Yara’s N-Tech Platform: Making Strides with Green Ammonia

By Stephen H. Crolius on April 05, 2018

Yara International, one of the world’s largest ammonia producers, is making strides in its development of green ammonia as a fertilizer, chemical intermediate, and energy carrier. The progress is mentioned in the company’s 2017 annual report, released last week, and documented in more detail in a presentation delivered in late February at the 2018 Nitrogen + Syngas Conference in Gothenburg, Sweden.

Annual Reporting from Yara

The green ammonia work was initiated more than one year ago by the company’s Corporate Innovation department, as described in Yara’s 2016 Annual Report:

This focus on innovation led to the creation of a new Corporate Innovation (CI) function [whose] objective is to expand the scope of innovation to a longer time and strategic horizon. The initial focus includes exploration of the significance of circular economy and new green production technologies.

Yara International 2016 Annual Report

One year later, Yara’s 2017 Annual Report, published last week, describes the launch of two new platforms under its Corporate Innovation banner:

N-Tech platform: Securing the long-term competitive position for Yara’s nitrate production, and establishing a leading position on de-carbonized ammonia production combined with a business model of ammonia as an energy carrier.

Circular Economy: Responding to societal needs by retrieving nutrients from waste and bringing them to the market, either as organo-mineral fertilizer, as secondary sources of raw material in primary production or on the urban short nutrient cycle.

Yara International 2017 Annual Report

Nitrogen + Syngas Presentation

Yara’s presentation at the recent Nitrogen + Syngas conference was delivered by Senior Innovation Manager Eystein Leren. In it he articulated a striking vision for green ammonia that is rooted in specific factors — “tipping points and market drivers” — that will be in play in coming decades.

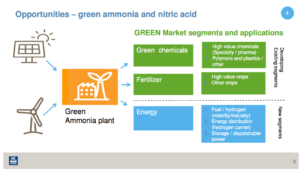

In an early slide, Leren delineated three distinct markets that will be relevant for the green product. The first two – fertilizer and green chemicals – involve “developing existing segments.” Products of interest include fertilizer for “high-value crops”, and “high-value chemicals . . . polymers, and plastics.” The “high-value” attribute is key because high-value products can support premium prices which can cover higher costs of production. The third segment is highlighted as a new one for Yara: energy. Here the applications include fuel for mobility and industry; distribution of energy; and energy storage for dispatchable power. In his explanation of the latter case, Leren refers to the challenges that emerge when the replacement of “conventional power with renewable power decouples production from consumption.” He incorporates a graphic and a quote from Grigorii Soloveichik, Program Director of the U.S. Department of Energy’s ARPA-E REFUEL program: “For long term storage and/or transport of renewable energy over distance, AMMONIA is described as the ‘ideal renewable energy carrier.’”

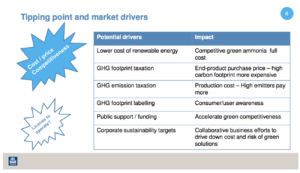

Leren follows with a slide that lists six drivers of “cost/price competitiveness” that could launch green ammonia in one or more of the targeted segments. Two of the drivers – GHG footprint labeling and corporate sustainability policies – do not pertain directly to economics but could nonetheless enhance the case for green ammonia market development. The other four address economic factors. Two involve pricing schemes for GHG emissions, and one involves investment from public sources. The final one involves reducing the cost of renewable energy.

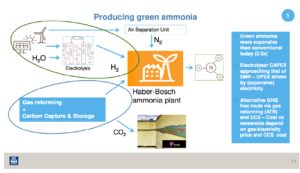

A slide on the latter theme indicates that green ammonia today is 2-3 times more costly than the brown commodity. Leren notes that the capital expense per unit of hydrogen produced via water electrolysis is now approaching that of hydrogen from steam reforming of natural gas. This means that competitiveness will now be a function of reducing cost on the operating expense side, either by securing affordable renewable electricity or greening the natural-gas-based process via auto thermal reforming and carbon capture and sequestration.

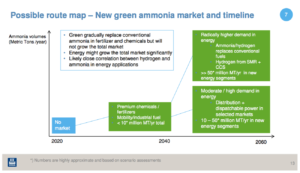

Leren’s presentation reaches its culmination with a slide headlined “Possible route map – New green ammonia market and timeline.” This slide starts with the observation that, while green ammonia could “gradually replace conventional ammonia in fertilizer and chemicals,” this dynamic by itself it is unlikely to “grow the total market.” The slide then suggests that over the next two decades green ammonia could spur moderate growth — less than 10 million tonnes total — if it is able to penetrate chemical and energy markets. (Today’s global consumption of ammonia is between 160 and 170 million tonnes annually.)

Leren’s slide then projects two possible growth scenarios through 2060. The more modest is a linear extrapolation of the 2020-2040 growth trajectory in chemical and energy markets which could account for as much as 50 million incremental tonnes of demand. The other is based on “radically higher demand” in energy, and is animated by ammonia-borne hydrogen displacing conventional fuels in mobility and power generation applications. The incremental demand produced by this scenario could be substantial: “>>50 million tonnes.”

Increasing Mainstream Awareness

The Nitrogen + Syngas Conference is organized annually by CRU, a London-based business consultancy whose areas of expertise include mining, metal and fertilizer commodities. The firm bills it as the “world leading nitrogen conference” and reported that this year attendance exceeded “670 industry professionals.” Leren’s presentation may have been the first time that the ammonia energy concept was broached in a serious way with this audience. The concept was not mentioned in a report summarizing the 2018 conference.

In a further sign of ammonia energy’s increasing profile with mainstream constituencies, the magazine Nitrogen + Syngas (which, in spite of an identical title format, is not published by CRU) ran an article in its November-December 2017 issue entitled “Power to ammonia.” The article included descriptions of P2A initiatives around the world including the pilots in the Netherlands, the ARPA-E REFUEL program in the United States, and Yara’s solar ammonia demonstration project in Australia.

In an email exchange with Ammonia Energy, Richard Hands, the article’s author and Nitrogen + Syngas’s editor, mentioned that he remains “somewhat skeptical of the prospects for ammonia as an energy carrier.” Indeed, in the conclusion to his story, Hands lists a series of “extremely large caveats” about P2A. First is the question of NOx generation when ammonia is burned as a fuel. Second are questions about ammonia’s safety profile, especially in the context of the distribution infrastructure that will be needed to move the commodity from point of production or entry to point of use. And third is the elevated cost and/or impracticality of renewable hydrogen-to-ammonia schemes.

These points all have validity and there is room for differing opinions on the difficulty of clearing these hurdles. Nonetheless, in his final paragraph Hands acknowledges an emerging reality:

Having said all of the above, there is nevertheless now a concerted push from many governments and the involvement of many research institutes and major technology companies, and it seems likely that the concept of ammonia as an energy carrier as part of a ‘decarbonisation’ strategy may be with us to stay.

“Power to Ammonia,” Nitrogen + Syngas, November-December 2017