The Offshore-Wind / Ammonia Nexus

By Stephen H. Crolius on June 07, 2018

In early April the Business Network for Offshore Wind held its 2018 International Offshore Wind Partnering Forum in Princeton, New Jersey in the U.S. Ammonia energy was not on the agenda, at least as a matter of formal programming. But it did come up during a panel session entitled “Offshore Wind Energy Hydrogen Production, Grid Balancing and Decarbonization.” We know this because Steve Szymanski, Director of Business Development for Proton OnSite (a subsidiary of Norway’s Nel ASA), was on the panel and says he was the one to bring it up. The topic attracted “a lot of interest and a lot of good questions,” Szymanski said. Nel is an industry member of the NH3 Fuel Association.

The Business Network for Offshore Wind is an American non-profit organization “dedicated to building a business network that will usher the U.S. into the offshore wind market.” It has 28 industry sponsors ranging from global players like Siemens and Statoil to hands-on wind developers such as Deepwater Wind, the proprietor of the United States’ first offshore wind farm. In a subsequent email, Szymanski said that the Forum was a “serious, implementation-oriented conference” at which “all of the major trade unions were in attendance (iron workers, shipyard workers, riggers, etc.), as well as project developers and equipment providers.” Governor Phil Murphy of New Jersey gave the keynote address.

The nexus of offshore wind and ammonia energy is a natural one. For starters, the generating potential of offshore wind is enormous. An International Energy Agency report, “Renewable Energy for Industry: Offshore Wind in Northern Europe,” released on May 25, cites a 2017 study that “defines an economic potential of 600 to 1,350 GW generating 2,500 to 6,000 TWh/y” for wind power from a zone that extends “from five nautical miles from the shore to the limit of the Economic Exclusive Zones of EU member States (including the United Kingdom).” The report says these numbers are “very significant compared to the current total generation of electricity in the European Union, of 3,200 TWh in 2015.”

And then there is the fact that offshore wind is . . . offshore. Economic Exclusive Zones generally extend 200 nautical miles (370 km) from the coastline. Another study cited by the report estimates that the cost of submarine cable is order-of-magnitude €1 million ($1.2 million) per km. Conversion of electricity to ammonia and transport of ammonia by ship could in certain circumstances provide a beneficial alternative to the installation and maintenance of submarine cable.

And finally there is the challenge and opportunity cited in the abstract for the “Hydrogen Production, Grid Balancing and Decarbonization” panel:

The mismatch between wind energy supply and consumer electricity demand results in curtailment: the loss of energy that otherwise could be usefully sent to the electric grid. There are at least two strategies for addressing this challenge: electric battery storage and hydrogen production. While onshore battery storage can be implemented now, renewable hydrogen production by water electrolysis is a strategic solution. In addition to electric grid balancing, hydrogen is a value-added commodity in the transportation, industrial and stationary power sectors.

The proposition that “offshore hydrogen” (and by extension ammonia) could play a useful role in the sustainable energy economy of the future is supported by the IEA report: “Offshore wind power could also run the production of storable and transportable fuels [derived from hydrogen], which could help fill the gaps of electrification in all end-use sectors, i.e. for some industry uses, provide long-term storable fuels for balancing plants, thus increasing the security of supply, and fuels for various long-haul transportation applications.”

With that said, it will be necessary for “offshore hydrogen” to establish a competitive cost position vs. other low-carbon forms of the commodity. And, the report says, this will have its challenges: “In most cases, the costs of producing hydrogen [from offshore wind] as a first building block for manufacturing hydrogen-rich chemicals and fuels, may remain higher than the cost of producing hydrogen from fossil fuels, even if these costs are increased by implementation of carbon capture and storage or re-use.”

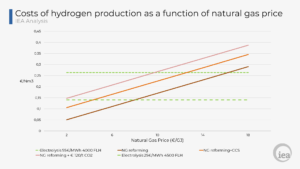

The chart at right shows hydrogen production cost under a best-case offshore electricity price of € 55 ($64) per MWh arrayed against the cost of hydrogen production using steam methane reforming (SMR) plus carbon capture at various prices of feed stock natural gas. The SMR/CCS option retains its economic superiority until the price of natural gas reaches € 12.50 ($14.60) per GJ (947,000 BTU) – approximately twice the range of European prices over the last year.

And even if SMR/CCS hydrogen is excluded from the option set, there is another benchmark to be reckoned with, according to a commentary published with the report: “the lowest achievable costs of hybrid solar and wind power in the World’s best renewable resource areas.” The cost of this electricity, represented as the lower dashed line in the chart, is projected at € 25 ($29) per MWh. Given this, the report recommends consideration of “ammonia production in the closest countries with excellent solar and wind resources, such as North African countries.”

The report makes one final point that resonates in North America no less than in Europe. “A fuller analysis could give a positive value to two important aspects of producing hydrogen from offshore wind in Europe: greater energy security, and lower price volatility.” In particular, “if both electricity and hydrogen were to be produced from NG with CCS, Europe would massively scale-up its NG imports. This could possibly [increase] its costs and its dependence on providers.”

Net net, when all factors are taken into consideration, “there appears to be . . . scope for a considerable expansion of offshore wind power in Northern Europe.”