Beaumont Clean Ammonia: kickstarting low-emission ammonia as a liquid commodity

By Kevin Rouwenhorst on January 26, 2025

In our December episode of Project Features, Rick Beuttel from Woodside Energy joined us to discuss the Beaumont Clean Ammonia Project in the US Gulf Coast. The recording is available on the AEA’s website, and you can also download the speaker presentation.

The Beaumont Clean Ammonia Project

As a global energy provider, Australia-based Woodside Energy is working on adding low-emission ammonia to its product mix. The company recently completed its acquisition of the Beaumont Clean Ammonia Project from OCI Global for approximately $2.35 billion. OCI will complete construction of the plant and handover the fully staffed, operational site next year.

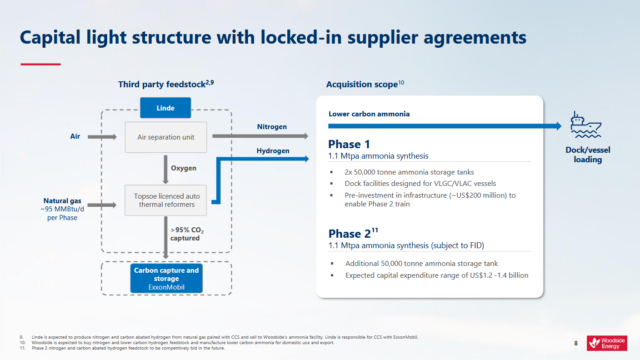

Located on the US Gulf Coast, phase one of the project will have the capacity to produce 1.1 million tons per year of ammonia, utilizing over-the-fence gas feedstock. The first phase of the project is 78% complete and targets production of first ammonia from 2025, leveraging existing hydrogen and nitrogen pipeline supply infrastructure in the Beaumont area. The design is based on OCI’s existing ammonia plants, including the eight facilities it has built since 2008.

Lower-carbon ammonia will be produced from 2026, when Linde will begin supplying low-emission hydrogen feedstock to the facility. ExxonMobil will offtake the carbon dioxide associated with Linde’s hydrogen production for transportation and permanent sequestration, compliant with European requirements for carbon mitigation. Beaumont Clean Ammonia will be among the first lower-carbon ammonia projects in the United States.

Click to expand. Overview of the Beaumont Clean Ammonia project and its “capital light structure”. From Buettel, Beaumont Clean Ammonia Project (Dec 2024).

The facility is designed to accommodate a second 1.1 million tons per year production train (phase two), with common facilities already in place such as piperacks, utilities, and the control room. Phase two remains pre-final investment decision (FID), with Woodside Energy targeting FID readiness for Phase two in 2026.

Ammonia as a low-emission commodity

Woodside Energy has a sizable existing LNG export business. Woodside Energy has exported LNG to Japan and South Korea for decades. More recently, West Europe started importing significant amounts of LNG, following the Russian invasion of Ukraine in 2022. These LNG importers are likely future ammonia importers for energy applications.

Click to expand. The capability combinations in Woodside’s Beaumont Clean Ammonia Project. From Buettel, Beaumont Clean Ammonia Project (Dec 2024).

Interestingly, the primary component in LNG (methane) is also the feedstock for gas-based ammonia production. By producing low-emission ammonia from gas reformation with CCS (carbon capture & storage), CO2 is mitigated at production location, rather than exporting LNG energy and attempting CO2 mitigation at the import location. This makes ammonia a low-emission liquid gas commodity, complementing Woodside Energy’s current LNG and future liquid hydrogen export projects. Woodside Energy approaches the liquid gas commodity market via a portfolio approach with multiple supply locations, such that supply can be guaranteed. Woodside Energy will use a similar approach for its emerging low-emission ammonia business.

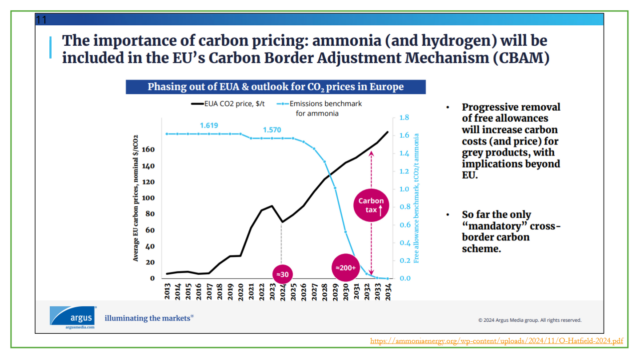

Europe as an early offtake market for low-emission ammonia

The Beaumont Clean Ammonia Project initially targets the European market. A key reason for this is the existing ETS (Emission Trading System), with phase out of Free Allowances and CBAM (Carbon Border Adjustment Mechanism). The Free Allowances provided the European industry to emit up to a given threshold, before buying CO2 emission rights. The current emission benchmark for the ammonia industry is about 1.6 ton CO2 per ton ammonia, but these Free Allowances will be phased out toward 2034. CBAM implies that CO2 emissions imported to the EU will be taxed at market ETS prices, which were in the range €60-100 per ton CO2 in 2023 and 2024. Woodside estimates a carbon footprint for its lower-carbon product of 0.8 tons CO2 per ton ammonia: well within current and future EU benchmarks.

Click to expand. The impact of removal of Free Allowances on the ammonia market. Source: Argus Media.

Most European ammonia plants are based on steam methane reforming (SMR), which makes full CCS relatively expensive, especially compared to newbuild autothermal reforming (ATR) plants. European ammonia plants are among the oldest globally. Due to relatively high gas prices in Europe, investment in newbuild low-emission ammonia plants based on autothermal reforming with CCS mostly occurs in locations with low-cost gas, such as in the US Gulf Coast and in the Middle East. This results in European fertilizer producers replacing part of their gas-based ammonia plants with imported ammonia, especially for non-urea products such as nitric acid and ammonium nitrate. For reference, the 27 countries in the European Union had a theoretical ammonia production capacity of around 17.7 million tons per annum in 2023 distributed over 32 ammonia production facilities.

In this context, low-emission ammonia trade from the US Gulf Coast to Europe is not a niche market, but a near-term commodity market with huge opportunities. Other markets are developing as well, such as Japan and South Korea for power generation and ammonia as maritime fuel. Each country has their own requirements and methodology for carbon mitigation calculation.