GX bonds: new Japanese green subsidy program unveiled

By Julian Atchison on May 17, 2023

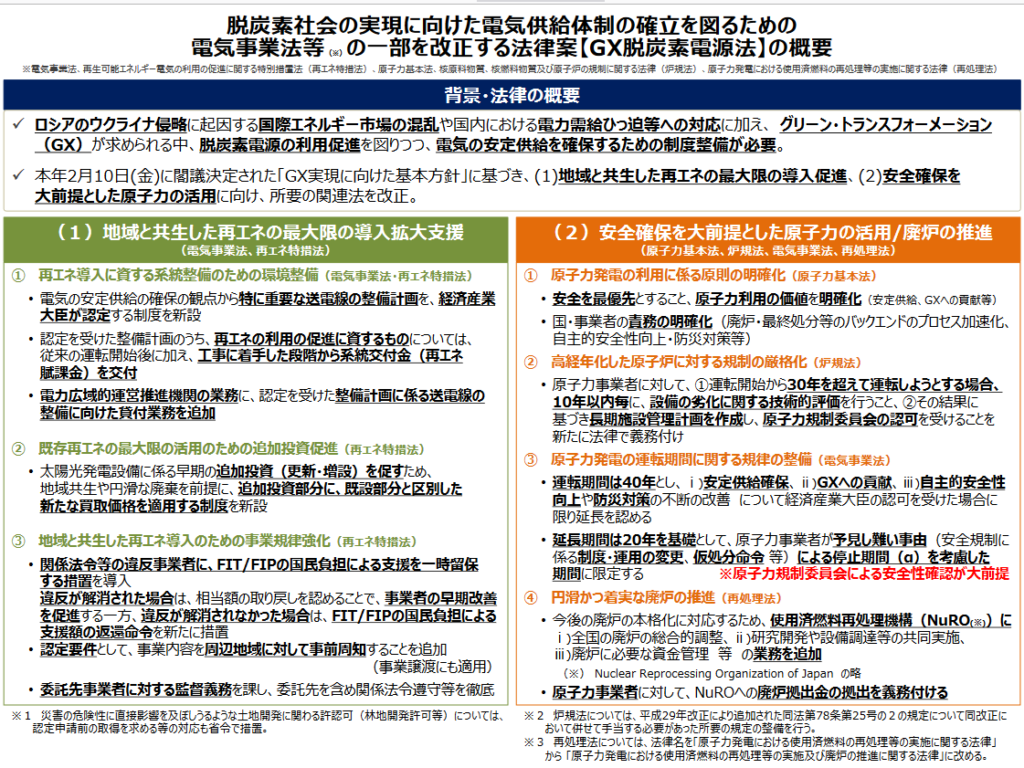

Green Transformation (known in Japan as GX) is a government-wide push to transition Japan’s industrial sector from one based on fossil fuel inputs to one based on clean energy. This February, the Japanese cabinet approved a core set of policies (Japanese language) that will underpin GX, and several pieces of legislation are working their way through the Japanese parliament. GX policies will also underpin an expected significant jump in hydrogen import & consumption targets for Japan, with a revised version of the national hydrogen strategy to be released at the end of this month.

Of interest here are two elements: policy related directly to the implementation of ammonia energy solutions, and a $1 trillion public-private investment package. The investment package will involve cooperation of companies who have joined the “GX League”: a Japan-wide alliance of private organisations working together with METI to fulfill the goals of Green Transformation.

Decarbonizing while ensuring stable supply

In order to promote the introduction of hydrogen & ammonia energy into Japanese industry, the government will:

- establish domestic production and supply systems for hydrogen & ammonia

- accelerate the development of co-firing and “mono-firing” technologies

- prepare a comprehensive system that “integrates regulation & support”

- demonstrate new applications at the upcoming Osaka/Kansai World Expo in 2025

- keep the transition working under a cohesive national strategy, providing certainty for businesses and international trading partners

- promote international standardisation for certification, in addition to carefully scrutinizing the emissions intensity of imported hydrogen & ammonia

These policy priorities track closely with an action plan produced by METI in December 2022 (Japanese language). Included in this plan is a scheme to subsidise the price difference between hydrogen, ammonia and fossil fuels into the 2040s. As its current benchmark, METI takes hydrogen as more than double the cost of LNG, and ammonia as more than three times the cost of coal. This scheme has an estimated price tag at around $36 billion, running into the 2030s (this will be part of the GX investment scheme described below). Also related to ammonia supply chains, infrastructure development and government-backed R&D will receive another $7 billion each.

The “Growth-Oriented Carbon Pricing Concept”

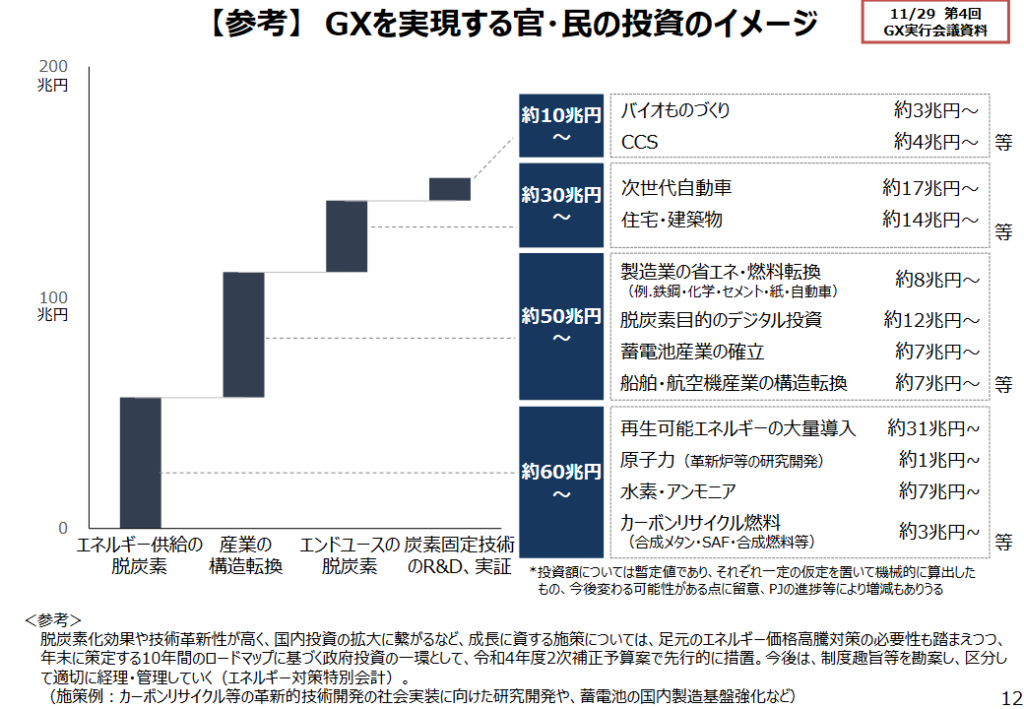

Over $1 trillion will be invested by the Japanese government over the next decade. Around $150 billion of “GX Economic Transition Bonds” will be issued each year for a decade to fund this investment, with the bonds themselves to be fulfilled by the introduction of a new carbon pricing scheme.

Starting with a voluntary emissions reduction scheme in 2023, a mandatory, “GX-League-wide” emission trading system will be introduced in 2026. Similar to other countries and jurisdictions, the price of carbon will be steadily increased over the medium to long-term. These pricing and carbon credit mechanisms will be established this year, allowing them to be used in the voluntary scheme and increasing familiarity. In 2033, an emissions auction system for power generators will be phased in, based on a similar system in the EU. In 2028, a carbon levy will be introduced to encourage carbon-intensive importers to adjust their practices.

The $1.1 trillion investment is split into several sections, with hydrogen & ammonia falling under the umbrella of “structural transformation”, and specifically a $441 billion investment related to fuels & power generation. Interestingly, at least half of this investment will go to the “mass introduction” of renewable energy. So while the narrative has traditionally been Japan importing low-carbon fuels & feedstocks to help it decarbonise its economy, domestic production and renewable energy generation now appears to be coming into focus.