H2Global quadruples funding for low-carbon hydrogen and derivatives

By Oscar Pearce on July 12, 2023

H2Global has quadrupled its funding for low-carbon hydrogen and derivatives, backed by the Federal Ministry for Economic Affairs and Climate Action of Germany (BMWK). The funding will support H2Global’s contract-for-difference instrument which covers the increased costs of producing “green” hydrogen and provides secure long-term contracts for suppliers.

Funding Boost

In December 2022, H2Global announced a €900 million endowment for its implementation entity Hintco to launch its contract-for-difference instrument, including a €360 million tender for the import of “green ammonia” to Belgium, the Netherlands or Germany. The initial funding was provided by BMWK.

BMWK is now financing a second funding window, offering an additional €3.5 billion. A further €300 million is expected to be provided by the Dutch government.

H2Global anticipates this funding will have a “catalytic effect” in “stimulating private sector engagement and market development”.

The additional funding of EUR 3.5 billion for the H2Global instrument over a period of ten years is essential to contribute to market liquidity, as it increases the volume of the renewable hydrogen contracts, enables the creation of a broad portfolio of pricing data and thus enhances its catalytic effect on market development.

From The Market Ramp-Up of Renewable Hydrogen and its Derivatives – the Role of H2Global, (H2Global, June 2023).

The Instrument Explained

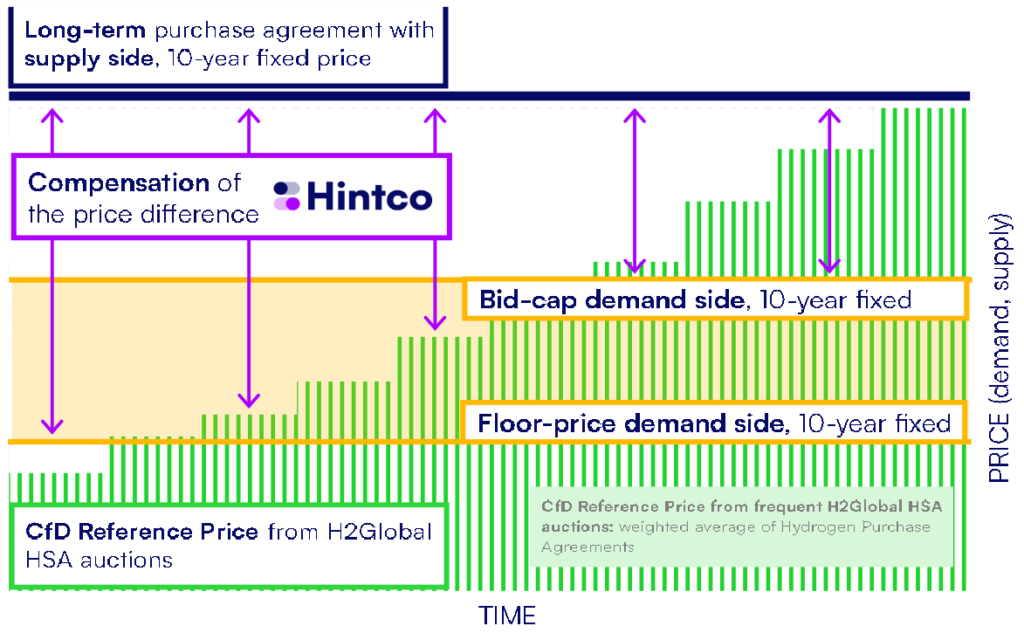

The H2Global Instrument operates in two stages. First, Hintco holds procurement auctions on the supply side of the PtX market, with 10-year purchase agreements offered to the most cost-effective suppliers. The earliest such agreements are due for delivery in late 2024 or early 2025. Next, Hintco will conduct demand-side auctions, selling its procured hydrogen or derivatives at the highest attainable price. Hintco’s newly increased endowment from H2Global covers the expected difference in these two prices.

H2Global’s justification for its instrument is that it contributes to solving several “market failures” in the nascent PtX industry. Specifically, the production of low-carbon hydrogen and derivatives must reach a larger scale before it can be price competitive with “grey” alternatives. Furthermore, the lack of a developed marketplace makes “price discovery” difficult – a serious impediment to investor confidence. By kick-starting the marketplace for low-carbon hydrogen, H2Global hopes to remove or reduce these short-term hurdles.

Over time, H2Global anticipates the cost of production for low-carbon hydrogen will fall and the willingness of consumers to pay a premium will increase, spurred by regulatory schemes and incentives. The price gap between Hintco’s demand- and supply-side contracts should therefore trend towards zero, ensuring that the subsidy is only a short-term measure. In such a future, H2Global hopes its instrument will be “replaced by platform-traded markets for renewable hydrogen” that enable liquidity, risk mitigation and, ultimately, greater volumes of investment.

You can read more about H2Global’s work on their website.