Hydrogen Council Releases Landmark Report

By Stephen H. Crolius on January 23, 2020

The Hydrogen Council, a group made up of “the CEOs of … leading energy, transport and industry companies,” this week released Path to hydrogen competitiveness: A cost perspective. The report carries some big news. Low-carbon hydrogen can become much more cost-competitive, much more quickly, than is generally appreciated. The gloss from the report’s Web page is that the cost of hydrogen “is projected to decrease by up to 50% by 2030 for a wide range of applications, making hydrogen competitive with other low-carbon alternatives and, in some cases, even conventional options.” The report projects that hydrogen viability will be strongest in long-distance and heavy-duty transportation, industrial heating, and heavy industry feedstocks, in all of which “the hydrogen route appears the decarbonisation option of choice.”

An April 2017 Ammonia Energy article, “The Hydrogen Consensus,” suggested that key constituencies were coming together around the vision of hydrogen as a mainstay of the sustainable energy economy of the future. The Hydrogen Council, newly launched in January 2017, was tagged as one of the parties to the consensus on the strength of its inaugural report How hydrogen empowers the energy transition. The article also discussed an International Energy Agency commentary “Producing industrial hydrogen from renewable energy” that had been published shortly before the article appeared. The commentary examined possible economic trajectories for hydrogen produced via electrolysis from renewably generated electricity and concluded that, under foreseeable circumstances, “renewables-based hydrogen production could … be competitive with [conventional] SMR [steam methane reforming].” This strand of the IEA’s thinking, and many others, came to maturity with the release of The Future of Hydrogen in June 2019. That groundbreaking report focused on the practical steps needed to build a low-carbon hydrogen economy, and also provided an implicit but unmistakable and indispensable endorsement of the hydrogen energy concept.

The Hydrogen Council had a strong automotive flavor at the time of its launch: five of its 13 founding members came from the top tier of the world’s automotive industry. Most of the rest were directly engaged in the supply of current or prospective motor fuels. In the intervening years, though, the Hydrogen Council has left behind all sectoral bias. In an announcement last week, the organization reported that, with 22 new recruits, it had reached a total membership of 81 companies. The group’s current breadth of representation can be seen in its incoming class whose members come from such industries as advanced materials, energy-related capital goods, and financial services. With this breadth and overall heft, the Hydrogen Council is now a major voice for business, if not the major voice for business, in the global discussion on hydrogen energy. Which makes Path to hydrogen competitiveness the next major building block in the increasingly compelling case for low-carbon hydrogen energy. Or, more precisely, and in the report’s words, it “provides an evidence base on the path to cost competitiveness” for hydrogen, which, “despite rapid improvements in recent years and a clear prospect for further cost reduction, [has a] competitiveness trajectory [that] remain[s] unclear to many.”

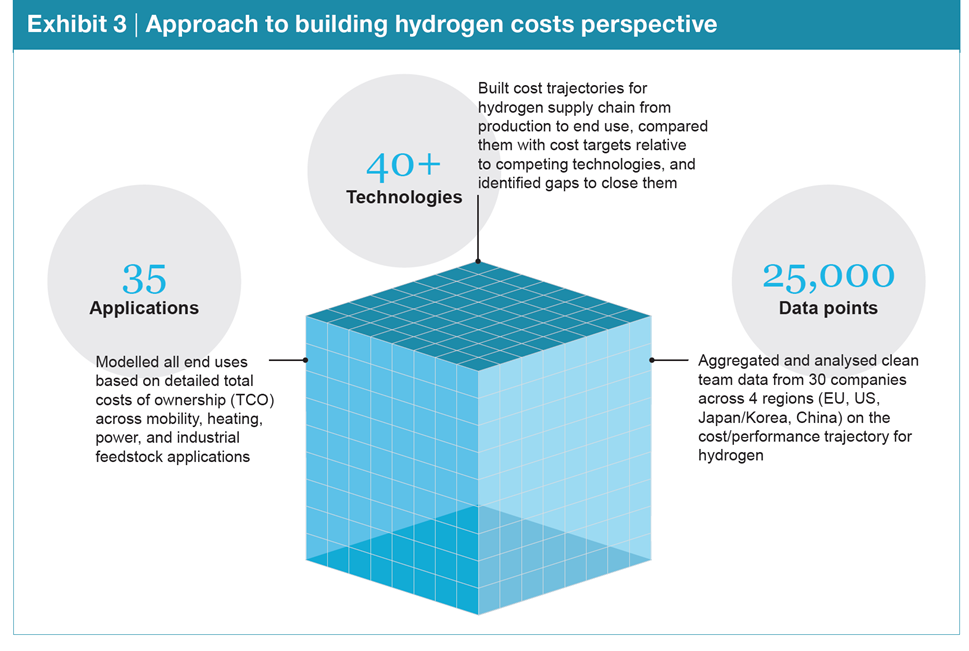

The report considers the application of 40 hydrogen technologies to 35 discrete use cases. The Hydrogen Council formed “an independent third-party clean team [anchored by global management consulting firm McKinsey & Company] who collected, aggregated and processed data from participating Hydrogen Council members, producing anonymised cost estimates by application.” When all of the number crunching was complete, the Hydrogen Council was able to project, employing the metric of total cost of ownership, how the cost to users would evolve in the coming decade, and how it would compare with the costs of existing energy systems and competing low-carbon technologies. On this foundation the report builds several layers of conclusions, starting with the drivers of cost reduction (“our findings suggest that scale-up will be the biggest driver of cost reduction, notably in the production and distribution of hydrogen and the manufacturing of system components”); and ending with recommendations for stakeholder actions in the realms of investment, policy alignment, and demand creation.

The wide scope of the analysis and the sourcing of the data from first parties provide an “evidence base” that has extraordinary authority. The Hydrogen Council can rightly claim that:

For policymakers, such a perspective provides firm ground on which to base financial and non-financial support that will unlock the economic value of hydrogen and to develop adequate policy frameworks. For decision-makers in industry, it brings a holistic picture of whole value chain cost dynamics and interactions, allowing them to put their own efforts into a broader perspective.

The Hydrogen Council, Path to Hydrogen Competitiveness, January 2020

Ammonia energy was scarcely acknowledged in earlier Hydrogen Council reports. This deficit has been remedied in Path to hydrogen competitiveness. Of particular note is the report’s discussion of the maritime fuel use case, in which the Hydrogen Council concurs in the emerging cross-stakeholder identification of ammonia as a strong candidate to replace heavy fuel oil as the primary bunker fuel. Included in the discussion, albeit in an aside, is the idea that the case for ammonia will be most compelling when it can be used directly as fuel. The parties working on ammonia-fueled turbines, internal combustion engines, and fuel cells certainly agree, and look forward to the day when the economics of an ammonia value chain can go head to head with those of an elemental hydrogen value chain.

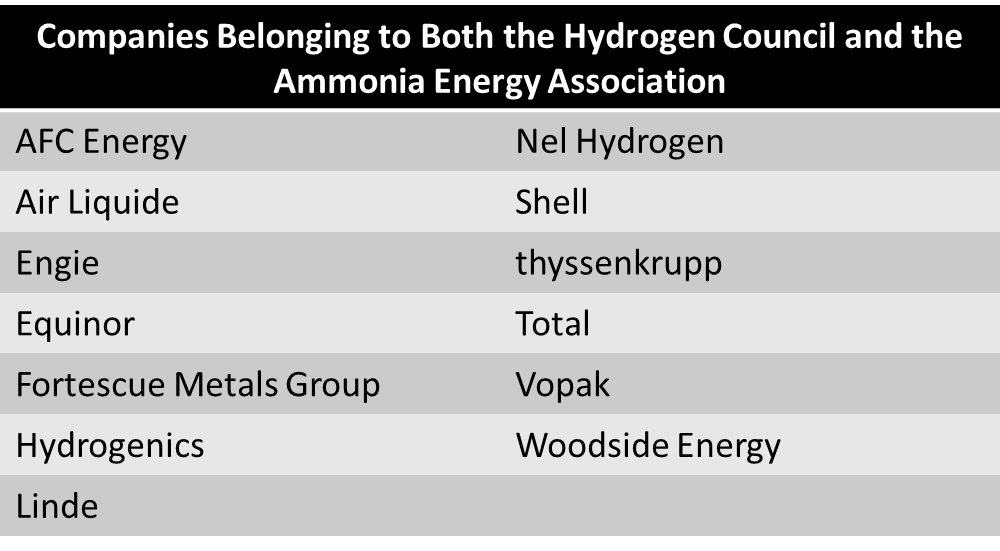

The prospects for a healthy alignment between the Hydrogen Council and the ammonia energy community are strong and rest on the fact that 13 of the organization’s 81 members are also members of the Ammonia Energy Association. This circumstance is not least among the reasons for optimism that the 2020s will be the breakout decade for hydrogen energy. The contours and particulars of the sustainable energy economy will grow out of myriad interactions among business, government, and civil society actors. Organizations like the Hydrogen Council and the Ammonia Energy Association will help rationalize the communication, cooperation, and collaboration that will be needed across stakeholders who have shared goals and overlapping interests but different competencies and strategic visions.