DNV GL predicts carbon-neutral fuels, including ammonia, to surpass oil for shipping by 2050

By Trevor Brown on September 14, 2018

This week, DNV GL published its annual Energy Transition Outlook, providing a long-term forecast for global energy production and consumption, and including a dedicated report describing its Maritime Forecast to 2050. This is the first forecast from a major classification society explicitly to evaluate ammonia as a maritime fuel.

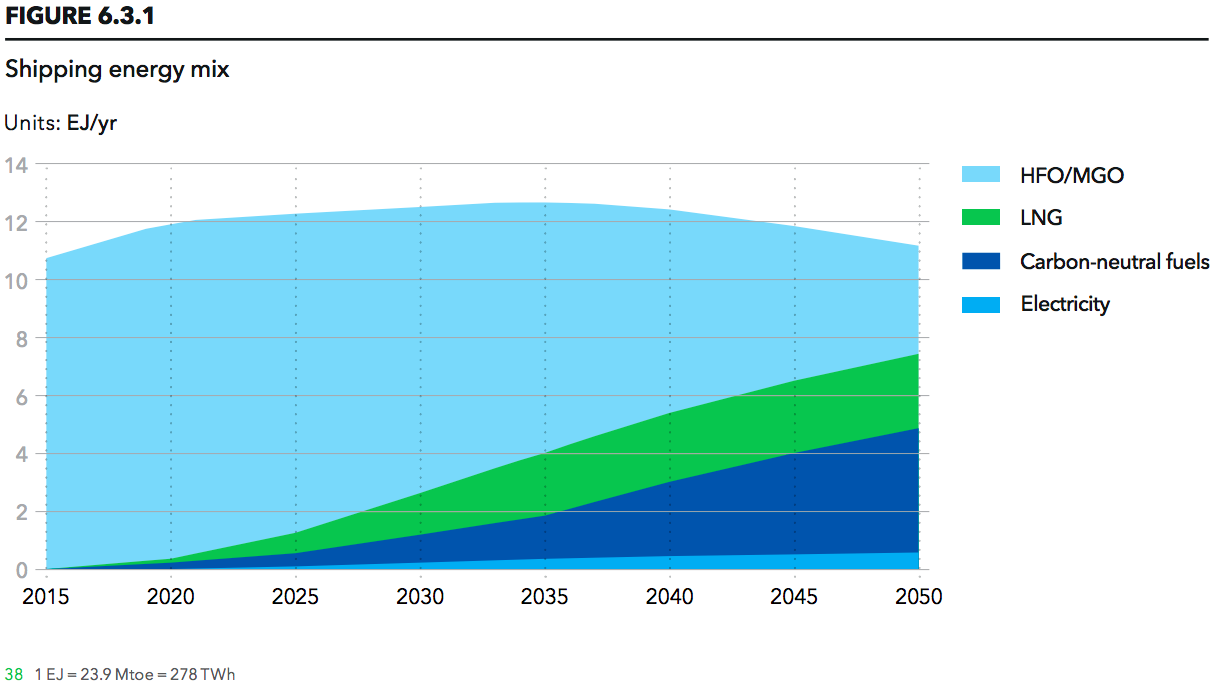

By 2050, DNV GL predicts that 39% of the global shipping energy mix will consist of “carbon-neutral fuels,” a category that include ammonia, hydrogen, biofuels, and other fuels produced from electricity. By 2050, these fuels will therefore have gained greater market share than oil, LNG, and battery-electric. If ammonia succeeds as the carbon-neutral fuel of choice in the shipping sector, this new demand will be roughly equivalent to 200 million tons of ammonia per year, more than today’s total global production.

Carbon-neutral fuels refer to a variety of energy fuels or energy systems that have no net GHG or carbon footprint. The term covers fuels with no carbon emissions at the stack, such as hydrogen (H2) and ammonia (NH3), provided that the energy used for producing them emits no GHGs. Examples include nuclear, renewable, or using carbon capture and storage (CCS). It also covers fuels with carbon emissions at the stack, such as biofuels, provided that the carbon contained in the fuel is sustainably sourced and part of the natural carbon cycle …

We cannot currently predict with any confidence which of the possible types of carbon-neutral fuels will be preferred. The uptake is very sensitive to price and local/global availability, which are, in turn, dependent on cost of production and infrastructure development. We have therefore grouped biofuels, electrofuels, hydrogen (H2), and ammonia (NH3) into a single category called carbon-neutral fuels …

We forecast that by 2050, 39% of shipping energy will be supplied by carbon-neutral fuels, slightly surpassing liquid fossil fuels such as MGO (Marine Gas Oil) and HFO, which together will supply 33% of the energy. LNG and liquid petroleum gas (LPG) will together account for 23% of the energy use. Electric batteries charged from shore will be an energy source on a third of ships from mid-century. Together with cold ironing, shore-based electricity will provide about 5% of the total energy for shipping.

The total energy use equates to 270 million tonnes of oil equivalent (Mtoe) in 2050, of which 90 Mtoe is supplied by HFO/MGO, 60 Mtoe by LNG, 100 Mtoe by carbon-neutral fuels, and an additional 160 terawatt hours (TWh) of electricity.

DNV GL Energy Transition Outlook 2018, Maritime Forecast to 2050, 09/10/2018

This is the first shipping industry forecast to consider ammonia. It is not a scenario, but a prediction: “Amidst a growing profusion of different energy scenarios, many customers ask us quite simply what we think is the most likely case. And it is the answer to this question that we present here.” This is DNV GL’s “best estimate future.”

But this is not the first shipping industry report to analyze the potential of ammonia. Lloyd’s Register has done excellent work to provide comparative analyses of carbon-neutral fuels, which identified ammonia as “the most competitive” fuel for zero-emission maritime vessels. Earlier this year, International Transport Forum, the OECD’s “think tank for transport policy,” published a report looking at decarbonization scenarios in shipping, and concluding that the sector could achieve deep decarbonization by 2035 with a 70% mix of ship using ammonia-hydrogen fuel. I summarized these scenarios in an article that asked What drives new investments in low-carbon ammonia production? My answer: One million tons per day demand.

Meeting the IMO’s GHG reduction targets

This transition is being driven by the International Maritime Organization (IMO) and its Initial GHG Strategy, published in April 2018. This document is the global maritime industry’s version of the Paris Agreement, and it commits the sector to deep decarbonization, pledging to “reduce the total annual GHG emissions by at least 50% by 2050,” and completely “phase them out, as soon as possible in this century.”

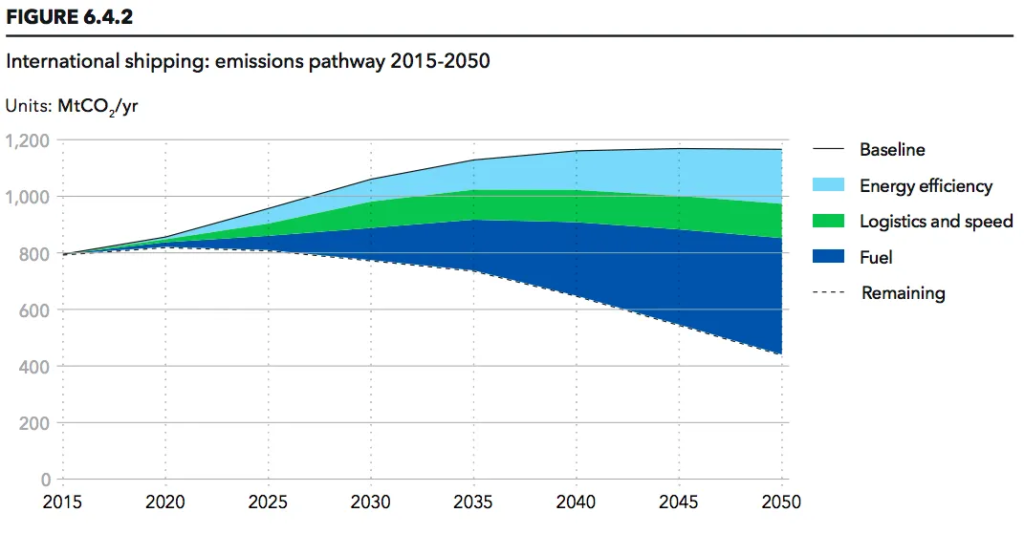

DNV GL forecasts that the shipping industry will achieve the IMO’s “ambitious” targets. It predicts steep emissions reductions, with the lion’s share due to the use of carbon-neutral fuels like ammonia and hydrogen.

According to DNV GL analysis, the shipping industry’s “carbon intensity will improve by 51% and 74% by 2030 and 2050, respectively,” relative to the IMO’s baseline year of 2008. And “we forecast that CO2 emissions for international shipping will fall … to 441 million tonnes (Mt) by 2050 … or 52% compared with 2008. Carbon-neutral fuels contribute 42% of the total CO2 reduction by mid-century.”

Why must we use carbon-neutral fuels, why not just low-carbon fuels?

The shipping industry is beginning to recognize the mathematical impossibility of achieving its GHG emission reduction targets using fossil-based fuels, even “low-carbon” fuels like LNG.

The maximum achievable reduction in CO2 emissions during combustion of LNG is 25% … Accounting for methane release (‘slip’), the GHG saving may be lower, or even negative, depending on engine technology. In practice, when considering the complete lifecycle for LNG, the GHG savings amount to roughly 0–18% …

LPG combustion results in CO2 emissions approximately 16% lower than those of HFO …

Using methanol in an internal combustion engine reduces CO2 emissions by approximately 10% compared with oil …

DNV GL Energy Transition Outlook 2018, Maritime Forecast to 2050, 09/10/2018

Relative to the IMO’s target of a 50% reduction in GHG emissions, fossil-derived fuels like LNG, LPG, and methanol offer very little opportunity. (However, they are excellent for achieving the IMO’s 2020 sulphur caps).

Without choosing between the various carbon-neutral fuels (ammonia or hydrogen or biofuels, etc), DNV GL identifies factors that it believes will influence selection and market adoption:

The potential for alternative marine fuels will depend on factors related to meeting emission and safety requirements, physical and chemical characteristics, availability, cost, safety, and local and global environmental footprint … There is no ‘magic bullet’ solution. In most cases, selection will be based on a compromise between benefits and drawbacks of various fuel options.

DNV GL Energy Transition Outlook 2018, Maritime Forecast to 2050, 09/10/2018

The benefits of ammonia as a maritime fuel

In the section dedicated to ammonia, the report articulates the core argument in favor of using ammonia as a fuel: energy density, relative to hydrogen, and the resulting economic advantage.

Safety and regulatory challenges and space / weight considerations related to storing large quantities of H2 on ships have generated interest in exploring alternative H2-based energy carriers. Ammonia (NH3), sometimes called ‘the other hydrogen’, is carbon-free and liquefies at a higher temperature than H2 (-33°C versus -253°C). Ammonia is over 50% more energy-dense per unit of volume than liquid H2. Storage and distribution can therefore be easier than for hydrogen.

A recent study claims that it can be less costly to use NH3 for long-term storage of liquid H2 (0.5 USD/kg for H2 in NH3 versus 15 USD/kg for H2 stored as LH, when estimated for half-year storage). This indicates that there might be significant cost savings associated with storing [liquid H2] as ammonia, including in ship applications.

DNV GL Energy Transition Outlook 2018, Maritime Forecast to 2050, 09/10/2018

And the technology options are all in place, and developing quickly:

Handling different fuels will require different propulsion systems (energy converters). Alternative propulsion systems for shipping include gas, dual, multi-fuel engines, marine fuel cells, battery electric propulsion systems, and gas and steam turbines … Two-stroke dual-fuel engines have increased fuel flexibility significantly … Promising steam- and gas-turbine concepts are also being considered. Marine fuel cells are emerging, providing a higher efficiency, and thereby lower fuel consumption and associated emissions, compared with combustion engines …

Ammonia engines are being developed, and major industrial projects will soon demonstrate the environmental benefits of NH3 in dual-fuel combustion. The use of NH3 gas as a fuel source in dual-fuel engine applications is a relatively novel idea, where it can be used as a substitute for natural gas … there are several fuel cells designed to use ammonia directly.

DNV GL Energy Transition Outlook 2018, Executive Summary, 09/10/2018

One caveat … ammonia is an electrofuel

Without wishing to take away from DNV GL’s excellent report, I must highlight one error of archaism: its definition of an electrofuel.

Permit me to state the obvious: an ‘electrofuel’ is a fuel made from electricity.

For some reason, despite extensive consideration of ammonia and hydrogen made from electricity, the report uses the word electrofuel as “an umbrella term for carbon-based fuels such as diesel, methane, and methanol, which are produced from CO2 and water using electricity as the source of energy.” Why ‘carbon-based’ as a definition of electrofuel? This is nonsense. In previous decades, when only hydrocarbons were under consideration, this definition might pass, but today it is nonsense. It serves no purpose to separate fuels by mode of production (electrofuel, biofuel) when referring to molecular structure.

Ammonia is an electrofuel. It can also be a biofuel. And it happens to contain no carbon.

DNV GL: managing risk since 1864

DNV GL describes itself as a “global quality assurance and risk management company,” and it is one of the maritime industry’s major classification societies. With operations stretching back to 1864, today’s firm was formed by the merger of the German GL and Norwegian Det Norske Veritas. According to the company, 70% of its business is energy-related, and it serves three sectors: maritime, oil and gas, and the power and renewable energy industries.

Based on DNV GL’s independent model of the world’s energy system, this annual Outlook aims to assist our customers’ analysts and decision makers, and those in other stakeholder organizations in the global energy supply chain, to develop their future strategic options.

Our customers own and operate assets with useful lives that span decades — and during this period pivotal changes in the world’s energy system will occur … immense challenges and opportunities lie ahead for the industries that we serve.

DNV GL Energy Transition Outlook 2018, Executive Summary, 09/10/2018

You can also read the full article at AmmoniaIndustry.com.