Yara and Nel collaborate to reduce electrolyzer costs; announce green ammonia pilot in Norway by 2022

By Trevor Brown on August 23, 2019

This week, two Norwegian companies, fertilizer producer Yara and electrolyzer manufacturer Nel, announced an agreement to test Nel’s “next generation” alkaline electrolyzer at an ammonia production site. The parties expect to begin operating a 5 MW prototype in 2022, feeding green hydrogen directly into Yara’s 500,000 ton per year ammonia plant at Porsgrunn.

This announcement builds on Nel’s December 2018 announcement of a grant awarded by the PILOT-E program for a “green fertilizer project with Yara.” Supported by Norway’s Research Council, Innovation Norway, and Enova, PILOT-E is “a funding scheme that aims to speed up the development and implementation of green energy technology,” Its focus is not only on supporting industry within Norway, but also on trade: developing clean-tech that can be exported.

As Nel’s CEO stated in the December announcement, “our next generation alkaline electrolyzer … basically is tailormade for large-scale ammonia production and other industrial applications.”

“It is an honor to work closely with Yara to develop efficient, green ammonia production solutions, triggered by the PILOT-E scheme,” says Jon André Løkke, Chief Executive Officer of Nel …

The next-generation, pressurized alkaline electrolyzer developed by Nel will be installed at the Yara facilities in Porsgrunn for piloting in an industrial environment and will have a capacity of approximately 5 MW. After the project, subject to certain criteria, ownership of the electrolyzer will be transferred to Yara for continued operation in the pilot plant.

Nel announcement, Nel ASA: Signs collaboration agreement with Yara related to green fertilizer project, August 20, 2019

Last month, I wrote about how Yara viewed green ammonia as key to meeting its commitment to be “carbon-neutral by 2050.” That article discussed both Yara’s promotional video marketing of green ammonia and its new financing incentives that align corporate costs with climate objectives. Yara’s announcement this week demonstrates both a small but tangible step towards its short-term emission reduction targets, and a significant long-term opportunity.

The capacity of the electrolyzer will be 5 MW corresponding to 1% of the hydrogen production in Porsgrunn. It is expected to be installed in 2022.

“We are very pleased with the partnership with Nel. Our ammonia plant will make the first small step towards carbon free fertilizer production. When further developed, Yara Porsgrunn will be in a unique position …” says Jon Sletten, Plant manager in Porsgrunn.

Yara announcement, Yara and Nel collaborate to produce carbon free hydrogen for fertilizer production, August 20, 2019

In October 2018, Yara announced the completion of an emission reduction project at its Sluiskil plant in the Netherlands, where it has built a pipeline connecting that ammonia plant to a supply of byproduct (low-carbon) hydrogen from a nearby ethylene plant. The carbon-free hydrogen supply at Porsgrunn will be smaller than that, but with a far greater potential to scale up. You can’t always find new sources of byproduct hydrogen, but you can always build more modular electrolyzers. The Porsgrunn plant isn’t Yara’s first electrolyzer tie-in project: in February 2019, Yara announced that it is working with Engie on a feasibility study to connect electrolyzers fed by solar power at its Pilbara plant in Australia.

Pilot project objective: electrolyzer cost reduction

The prototype electrolyzer installed at Porsgrunn will displace natural gas feedstock (and eliminate CO2 emissions) for roughly 1% of the ammonia produced at its 500,000 ton per year plant. While every 1% matters, this is clearly less of an emissions-reduction project, and more of a technology cost-reduction project.

The partners hope that, by working together to develop Nel’s “next generation” electrolyzer technology and test it in an industrial setting, they can begin to drive down the future cost of renewable hydrogen.

(We may be beginning to witness a new trend in sustainable financing, in response to the urgency of the climate crisis: investing in important but relatively expensive solutions with the explicit intention of moving the cost curve. See last week’s Negative Emissions Commitment by Stripe, the payment processing company that we use at this website, announcing its immediate intention “to purchase negative CO2 emissions at any price.”)

In addition to technology cost reduction, Yara can begin developing new markets for new products: green ammonia and green fertilizers, where the assumption must be that, at least initially, green products would earn a price premium over their fossil counterparts.

“We are also looking at the customer segment to see if we can commercialize this by having a share of our production that is marketed as CO₂-free fertilizer,” says [Tove Andersen, EVP Production in Yara].

E24 article, Nel og Yara skal gjøre «grønt» hydrogen billigere, August 20, 2019

It is important to note that 5 MW may not be the scale of the commercial product, once Nel has developed it beyond the prototype.

The mass-produced version of the next-generation electrolyzer may not be the size of the five megawatt Yara pilot … The capacity will depend on the experience the company has … But one thing is certain, and that is that [Nel] wants to further streamline production, hoping that production costs will fall further and make [the] technology even more competitive with other solutions.

“The whole design of the next generation electrolyzer is based on the fact that we can have fully automatic assembly at the factory,” says Nel CEO Jon André Løkke.

E24 article, Nel og Yara skal gjøre «grønt» hydrogen billigere, August 20, 2019

As Bjørn Simonsen, Nel’s VP Investor Relations, clarified this week via e-mail, “the development targets for our next-generation alkaline electrolyzer are lower unit cost, higher operational flexibility, higher pressure, lower footprint, and overall higher efficency,” relative to Nel’s current technology.

- “lower unit cost” relates to manufacturing efficiencies, driven by both automation and volume, with significant new markets on Nel’s horizon (see below);

- “higher operational flexibility” has implications for renewables beyond Norway’s (96% hydroelectric) grid, because it increases compatibility with intermittent renewable power supplies (wind or solar), and it could improve the electrolyzer’s ability to offer fast-response demand-side management (DSM) services within electricity markets.

- “higher pressure” is a crucial aspect for ammonia production because the conventional Haber-Bosch ammonia synthesis loop operates at high pressure. Hydrogen produced by atmospheric pressure electrolyzers, therefore, would need to go through an energy-intensive compression step, reducing total system efficiency. (I’ve written about an alternative approach, taken by JGC Corporation at its green ammonia pilot plant in Koriyama, Japan, where a newly-developed catalyst enables low-pressure ammonia synthesis using regular, low-pressure electrolyzers.) If Nel’s new electrolyzer generates high-pressure hydrogen, this would reduce or eliminate compression costs, increasing ammonia production efficiency.

- “lower footprint,” relates to plant size, supporting modular design and low-cost delivery;

- “overall higher efficency” is what will make green ammonia, produced from air and water using electricity, competitive with fossil ammonia.

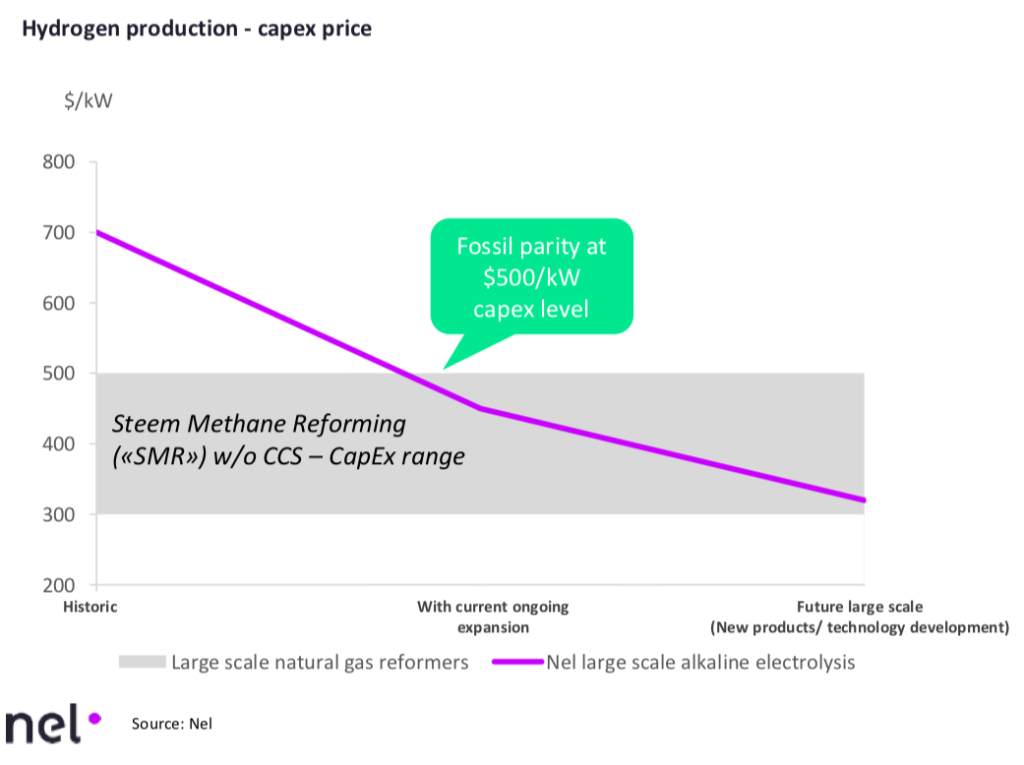

In its presentation for Q1 2019, Nel included a slide titled “Scale & automation will reduce CapEx for electrolyzers.” It states that electrolyzers will begin to hit “fossil parity” when the capital expenditure (CapEx) of an electrolyzer system is reduced to $500/kW.

According to the slide, Nel expects to deliver a 40% cost reduction (from $700/kW to $420/kW) by expanding the capacity of its electrolyzer manufacturing factory in Notodden, Norway, from 40 MW per year to 360MW per year. It aims to complete this expansion by 2020.

The next step in Nel’s hydrogen cost-reduction vision relies on realizing “future large scale” markets, which can both “increase production volume, and further size scaling of [Nel’s electrolyzers].” This is precisely what the Porsgrunn pilot could achieve.

Next-generation electrolyzer-ammonia technology

Nel’s website describes its existing alkaline technology as follows:

The world’s most energy efficient electrolysers, the A Series features a cell stack power consumption as low as 3.8 kWh/Nm3 of hydrogen gas produced, up to 2.2 MW per stack. A Series electrolysers can produce up to 3,880 Nm3/h of hydrogen or just over 8 ton per day.

Nel Hydrogen website, Atmospheric Alkaline Electrolyser, accessed August 2019

To translate these figures into the context of industrial ammonia production, 3.8 kWh/Nm3 is roughly 45 MWh/ton (metric tons, assuming a unit conversion rate for hydrogen of 11,890 Nm3/ton). Ammonia is 17.8% hydrogen by weight, so the Nel-Yara pilot aims to generate hydrogen for its ammonia plant with an energy efficiency (electrolyzer “cell stack power consumption”) of about 8 MWh/ton ammonia. Ammonia plants consume energy in other processes beyond the electrolyzer cell stack, but hydrogen production represents the vast majority — likely more than 90% — of the total power consumption.

In 2018, I wrote about a detailed techno-economic analysis, published by researchers from MIT and the University of Massachusetts — Amherst, on the energy requirements of an all-electric ammonia plant (Sustainable Ammonia Production from U.S. Offshore Wind Farms: A Techno-Economic Review). According to that study, hydrogen production using electrolysis would represent 93% of the total energy consumed in ammonia production. The technology assessed was an earlier generation of Nel electrolyzer (the Norsk Hydro Atmospheric Type 5040). Breaking down the 93% total energy consumed by the electrolyzer, the cell stack represented 84% and the balance of plant represented 9% (“4.3 kWh/Nm3 is for electrolysis and the remaining 0.5 kWh/Nm3 is for the balance of plant.”). Beyond hydrogen production, the air separation unit consumed less than 1% for nitrogen production, and the Haber-Bosch unit consumed only 5.5% of the total energy required for ammonia synthesis.

If those ratios serve as an accurate guide for the Nel-Yara pilot project (ie, the electrolyzer cell stack consumes 84% of the total energy), it would imply renewable ammonia production at a specific energy consumption of around 9.5 MWh per ton. This would improve on the prevailing figures publicly disclosed by thyssenkrupp Industrial Services in 2018 (10MWh per ton) and Siemens in 2017 (12 MWh per ton).

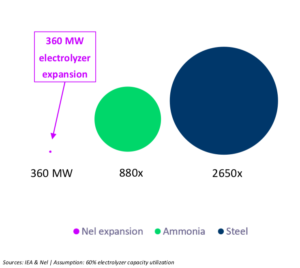

If Nel can achieve these ambitious cost and efficiency targets for its electrolyzers, it sees ammonia as a good first opportunity, but identifies “Massive future potential from CO-free steel production.”

Nel estimates the steel industry’s potential demand for renewable hydrogen as being three times bigger than the global green ammonia opportunity. The company is already working to deliver a 4.5 MW electrolyzer for “fossil free steel production” through the HYBRIT joint venture.

Green ammonia and fossil-free steel is less mature market, will only start to develop at large scale after 2025.

But, market potential is massive – important for Nel to be well positioned for the future.

Nel Q1 2019 Presentation, May 8, 2019