Report from the European Conference: Renewable Ammonia cost-competitive with Natural Gas Ammonia

By Trevor Brown on June 23, 2017

The viability of producing ammonia using renewable energy was one of the recurring themes of the recent Power to Ammonia conference in Rotterdam. Specifically, what cost reductions or market mechanisms would be necessary so that renewable ammonia – produced using electrolytic hydrogen in a Haber-Bosch plant – would be competitive with normal, “brown” ammonia, made from fossil fuels.

A number of major industry participants addressed this theme at the conference, including Yara and OCI Nitrogen, but it was the closing speech, from the International Energy Agency (IEA), that provided the key data to demonstrate that, because costs have already come down so far, renewable ammonia is cost-competitive in certain regions today.

As Cedric Philibert of the IEA put it in his comprehensive Concept Note, published days before the conference:

Thanks to the recent cost reductions of solar and wind technologies, ammonia production in large-scale plants based on electrolysis of water can compete with ammonia production based on natural gas, in areas with world-best combined solar and wind resources.

Cédric Philibert, IEA, Producing ammonia and fertilizers: new opportunities from renewables, May 16 2017

Although it is not explicitly mentioned in the quote above, the recent reductions in electrolyzer costs have been significant, and it is this projected cost-drop that reconciles Philibert’s bullish view with the caution of the others. I wrote about this in April this year, describing the IEA’s renewable hydrogen project and the announcement by Norwegian electrolyzer-maker Nel of its plans to build the “largest electrolyser plant ever designed … [a] GIGA factory concept for renewable hydrogen production to outcompete natural gas reforming.”

Establishing a cost-target for electrolyzers

The first crucial price point was identified by OCI Nitrogen as part of the Power to Ammonia feasibility study, about which I’ve written in detail.

If the investment, mainly in the electrolysers, could be reduced significantly and/or the pricing of renewable NH3 is significantly higher and/or the cost for CO2 emissions are higher, the electrification route could be profitable before the year 2030.

The Power to Ammonia feasibility study specified a target cost-reduction for the electrolyzers: down 70% from the base-case 1,000 EUR per kW.

However, according to the new Nel data cited by the IEA a few months after the Power to Ammonia study was published, its GIGA-scale electrolyzer would cost just $450 per kW, which is close to 400 EUR, representing a 60% reduction on the base-case assumption used by OCI above. While the cost of Nel’s project is location-specific, it demonstrates how quickly technology costs can plummet, and how soon renewable ammonia could be competitive even according to a cautious industry assessment.

Establishing a target carbon price

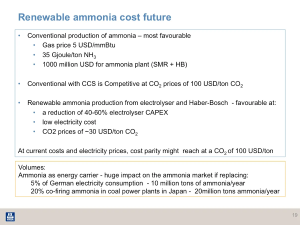

In his presentation, Rob Stevens, VP Technology Scouting at Yara, shared the data that the world’s biggest ammonia producer uses to assess the viability of renewable ammonia.

First, conventional ammonia, produced from a natural gas feedstock, could become carbon-free using carbon capture and sequestration (CCS) to bury the CO2 underground; with today’s technologies, this would be commercially competitive with a carbon tax “at CO2 prices of 100 USD/ton CO2.” (I note that Yara is part of a major national effort to build commercial CCS operations in Norway.)

For a truly carbon-free process, Yara estimates renewable ammonia would be competitive if we can achieve cost reductions in three areas: electrolyser capex (by a smaller percentage than OCI, just 40-60%), a low electricity cost, and a carbon price of just $30 per ton CO2. Alternatively, with no electrolyzer or electricity cost reductions, a larger carbon price of $100 would level the playing field by itself.

(It is worth remembering that ammonia production using natural gas emits at least 1.8 tons of CO2 per ton ammonia, assuming the best and most efficient process. In reality, the US industry emits an average of 2.1 tons CO2 per ton ammonia and so, with a $100/ton carbon tax, cheap ammonia made from cheap natural gas would carry an additional carbon premium of around $210 per ton. Roughly speaking, this represents a 60% cost increase on today’s low ammonia price.)

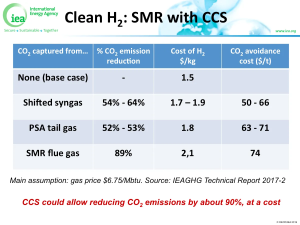

Establishing a price for carbon capture and sequestration

The IEA’s Philibert also addressed the costs of CCS, providing detailed estimates for various options, depending on exactly how much of the CO2 you attempt to capture. For example, to capture 89% of the CO2 would cost $74 per ton (of CO2).

(Again, given the average carbon emissions from US ammonia production, this would increase costs by more than $155 per ton ammonia.)

The data for this comes from the IEA’s extremely well-researched, almost 300-page Techno-Economic Evaluation of SMR Based Standalone (Merchant) Hydrogen Plant with CCS.

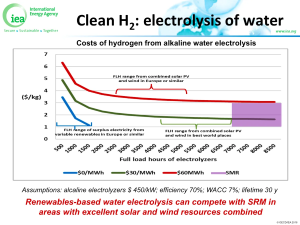

Establishing a target electricity price

Philibert also provides cost data for electrolytic hydrogen, demonstrating that “Renewables-based water electrolysis can compete with SRM in areas with excellent solar and wind resources combined.” The excellence of these resources shows in two places: first, the electricity cost and second, the “full load hours” (FLH), which reflect the ability to run the plant constantly.

Both Siemens and the IEA cited low electricity prices in their presentations. Siemens quoted the “record-low bid in September 2016: 2.4 US cent/kWh for 350 MW solar PV.” The IEA’s Philibert used rounder numbers but drew a deeper conclusion – cost parity with the traditional production methods that use steam methane reformation (SMR) of a natural gas feedstock:

Where solar or wind resources are excellent, the cost of electricity from solar or wind power plants could be at or below $ 30/MWh, as suggested by the prices recently announced for new-built wind farms in Morocco and solar plants in Chile and Dubai. At such prices and with sufficient load factors, the cost of hydrogen would not exceed $ 2/kg and compete with SMR.

Cédric Philibert, IEA, Producing ammonia and fertilizers: new opportunities from renewables, May 16 2017

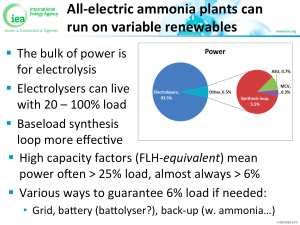

Philibert’s concept note provides detailed numbers to illustrate the scale of the opportunity here:

Variability of power creates various challenges. Alkaline electrolysers can operate between 20% and 100% of their nominal load. ASU and MCV consumption units need small amounts of power and their outputs are storable. The synthesis loop, however, would best work with continuous operations and requires continuous feed-in – but it only consumes about 5% of the total.

A plant run by solar and wind, or in some cases by wind power alone, with capacity factors of 5 000 to 7 000 full load hours (FLH), will have 25% of its load available most of the time, and times with less than 5% may be virtually non-existent. Short-time storage of compressed hydrogen and nitrogen could be extended somewhat to ensure continuous operations of the synthesis loop. The additional cost would be small as the H2 need to be compressed anyway before entering the synthesis loops.

A large ammonia plant aimed at producing 500 000 t/y, whether for exports or local transformation into a variety of fertilisers, would consume about 4.8 TWh annually for producing over 88 000 t H2 and running all sub-systems. Assuming 6 000 FLH for combined solar and wind power capacities, the required deployment could be, for example, of 785 MW wind turbines and up to 785 MW solar PV plants, for 735 MW electrolysers.

Cédric Philibert, IEA, Producing ammonia and fertilizers: new opportunities from renewables, May 16 2017

The benefit, as Philibert points out, of combining both wind and solar power sources, is that each balances the other, meaning that the intermittency of the renewables is no longer very intermittent – with significant consequences for ammonia production, which requires constant operation.

Philibert’s Concept Note on Renewable Ammonia is available at the IEA website. The presentations from the Power to Ammonia conference in May 2017 are only available online for conference attendees at this time.

Read the full article at AmmoniaIndustry.com.