Ammonia in China: change is coming

By Trevor Brown on November 07, 2019

ANNUAL REVIEW 2019

In the ammonia industry, Chinese data is notoriously hard to verify. Without question, the country produces more ammonia today than any other nation, and yet it has recently closed million of tons of annual capacity. Its cities are smothered in pollution, and its coal-based ammonia plants use the dirtiest technologies available. Huge questions remain. When will clean technologies be introduced to replace this coal-based ammonia? When will the Chinese carbon price be extended to its fertilizer producers? When will we see the first Chinese green ammonia demonstration plant? And when will green ammonia be recognized as a valuable storage and distribution technology within China’s clean energy portfolio?

One answer is clear: China has repeatedly proven its desire and ability to become a global leader in developing and deploying clean technologies in the explicit effort to combat climate change. Within China, therefore, the question of large-scale adoption of ammonia energy technologies is increasingly becoming simpler. When?

Today’s technology: coal-based ammonia-urea plants

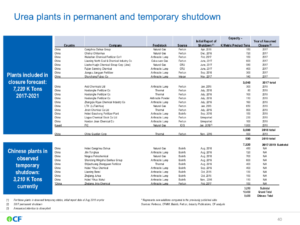

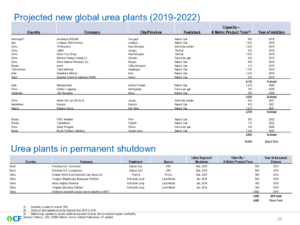

“Dirty” coal-fed ammonia-urea plants in China are being closed faster than they are being replaced. According to ongoing updates in the investor presentations published by US-based ammonia producer CF Industries, over 10 million metric tons of annual urea capacity has been permanently closed in China since 2017. (Urea synthesis consumes 0.58 tons of ammonia per ton of urea, so this means that around 6 million tons of annual ammonia capacity has been closed.)

It is not obvious to what extent these closures are the result of global market economics alone, or whether local environmental factors also involved. Certainly, Chinese industries located upwind of profoundly polluted cities are now fundamentally challenged. A legitimate question for Chinese urea producers has become whether it is cheaper to close a factory, or simply relocate it, by deconstructing it and shipping it to a less populated area.

In 2018, China produced about 54 million metric tons of ammonia, so these closures represent more than 10% of the industry in just two years. Much but not all of this capacity will be replaced by new coal-based plants.

No analysis I’ve yet seen has incorporated these closures / newbuilds into an updated estimation of emissions from Chinese ammonia production. The global benchmark (the Energy Efficiency & CO2 Emissions benchmarking study undertaken by the International Fertilizer Association), does not include a single Chinese data point in its 2018 edition because, as I understand it, Chinese ammonia producers are not easily able to share this kind of data. Of course, this complete omission of the world’s largest and perhaps most-polluting fleet of ammonia plants seriously skews the “global” benchmark.

Tomorrow’s technology: electrochemical ammonia synthesis

At the same time, Chinese academics are publishing more research papers on next-generation ammonia synthesis technologies than academics from any other country, possibly even including the United States.

If I categorize by catalyst just a handful of the electrochemical ammonia synthesis papers published over the last year, we have the usual suspects Gold, and Ruthenium, and Gold, and Ruthenium, as well as more esoteric materials including Bismuth nanocrystals, Nitrogen and Phosphorous co-doped carbon, Molybdenum disulfide, Lanthanum ferrite, single‐atom catalysts, and (my favorite) flower-like SnS2 and forest-like ZnS nanoarrays on nickel foam. One of these projects demonstrated Faradaic Efficiency greater than 25%.

We have reported only one academic study from China this year: an analysis from Xiamen University that demonstrated how “ammonia, an environmentally benign hydrogen carrier, is expected to [resolve] the conflicts of renewable energy supply and consumption in China.”

Green ammonia and the Chinese climate policy framework

While an explicit transition to green ammonia has not yet become policy, government regulations in China are forcing profound changes throughout the sector, not least due to carbon pricing.

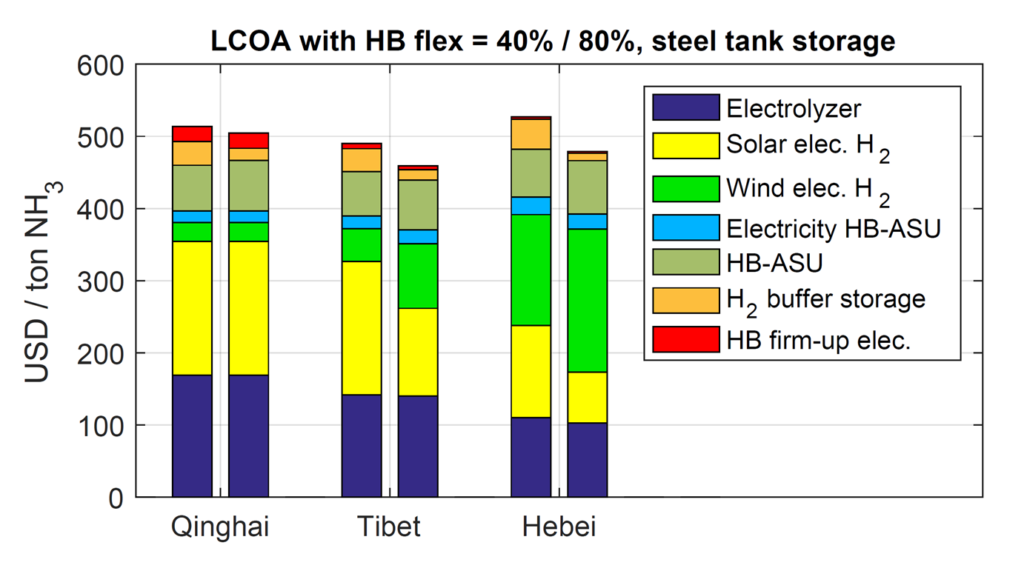

This year, IEA analysis demonstrated that green ammonia, produced from China’s excellent wind and solar resources, is already almost cost-competitive with coal-based ammonia, with only an 18% price increase for the renewable commodity. This is a levelized cost of ammonia (LCOA) of USD$459 per ton of green ammonia, versus an estimated cost of USD$380 to USD$410 per ton of coal-based ammonia.

According to the Guide to Chinese Climate Policy 2019 published a few weeks ago by the Columbia Center on Global Energy Policy, over the last five years the Chinese economy has grown by 42% but its carbon emissions have grown by only 2-5%. China has decoupled its economic growth from its carbon emissions. In his conclusion, the Guide‘s author, David Sandalow, summarizes the ways in which “the Chinese government is taking significant steps to address climate change.”

Cutting Coal Consumption. Reducing coal’s role in China’s economy is a goal of the Chinese government …

David Sandalow, Guide to Chinese Climate Policy 2019, Columbia Center on Global Energy Policy, September 2019

Deploying Low-Carbon Power. The Chinese government is committed to significant growth in solar power, wind power, hydropower and nuclear power …

Putting a Price on Carbon Emissions. The Chinese government is implementing a program to put a price on CO2 emissions. CO2 trading programs—some dating back to 2013—are operating in eight cities and provinces. A nationwide CO2 trading program for the power sector was launched at the end of 2017 …

Improving Energy Efficiency. Improving energy efficiency is a long-standing goal of the Chinese government … implemented through provincial targets, government spending, regulations and standards …

Adopting Many Other Policies. The Chinese government has dozens of other policies that reduce emissions of heat-trapping gases. These include policies to: build mass transit, promote green finance … develop HFC alternatives, conserve forests and grasslands, and plant trees on a mass scale …

Committing to Peak CO2 Emissions by 2030. The Chinese government’s highest-profile climate change goal is “to achieve the peaking of carbon dioxide emissions around 2030, making best efforts to peak early” …

Speaking Publicly on Climate Change. In their public statements, President Xi Jinping and other Chinese leaders send the message that climate change is real, that they are serious about addressing it and that doing so is part of China’s development strategy. Calls for low-carbon development are common, including President Xi’s call for a “green, low-carbon, circular and sustainable way of life.” President Xi has said that “addressing climate change and implementation of sustainable development is not what we are asked to do, but what we really want to do and we will do well.”

It seems that, today, Chinese climate change policy does not extend to ammonia, neither penalizing coal-based urea production nor rewarding the incorporation of renewable ammonia in a portfolio of clean energy technologies. However, it appears highly likely that this situation will change, and fast. The only question is, When?

AMMONIA ENERGY REPORTING ON THIS TOPIC SINCE LAST YEAR

- February 2019: IEA Analysis: Green Chinese P2A Could Compete with Brown NH3

- March 2019: Ammonia as an environmentally benign energy carrier for the fast growth of China

A YEAR IN REVIEW

This article is part of our Annual Review 2019. To mark the third anniversary of Ammonia Energy, we are highlighting ten “tip-of-the-iceberg” topics that we’ve written about over the last 12 months. In each case, we think we see something just peeking above the current flow of events that is developing into a major phenomenon below the surface.

Read all the stories in our Annual Review 2019.