Power to Ammonia: The OCI Nitrogen – Geleen case

By Trevor Brown on May 18, 2017

The Power-to-Ammonia feasibility study includes an assessment of the costs and benefits of producing ammonia from renewable energy at OCI Nitrogen’s existing production site in Geleen.

Of all the companies who joined forces in the Power-to-Ammonia project, OCI is the only ammonia producer. Its business case for making carbon-free ammonia is especially interesting therefore: not just because of the company’s deep understanding of the ammonia market and available technologies, but also because it faces corporate exposure to the financial, operational, and social risks of relying upon a fossil-fueled technology in a carbon constrained future.

I’ve previously written about Power-to-Ammonia and the other two business cases it analyzes. First, electricity producer Vattenfall and its subsidiary Nuon at Eemshaven looked at ammonia as a means for the “large scale [energy] storage and import,” which will be required if the Netherlands is to meet its national CO2 reduction targets. Second, grid operator Stedin at Goeree-Overflakkee looked at smaller storage and transport options that would mitigate investments in grid expansion and improvement. My next article will provide details on the specific options that Power to Ammonia includes in its technology assessment for ammonia synthesis.

Over the next few years, this industrial consortium intends to build pilot projects to develop and demonstrate the necessary technologies. Today and tomorrow, however, they are heavily featured in the Power-to-Ammonia Conference, in Rotterdam on May 18-19.

Pilot projects are needed

While OCI’s analysis concludes that the economics don’t presently favor production of renewable ammonia in The Netherlands (on the basis of today’s local prices for green electricity), the study does identify a roadmap for research and development, as well as for financial innovation, by which “the electrification route could be profitable before the year 2030.”

And, while OCI believes that domestic (Dutch) production of renewable ammonia isn’t profitable today, it makes the case that carbon-free ammonia imports from regions with more favorable power costs could be subsidized by The Netherlands, helping the country to meet its CO2 reduction targets.

The production of green NH3 from renewable electricity in The Netherlands is economically not attractive at this moment and on the short term. The main reasons are a limited availability of cheap renewable electricity resulting in a limited number of operating hours in combination with high investment costs, mainly determined by the electrolysers for the production of H2 …

Importing NH3 with a low or no CO2 footprint as a fuel for carbon neutral electricity production is feasible with an SDE+ type subsidy and has the potential to contribute significantly to the required CO2-reductions (maximum 3.5 Mton/year in case of base load operation producting 10 TWhe) …

However, if the investment, mainly in the electrolysers, could be reduced significantly and/or the pricing of renewable NH3 is significantly higher and/or the cost for CO2 emissions are higher, the electrification route could be profitable before the year 2030. Innovations on the electrolyser markets such as the battolyser also appeared to have a great potential. Other ways to increase profitability could be to act on both day-ahead-market and imbalance market, to include avoided investment (e.g. in power grid) and to find subsidy schemes (like SDE+/EIA) or attractive financing models.

As OCI Nitrogen sees it, “prior for companies to start employing these technologies, pilots are needed. A follow-up step would be to investigate the way in which these pilots could be eligible for subsidies.”

Our conclusion is that energy storage is a major part of the route to realise CO2-reduction. The consequence is that the government should find ways to subsidise the unprofitable top of energy storage as an extension to the SDE+ subsidy.

OCI makes it clear that “the ultimate goal is to eliminate CO2 emissions at both electricity and NH3 production,” however, the order in which these industries decarbonize is important.

For the traditional NH3 suppliers it is a logical path to expect that at first the huge existing NH3 volumes will be decarbonized before using the NH3 for electricity production in gas fired power stations. The natural gas that is no longer used for NH3 production can be used more efficiently to produce electricity when renewable energy is in short supply.

Ammonia Cost and Operating Rate

Obviously, to produce low-cost ammonia from renewables, “energy should be cheap and the installation should run for a large number of hours.” (These operating hours are crucial for project financing because the capital investment is amortized across total quantity of products sold. The more hours the plant operates, the more tons of ammonia it produces, the cheaper each ton of ammonia becomes – because each ton carries a smaller amount of the original investment cost.)

However, OCI identifies an issue with operating to maximum capacity because, given variable electricity pricing, power will sometimes be expensive: at those times, it may not make sense to buy the expensive electricity.

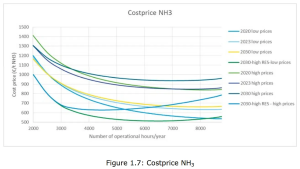

In the accompanying chart of “NH3 Costprice,” in which OCI forecasts the price curve for a ton of ammonia depending on how many hours per year the plant operates, for various market scenarios, the prices curve upwards when the plant operates for more hours than can take advantage of cheap electricity.

Balancing these conflicting economic realities is an optimization challenge: maximum operating hours for minimal electricity cost.

The fixed costs include maintenance, wages, land lease, grid connections, depreciation and interest. Variable costs consist mainly of electricity (and some nitrogen and water). If the plant can be operated only during the hours when electricity is cheapest (based on day-ahead market), variable costs can be minimised. When calculating the production costs of NH3 the number of hours the plant is operating is affecting both factors: more hours means less fixed costs per ton, but the average electricity price also rises.

In the near future and lower RES scenario’s, the installation should be running almost continuously to achieve the lowest cost price. In the high RES scenario’s the utilization will drop to 50-60%, following the oversupply and preventing curtailment of RES …

The availability of low cost electricity during a large percentage of the time will be a challenge … For the short term, the costs of CO2 free NH3 are higher compared to the cost of NH3 on the basis of natural gas (300-350 EUR/ton). In 2030 in high renewable energy scenario cases the price differences are smaller. With further optimisation of the operational hours the break-even point might be reached.

Plant specification

OCI’s assessment focuses on a small-scale ammonia plant, with an annual capacity of 20,000 mtpy, “because this would be an optimal size for testing all the effects of discontinuous operation, and where product volumes are still significant.”

The investment is in the magnitude of 30 MEUR, based on an estimate by Proton Ventures.

• The lifetime of PEM-electrolysers is around 10 years, where the NH3 synthesis plant will be depreciated in 15 years.

• Electricity consumption and other variable costs (demi[neralized] water, air etc are mainly energy driven) will be equivalent to 10.5 MWhe/ton NH3.

• Production will be linear to the operating hours, with 20 kton/year based on 8000 operational hours per year.

• Fixed cost (2% of the capex), depreciation (15 years) and interest (7% WACC) together will be around 5 MEUR/year.

Finally, the Power to Ammonia feasibility study concluded that OCI Nitrogen’s business case needs intervention in the short term, either through technology development, financial innovation, or subsidy.

As market prices for NH3 are generally well below 500 EUR/ton, it is not yet possible to produce [renewable] NH3 at a profitable level for OCI Nitrogen. The gap with current market prices, around 300 EUR/ton, is too big to bridge …

However for the 2030 high renewable energy scenario differences are small. And with some further optimisation of the operational hours the break-even point might be reached. However, if the investment could be reduced significantly and/or the pricing of renewable NH3 is significantly higher, this electrification route could be profitable before 2030. Innovations on the electrolyser markets such as the battolyser also have a great potential.

Other ways to increase profitability could be to act on both day-ahead-market and imbalance market, to include avoided investment (e.g. in power grid) and to find subsidy schemes (like SDE+/EIA) or alternative attractive financing models.

You can read about the other business cases, for Nuon at Eemshaven and Stedin at Goeree-Overflakkee, or download the full Power to Ammonia feasibility study from the ISPT website.

Read the full article at AmmoniaIndustry.com.