The capital intensity of small-scale ammonia plants

By Trevor Brown on January 19, 2018

The list of investment drivers for building new ammonia plants in the US over the last few years was short, beginning and ending with cheap natural gas. Markets change, however, and the investment drivers for the next generation of new ammonia plants might include low cost electrolyzers, low cost renewable power, carbon taxes, and global demand for ammonia as a carbon-free energy vector.

The market adoption of ammonia in energy applications, including large-scale seasonal storage of renewable power, long-distance hydrogen transportation and distribution, and carbon-free fuel for stationary and mobile applications, will outstrip any pre-existing demand (fertilizers, explosives) by some orders of magnitude.

For this to make sense, however, ammonia needs to be produced without fossil fuel inputs. This is perfectly possible using Haber-Bosch technology with electrolyzers, but today’s wind and solar power plants exist on a smaller scale than could support a standard (very big) Haber-Bosch plant.

So, to produce renewable ammonia, small-scale ammonia production is essential.

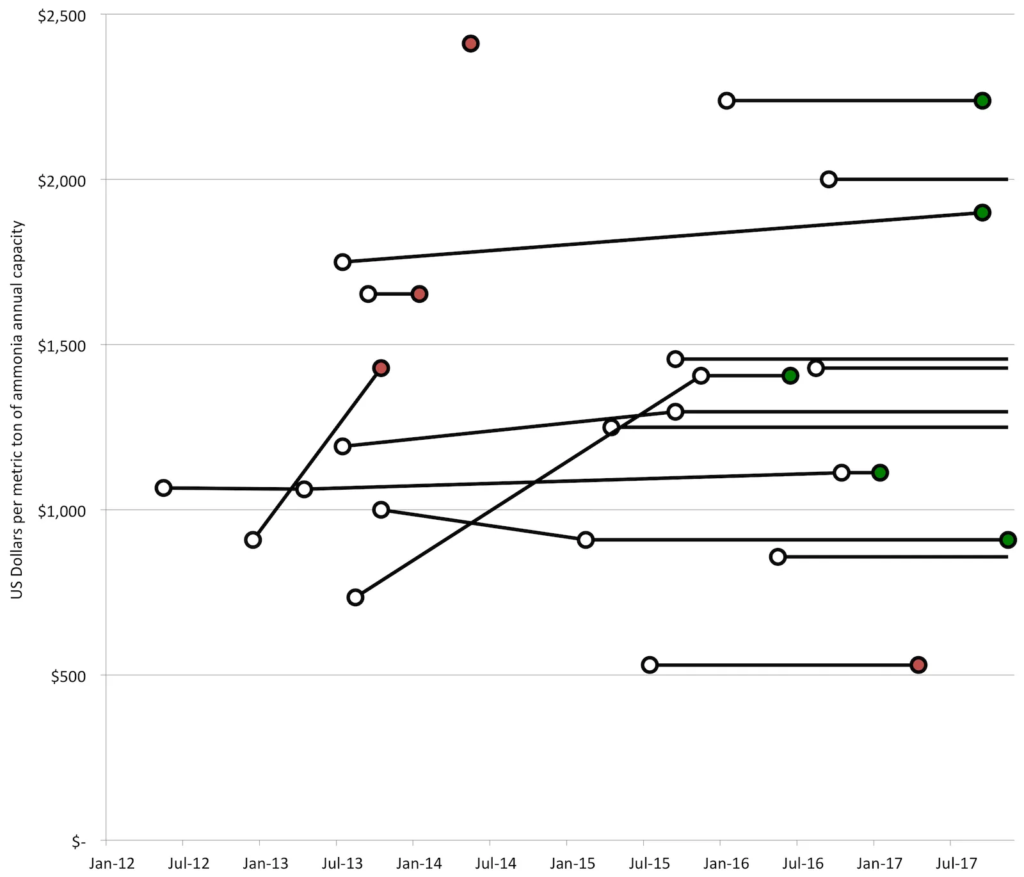

This time series chart shows the capital intensity of today’s ammonia plants, using observed data from the last five years of industry expansion across North America, controlled to allow apple-to-apple comparisons. The data begins in January 2012 and ends in November 2017.

Each data point represents an announced cost for a new ammonia plant. Projects ending in red circles were cancelled; those ending in green circles are or will be operational; the others may or may not get built but are all in active development.

Together, the data illustrate competitive advantages of alternative investment strategies, and demonstrate a shift away from the prior trend toward (and received wisdom of) monolithic mega-plants that rely on a natural gas feedstock.

Many additional ammonia-urea-UAN projects have been proposed and built over the last five years, but this dataset only includes projects with transparent ammonia-only capital expenditure data.

Greenfields, Brownfields, Conversions

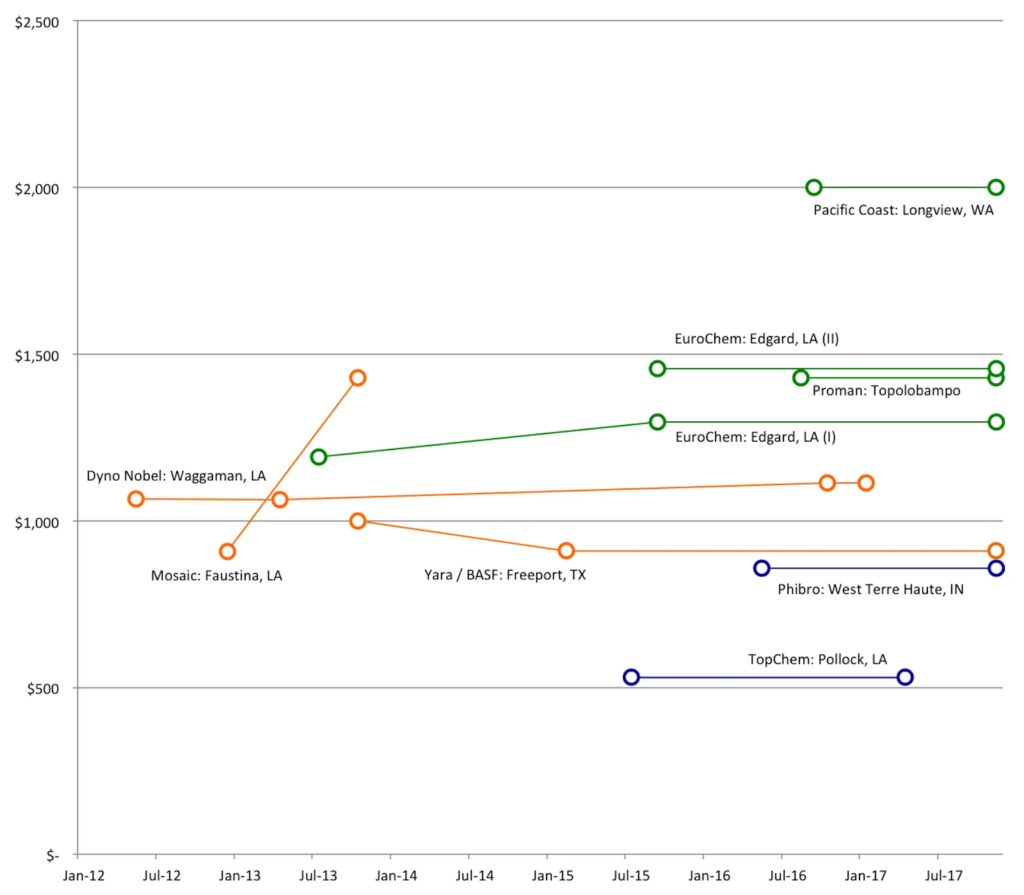

To illustrate a few of these projects, here’s a comparison of greenfields (new developments, requiring new infrastructure like pipelines or rail connections), brownfields (new developments on existing industrial land), and conversion projects (where an existing asset is converted from power production, for example, to ammonia production).

- Greenfields are relatively expensive, with a capital intensity from $1,300 to $2,000 per ton.

- Brownfields are more realistic: they are being built at a capital intensity of $900 to $1,100 per ton ammonia.

- Conversion projects look amazing on paper, but none have begun construction yet. Perhaps these are stymied by the difficulties of actually converting the asset, and the risks that entails.

The next big thing: small

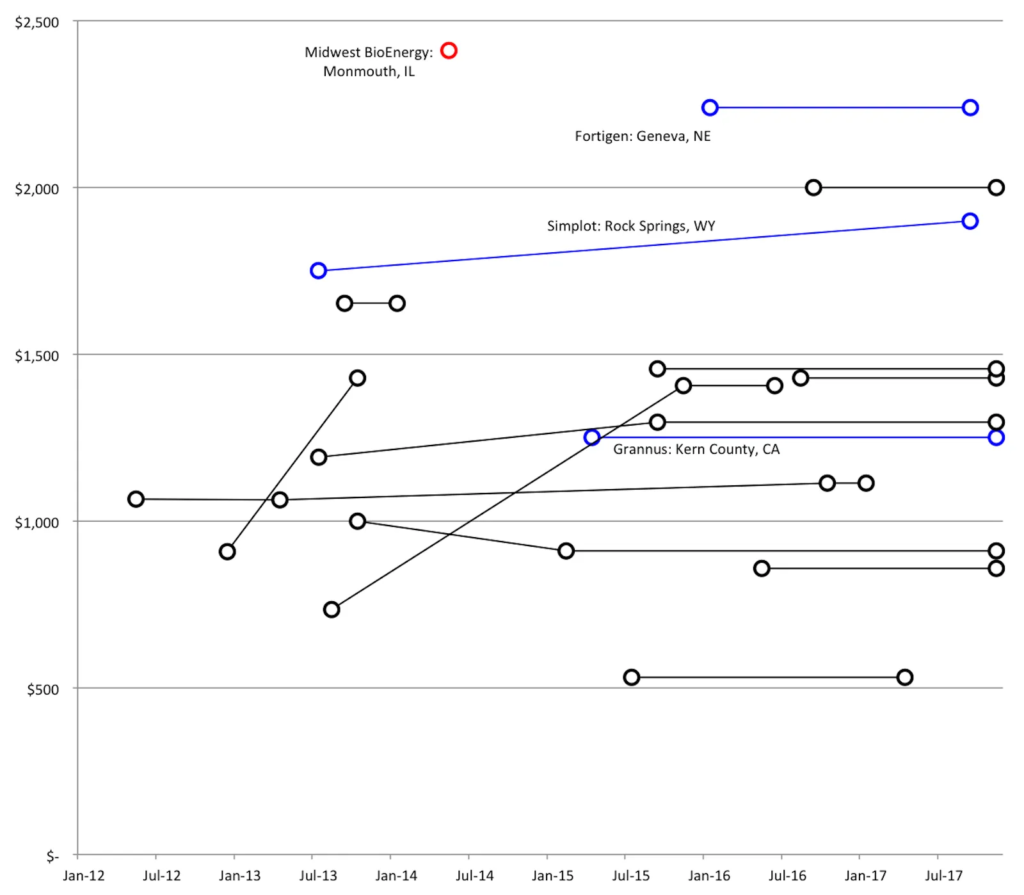

Conventional wisdom tells us that small-scale plants, with capacities under 200,000 tons per year, should be uncompetitive – and yet there are small-scale projects that successfully reached financial close, began construction, and are now fully operational.

In Wyoming, Simplot invested $350 million for a 600 stpd (short ton per day) / ~200,000 mtpy (metric ton per year) ammonia plant. Construction by Linde, using Casale’s ammonia technology, began in October 2014 and the Rock Springs, WY plant was commissioned in September 2017.

In Nebraska, Fortigen invested $75 million for a 100 stpd ammonia plant, which was a decades-old, second-hand N-Ren ammonia loop, revamped for the 21st Century with some new front-end units that, I’m told, will give this miniature plant an operational efficiency “within a few mmBTUs” of a world-scale plant. Construction by the Gorham Group began in March 2016 and the ammonia plant in Geneva, NE, is already complete (problems with the storage tank, however, delayed full commissioning).

These investment decisions demonstrate the economic viability of small-scale, regional production models, even when they have a capital intensity of $1,900 to $2,250 per ton.

(In California, Grannus is developing a first-of-a-kind 80,000 mtpy ammonia plant, to demonstrate the viability of its small-scale, modular ammonia/urea/power polygeneration technology, which licenses ammonia technology from Haldor-Topsoe. However, I won’t comment on this because the project hasn’t reached financial close or started construction.)

Both of these completed projects have local demand for 100% of the product. Simplot used to buy ammonia on the market, and now is self-sufficient; it upgrades the ammonia to mono-ammonium phosphate (MAP) fertilizer. Fortigen has an offtake agreement with the local co-op, Farmers Cooperative, which distributes fertilizers from 60 locations across Nebraska and Kansas.

Both projects were 100% financed by their owners, without the public debt offerings or years-long equity raises that have caused other, bigger projects to fail. Those bigger projects may have benefitted from efficiencies of scale, but they may also prove to be simply too big to finance.

Power to Ammonia

An interesting number omitted from these charts is the capital intensity of the Power-to-Ammonia project in The Netherlands, which proposes small-scale, modular ammonia plants running on electrolytic hydrogen from renewable power sources. Conventional wisdom tells us that these shouldn’t be economically viable because they lack the efficiencies of scale of a world-scale plant – however, the data suggest that renewable ammonia plants, in Europe, will be less capital intensive than either the Simplot plant or the Fortigen plant – two examples of real, commercial, built projects.

With a cost estimate of EUR 30 million and a production capacity of 20,000 mtpy, Proton Ventures’ Power-to-Ammonia plant has a capital intensity of roughly $1,670 per ton ammonia capacity. Like the Simplot plant, this is built upon ammonia technology from Casale.

The first of these Power-to-Ammonia plants was confirmed last month, and is scheduled to be commissioned in Goeree-Overflakkee by January 2020.

The interesting question, therefore, is what kind of cost curve will we see for these ammonia synthesis modules: once the demonstration plant has shown that this is possible, how far and how fast can the costs come down on future units?

You can also read the full article at AmmoniaIndustry.com.