Ammonia Featured in Japan’s New Green Growth Strategy

By Stephen H. Crolius on January 14, 2021

Last month Japan’s Ministry of Economy, Trade and Industry (METI) unveiled a policy platform that will help the country realize its goal of achieving carbon-neutrality by 2050. According to a December 25, 2020 METI press release, the “Green Growth Strategy towards 2050 Carbon Neutrality” sets goals for 14 “priority fields” and “formulates action plans covering comprehensive policies in areas such as budgets, taxes, regulation reforms and standardization, and international collaboration.” “Ammonia fuel” and hydrogen are each the focus of a distinct priority field.

An Associated Press article tied the strategy to “Prime Minister Yoshihide Suga’s ambitious pledge to go carbon free by 2050 and generate nearly $2 trillion growth in green business and investment.” The article mentions offshore wind, battery-based energy storage, and the elimination of gasoline-powered vehicles “by the mid-2030s” as other priority fields.

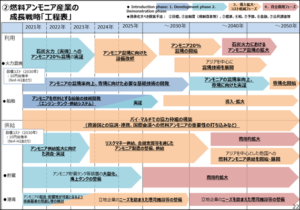

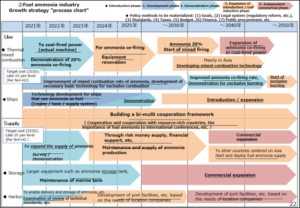

The main focus for ammonia is co-firing with coal for electricity generation. A policy document, “Overview of Green Growth Strategy” includes in its ammonia discussion use-side technology development and supply-side capacity development. Key issues in the technology area are greater NOx generation and reduced radiant heat from ammonia combustion relative to coal. A roadmap included within the Overview shows that the focus through 2025 will be “improvement of mixed combustion [at a 20%] rate of ammonia” co-firing and “development of necessary basic technology for exclusive [mono-fuel ammonia] combustion.” The second half of the decade will see commercial roll-out of 20% co-firing systems and “development of necessary basic technology for exclusive [mono-fuel ammonia] combustion.” The mono-fuel ammonia combustion systems are tagged for commercial deployment in the late 2040s.

On the supply side, the Overview states that “one coal-fired unit with 20% co-firing requires 500,000 tonnes of ammonia annually. If implemented on all domestic coal-fired power plants, 20 million tonnes of ammonia would be required annually.” Pursuant to the theme of international collaboration, the strategy envisions the cooperative development of a supply chain that links “ammonia-producing countries (North America, Australia, Middle East) with consuming countries (Asia including Japan).” By 2050, the total volume of ammonia trade related to electricity generation would reach 100 million tonnes.

The strategy’s international dimension is also intended to be a source of economic growth for Japan. It is anticipated that the adoption of co-firing technology by 10% of coal-fired power plants in Southeast Asia would lead to an investment in Japanese goods and services of ¥500 billion (USD $4.8 billion). By 2050 the total market for specialized ammonia combustion technology could grow to ¥1.7 trillion (USD $16.3 billion).

The roadmap also touches on ammonia as a fuel for the maritime sector. The plan in this case is to develop technology for engines and on-board fuel supply systems over the next 4-5 years, with demonstrations starting in 2024. Full implementation of ammonia-fueled vessels is envisioned for the 2030s.

The strategy provides the latest indication of METI’s embrace of ammonia energy. In March 2020 METI included a discussion of “fuel ammonia” in its New International Resource Strategy. Seven months later METI formed a council to work on the implementation of ammonia as an energy commodity.