Green Maritime Corridors – A catalyst for transition to green shipping fuels

By Conor Furstenberg Stott on March 01, 2022

The ports of Los Angeles and Shanghai have announced the intention to create a green shipping corridor across the Pacific Ocean. The ambition is for ships trading between these ports to run on alternative low greenhouse gas emission fuels. Ammonia stands among the options as such an alternative.

The chicken or the egg?

Never has the expression “Chicken and Egg syndrome” had so much use. When it comes to debate about decarbonising maritime fuel the question of who must invest in the new technology first always arises, the shipowner or the fuel producer? It seems that the Green Corridor concept may well have cracked the nut.

With successive milestone conferences at the United Nations, the World Economic Forum and elsewhere, impetus for decarbonization of the maritime industry increases. COP 26 saw the announcement of two important maritime initiatives: coZEV (Cargo owners for zero emission vessels) and the Clydebank Declaration. The Clydebank Declaration sets out ambitions to create corridors of green shipping to seed the industry with supply and demand of green fuels. Meanwhile, through a great cross-section of industry and academic papers, ammonia stands among, if not at the top of the contestants for alternative ship fuel.

“Green corridors”: the concept

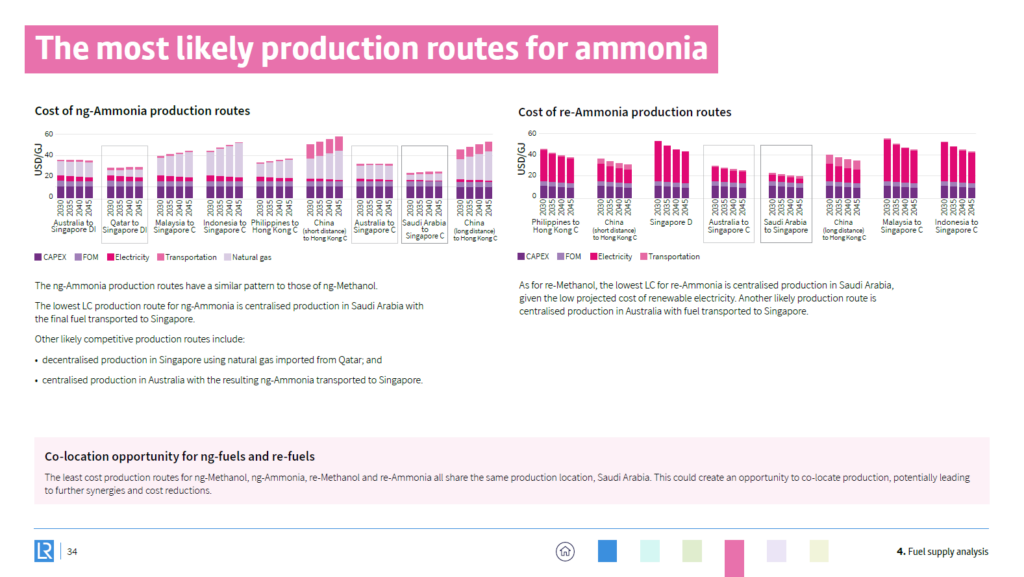

This green corridor concept has demanded elaboration, such as a paper by Lloyd’s Register (LR) Maritime Decarbonisation Hub – First movers in Shipping’s Decarbonisation- a framework for getting started. Lloyd’s evaluates the fuel alternatives methanol, ammonia or hydrogen as applied to a regional fleet of container feeder vessels, operating a green corridor framework. Each alternative fuel transition scenario is broken into stages where the carbon content is progressively reduced. They use the stage categorisations; bio- for bio methanol, ng- for LNG derived and, re-fully renewable.

Among the key findings this report states:

In contrast [to a three stage methanol transition], the two-stage ammonia and hydrogen transitions require the construction of a larger plant in the first decade, with more pressure to scale quickly. Delaying investments to later in the transition like this may result in competition for energy sources that may have a stronger market elsewhere, e.g. hydrogen for heating or renewable electricity for the power sector. The benefit, however, for the ammonia transition in particular is that should risks be successfully avoided, this would likely be the lowest cost transition overall.

Lloyd’s Register, First movers in Shipping’s Decarbonisation- a framework for getting started (Dec 2021)

“Green corridors”: the key enablers

The Getting To Zero Collation explored options and enablers for development of Green Corridors in their paper “The Next Wave: Green Corridors”.

This study assesses four central enablers:

- Cross Value Chain Collaboration

- A Viable fuel pathway

- Customer demand

- Policy and regulation

It applies these to make a pre-feasibility assessment of the Australia-Japan iron ore route and the Asia-Europe container route. It also describes a case study of the Northeast Asia-U.S. car carrier route, citing “significant opportunities for industry players to collaborate end-to-end across the value chain to reduce emissions, even before zero-emission fuels become available.”

When summarising the Asia-Europe container route the authors state:

“Green methanol and green ammonia are the two zero-emission fuels likely to be deployed on the route. While methanol engines are available currently, green ammonia has the long-term cost advantage on this route. Depending on the measures implemented in the corridor, an end-to-end annualised TCO gap of between $10 million and $13 million per vessel (equivalent to a 35 to 45 percent incremental cost increase) could be expected in 2030. Actions under consideration by policymakers, such as the EU’s Fit for 55 package for shipping, could reduce the cost gap to 25 percent in 2030. Recycling the corridor’s share of revenues into support mechanisms for first movers could close the gap entirely.”

Global Maritime Forum, The Next Wave: Green Corridors (Nov 2021)

Green corridors in practice

But what is a maritime green corridor? In the absence of existing production, infrastructure or industry demand for alternative fuels, the concept joins the development of both fuel supply and shipping demand in its simplest form, at one individual trade route. The ship knows that it shall receive enough of a special fuel at each or perhaps just one of the ports on a route. Crucially, the producer of the alternative fuel also knows there will be steady demand from shipping.

Los Angeles to Shanghai

The announcement by the Port of Los Angeles and Port of Shanghai represents the first major green corridor plan announcement. They target reduction of emissions through the 2020s and to begin transitioning to zero-carbon fueled ships by 2030.

This partnership is convened by C40 Cities, “a network of mayors of nearly 100 world-leading cities collaborating to deliver the urgent action needed right now to confront the climate crisis”. It encompasses the cities, their ports, cargo owners and container shipping companies. The shipping companies represent a considerable proportion of the container shipping industry and include Maersk, CMA-CGM and COSCO Shipping Lines. The cargo owners are represented by CoZEV (Cargo Owners for Zero Emission Vessels) who count Unilever and Amazon among their membership. The Aspen Institute’s Shipping Decarbonization Initiative and the Maritime Technology Cooperation Centre-Asia (hosted by Shanghai Maritime University) provide support.

Green Corridors do not necessarily default to any one type of decarbonization strategy but instead seek an optimum path for energy efficiency and relevant low emission fuels. So, what role may ammonia usefully play here?

Ammonia at the LA end of the corridor?

In September 2021 Los Angeles city council voted to transition to 100% clean energy by 2035 in line with President Biden’s national goals. The decision in L.A. followed an assessment by NREL (The LA100 report) which details the role to be played by combustion energy sources in what is largely an electrification campaign. Ammonia is one of the two electrically derived hydrogen fuels mentioned for consideration. The report indicates a route for the city to partner with industry for reduction of hydrogen cost as part of economy-wide decarbonization – including non-electrified transportation and the use of alternative fuels. The Los Angeles Department of Water & Power (who supplies electricity to the Port of Los Angeles) will take the lead on this transition.

The Port of Los Angeles is already taking steps to implement alternative fuel solutions in its onshore operations, with a zero emissions trucking program currently out to tender (the first fuel cell trucks were demonstrated in July 2021). California’s next largest port – Long Beach – is undertaking a similar, technology-based approach to decarbonizing its operations.

There is a clear willingness from key players at the LA end of this trans-Pacific shipping corridor to embrace alternative fuel solutions and work together to unlock a suite of zero emissions technologies, albeit limited to an onshore focus for now. Shifting focus onto the water – where ammonia maritime fuel will undoubtedly play a critical role – is the logical next step.