuel available. It is, literally, the bottom of the barrel.

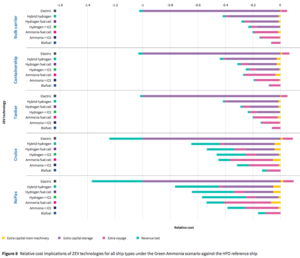

In addition to the fuel-cost issue (OPEX), comparison against a benchmark forces the alternative fuels to overcome a technology-change cost (CAPEX) hurdle, which, for the incumbent fuel, is always zero.

It is therefore no surprise that, today, “there is no scenario under which the ZEV options are likely to be more profitable than the HFO reference ship. This underlines the importance of policy and regulation as drivers for change, since market forces alone appear unlikely to prove sufficient.”

In addition to policy and regulation, the report highlights two crucial ideas for driving industrial change.

First, the maritime industry is not a passive observer of technology: it has an active role to play, driving down the cost curve, both by developing and demonstrating zero-emission technologies and, as a result, by enabling efficiencies of scale in production.

Second, some entities in the maritime sector operate in unique, niche markets where ammonia fuel technologies are already competitive, and they have an unrivaled opportunity – today – to deploy these technologies.

Fortunately, the technology and processes that are contributors to this gap in voyage cost competitiveness are currently low in terms of maturity and have definite potential for improvements and economies of scale …

Even in the timescales covered by this study, there is potential for a significant portion of the competitiveness gap to be closed; gauging this will be the focus of further study. For those in shipping with niche access to a low-cost supply of these fuel/energy sources, or an ability to pass on a voyage cost premium to a supply chain that values zero-emission services, the gap may have already closed.

Lloyd’s Register, Zero-Emission Vessels 2030, December 2017

The report was produced by Lloyd’s Register and UMAS. Lloyd’s Register established itself more than 250 years ago as a maritime classification society, and is now “one of the world’s leading providers of professional services for engineering and technology – improving safety and increasing the performance of critical infrastructures.” UMAS (University Maritime Advisory Services), based in University College London (UCL), “draws upon the world-leading shipping expertise of the UCL Energy Institute, combined with the advisory and management system expertise of MATRANS.”

Why not Biofuels?

Initially, biofuels appear to be “the most attractive ZEV solution … economically due to their low capital cost implications for machinery and storage, and low fuel and voyage costs.” Unfortunately, however, the report identifies “two key, and coupled, challenges – sustainability and availability.”

The scale of demand that the maritime fuel industry represents could create “practical limits on production causing prices to rise to the point where biofuel options become uncompetitive relative to the ‘next best’ option.”

Why not Batteries?

This report examines long-haul shipping and stresses that, while battery-electric vessels might work for ferries or coastal vessels “travelling very short distances,” for the “medium to long (i.e. trans-oceanic) voyages” studied in this report, “battery technology is simply not competitive.” (An excellent example of the optimal-use battery-electric short-haul vessel would be the Yara Birkeland.)

Why not Hydrogen?

One of the essential considerations of this study, which is an “economic analysis, estimating the cash flow” of a range of merchant vessels using each zero-emission technology, is the lost revenue, due to the displacement of cargo by additional fuel storage tanks. Because hydrogen is significantly less energy-dense than ammonia, “it is the latter, in combination with the ICE, that appears the most competitive. This is because of the lower capital costs associated with the onboard storage of ammonia, relative to hydrogen.”