Small-scale ammonia: where the economics work and the technology is ready

By Trevor Brown on September 21, 2018

The movement toward small-scale ammonia is accelerating for two reasons. First, small ammonia plants are flexible. And, second, small ammonia plants are flexible.

They are feed stock-flexible, meaning that they can use the small quantities of low-value or stranded resources that are widely available at a local scale. This includes flared natural gas, landfill gas, or wind power.

And they are market-flexible, meaning that they can serve various local needs, selling products like fertilizer, energy storage, or fuel; or services like resource independence, price stability, or supply chain robustness.

While the scale of these plants is small, the impact of this technology is big. As industry-insider publication Nitrogen+Syngas explained in its last issue, “as ammonia production moves toward more sustainable and renewable feed stocks the ammonia market is facing a potentially radical change.”

Technologies for small ammonia plants are becoming increasingly important as ammonia production is moving toward more sustainable and renewable feedstocks. As the availability of these feedstocks cannot match that of fossil fuels, small and distributed plants are required, as well as dedicated technical solutions to match new and unconventional needs …

It could turn out that localised production of a small quantity of ammonia in the direct vicinity of the consumer is an economically favourable option, despite the higher specific investment cost which naturally exists for a smaller plant.

Nitrogen+Syngas, Sustainable ammonia for food and power, July/August 2018

Proton Ventures: the NFUEL unit

The Nitrogen+Syngas article, Sustainable ammonia for food and power, provides an in-depth profile of Dutch mini-ammonia plant pioneer Proton Ventures.

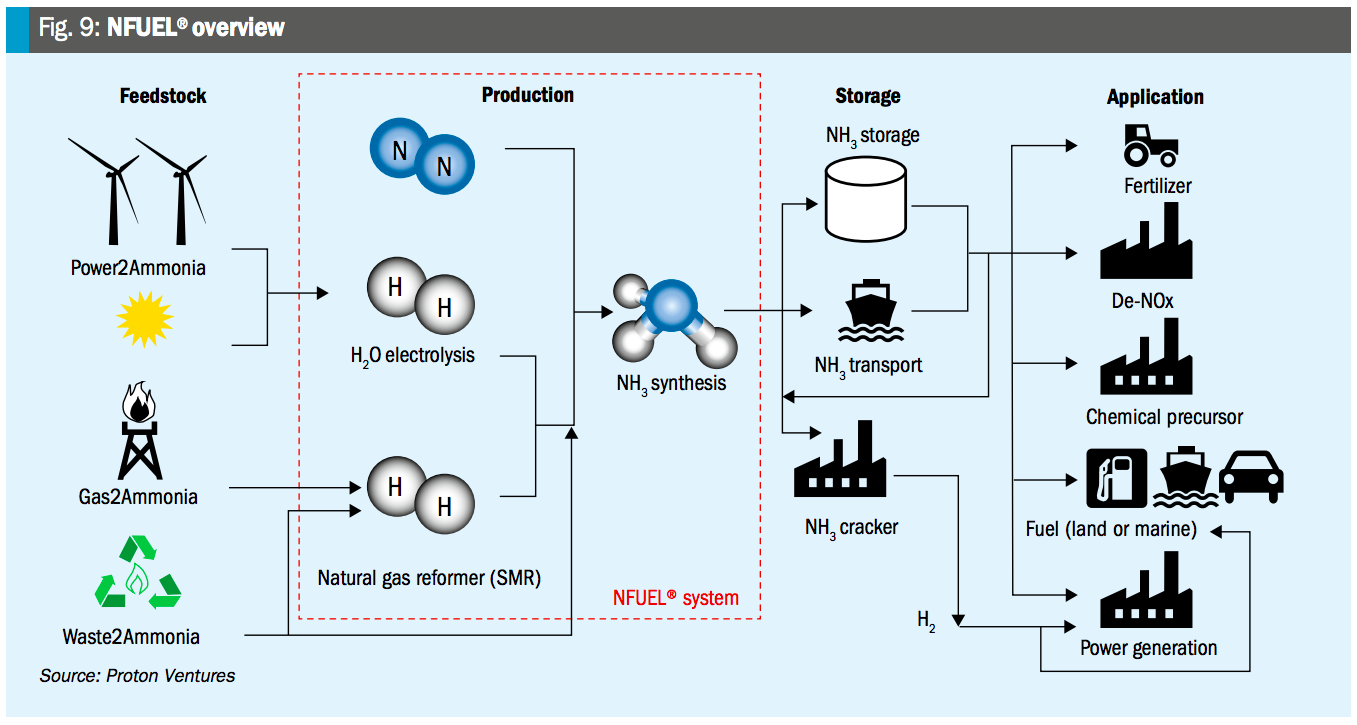

Proton Ventures offers modern technical solutions which make it possible to move away from large-scale plants towards small-scale ammonia production units (NFUEL® units).

Proton Ventures can provide customers with small-scale ammonia plants, ensuring customer’s independence of transport costs and ammonia price fluctuations …

Standardised designs are available for minimum capex and optimised opex. Site activities are minimal thanks to its plug-and-play designed skids.

Nitrogen+Syngas, Sustainable ammonia for food and power, July/August 2018

Proton Ventures’ business model emphasizes feed stock flexibility: the NFUEL unit can consume natural gas, to monetize “oil well flares” or stranded assets, or biogas, to recycle waste from landfills or anaerobic digesters; in addition, the units could consume byproduct hydrogen directly, or produce their own hydrogen using electricity to split water.

The gas-to-ammonia concept (using SMR) benefits from a lower global emission footprint and can create value-added products from stranded sources. It is only economically viable if there are no large ammonia plants nearby or in places where the feed stock is basically free.

Advantages of the power-to-ammonia concept (using electrolysers) include: the efficient storage of energy in liquid form, it is CO2-free and it creates a carbon-free fuel.

A key benefit of the waste-to-ammonia concept is that it makes a value-added product from waste sources … Take, for example, the 180 million Nm3 of high purity associated gas being flared in the Bakken shale play, North Dakota, USA, corresponding to 180,000 [metric tons] of NH3 production. The otherwise flared associated gas can be at close to zero costs, resulting in a market competitive ammonia price.

Nitrogen+Syngas, Sustainable ammonia for food and power, July/August 2018

The Proton Ventures technology combines SMR or electrolysis units for hydrogen production with Casale’s Haber-Bosch ammonia loop. Small-scale ammonia is no longer in-development, it is deployed: “industrial references for 20,000 [metric ton per year] NH3 reactors include two units in China, one in Argentina and one in Switzerland.

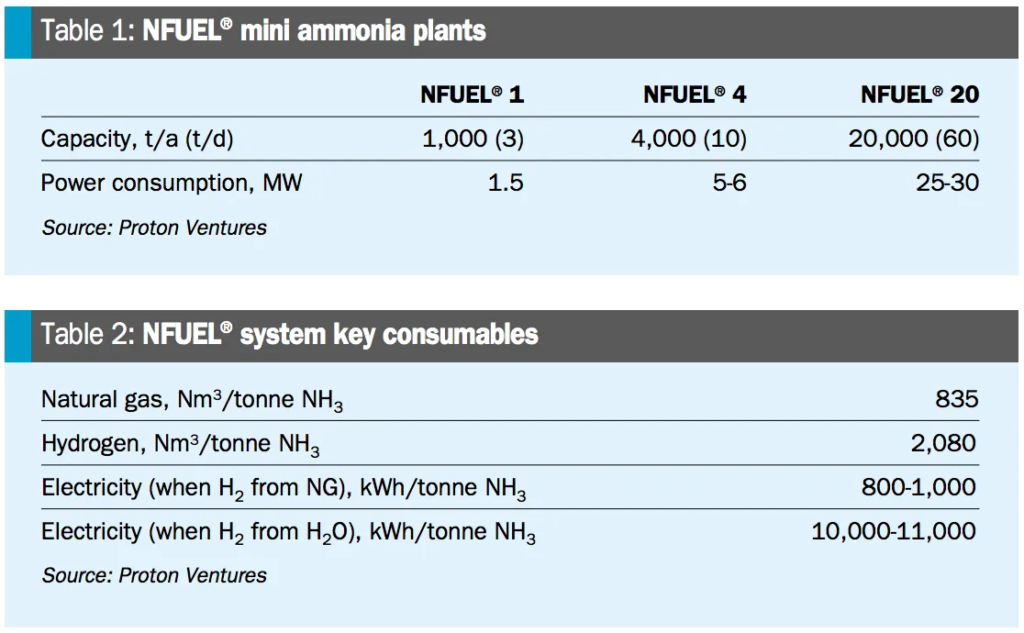

The Nitrogen+Syngas article contains useful data on the energy consumption of the NFUEL units, at various scales.

A 1.5 MW unit could produce 3 metric tons of ammonia per day, at an implied energy intensity of 12 MWh per ton. With 10-11 MWh for hydrogen production from electrolysis, these data imply that 83-92% of the power consumed by an all-electric ammonia plant is used in hydrogen production. (For large-scale all-electric ammonia plants, using wind power, I’ve seen this number estimated as 96%)

For hydrogen producers and consumers, this is an important fact: if producing hydrogen at a local scale, you have already done almost all of the work. Adding ammonia synthesis only takes the remaining 8-17% of the system’s total energy consumption, but doing so provides the opportunity to access valuable new markets.

The economics work, because these ammonia plants are not permanent installations, not fixed assets. “Mini ammonia units are modular, fully transportable, skids / containerised and can be installed in various locations with minimum installation costs.” In other words, you can install your NFUEL unit, monetize your waste stream for a few years, and then haul it to the next site.

From a financing perspective, this raises an interesting question of whether a mini-ammonia plant even requires capital expenditure: with ease of transport, this hardware could be treated as a long-term lease.

BayoTech: the nested flow reactor

On the other side of the planet, in the deserts of New Mexico, BayoTech announced this week that it has completed the prototype for its modular hydrogen unit.

Albuquerque startup BayoTech Inc. is blazing a path for hydrogen, ammonia and fertilizer producers to replace today’s mammoth, centralized facilities with modular, transportable production units.

The technology, originally developed at Sandia National Laboratories, could allow chemical companies to produce fuel and fertilizer right where it’s used – at the doorsteps of farms, or next to future filling stations for hydrogen-powered vehicles. That could mean far-lower costs for growing food, and for replacing carbon-emitting, gasoline-fueled cars with cleaner ones that run on fuel cells.

And it’s technology that will hit the market next year, said BayoTech CEO Justin Eisenach.

Albuquerque Journal, BayoTech builds its first modular hydrogen plant, 09/17/2018

Again, this is a mini-ammonia plant that combines traditional SMR natural gas reforming with the Haber-Bosch process. But, according to this week’s announcement, the BayoTech process “makes better use of energy in the heating and cooling process, improving efficiency by about 25 percent compared with traditional plants.”

(When I last wrote about BayoTech, in my article Small-scale ammonia production is the next big thing from May 2018, I quoted BayoTech’s claims as follows: “The natural gas required to produce a ton of ammonia is reduced by 25%. The capital cost on a per ton basis is reduced by 30% and the physical footprint on a per ton basis is reduced by 70%. CO2 Green House Gas emissions are reduced by 25% and when distribution emissions are factored in the savings jumps to 80%.”)

BayoTech is evidently having some success raising funds, taking in $16 million in venture investment in the last two years, “including a substantial contribution from a global fertilizer producer that’s signed on as BayoTech’s strategic partner … one of the world’s largest fertilizer producers.”

“We’ll begin building the first prototype system in November for delivery to our strategic partner in 2019,” Eisenach said. “The company will use it for fertilizer production, providing a much cheaper way for them to make the hydrogen they need for their manufacturing process … They’ll test it first, and then hopefully convert to commercial orders that we’ll fill under a supply agreement.”

It’s the first step in a three-part, modular strategy to build a full fertilizer plant by 2020. With the hydrogen unit now developed, BayoTech will build its first ammonia-production unit next year, and then add a final unit to produce nitrogen fertilizer.

Albuquerque Journal, BayoTech builds its first modular hydrogen plant, 09/17/2018

While fertilizer is the existing market, and therefore the initial target market for small-scale ammonia plant technology developers, it is not the only focus for BayoTech and its investors, who also discuss future, larger markets for ammonia: as a fuel and as a hydrogen storage medium.

Ammonia for Energy Storage

Similarly, the Nitrogen+Syngas article provides a detailed description of the nascent market for ammonia as energy storage, and its increasingly attractive economics:

Power-to-ammonia enables energy to be transported and stored for periods of days, weeks or even months.

Electricity storage in the form of ammonia will add cost to the overall electricity system. However, large scale CO2-neutral energy storage will introduce important benefits for the system, enabling a further penetration of intermittent renewable electricity sources ..

At deep decarbonisation … the initially more costly use of ammonia as a CO2-neutral fuel for electricity production becomes very attractive and one of the few realistic alternatives.

The installation of additional renewable wind and solar capacity on its own is not sufficient to meet ambitious CO2 reduction targets of 80-95% by 2050. Large scale storage and import of renewable electricity is required to meet these targets. Power-to-ammonia enables both storage and import and has the potential to contribute substantially to CO2 reduction targets.

Nitrogen+Syngas, Sustainable ammonia for food and power, July/August 2018

You can also read the full article at AmmoniaIndustry.com.