If green ammonia, whence urea? Stamicarbon’s Innovation Agenda

By Trevor Brown on May 03, 2019

One of the most interesting unanswered questions surrounding green ammonia is this: what about urea?

Last month, a major announcement by Stamicarbon (“the world market leader in design, licensing and development of urea plants”) implies an answer: in the long-term context of climate change, urea as a fertilizer may simply need to be phased out.

Stamicarbon announced its new Innovation Agenda at the company’s “Future Day” event in Utrecht in April. Its Innovation Agenda covers three areas: speciality fertilizers, digitalization, and “Renewable production of fertilizer (using wind or solar energy to produce fertilizer).”

Urea is the most-used nitrogen fertilizer in the world. About 175 million tons of urea are produced each year; this consumes roughly 53% of all the ammonia produced on the planet (according to the Yara Fertilizer Industry Handbook, published in October 2018). Urea is made by combining ammonia with carbon dioxide (CO2), which is a byproduct of fossil fuel reformation in today’s ammonia plant. If, in the future, ammonia is produced without fossil fuels – eliminating CO2 emissions – it will no longer be feasible to produce urea.

Fertilizer producers of the future would, presumably, manufacture nitrates instead.

Stamicarbon, the innovation and license company of Maire Tecnimont Group, has announced its innovation agenda to drive sustainable solutions in agriculture … This investment will cover incremental and strategic innovation, research and development to further enhance its technological angle …

The use of renewable energy to produce fertilizer is an area where Stamicarbon is very interested to collaborate with partners and apply its expertise …

“This is also a call to action to all individuals, companies, and organizations who would like to help us reach that goal of food security and sustainable agriculture,” [said Managing Director Mr. Pejman Djavdan].

Stamicarbon announcement, STAMICARBON ANNOUNCES INNOVATION AGENDA TO INVEST IN A SUSTAINABLE FUTURE WITH FERTILIZERS, 04/08/2019

Stamicarbon is a technology licensing company. It owns no ammonia production technology, and it isn’t trying to develop any. It does, however, own production technologies for both urea and nitrates, and this announcement indicates that it is preparing for a future in which green ammonia plants have no byproduct CO2. (To be clear, this refers to the long-term: today, urea is central to Stamicarbon’s business model; its last big announcement, a few months ago, was for another huge urea plant in Russia).

Some background on urea

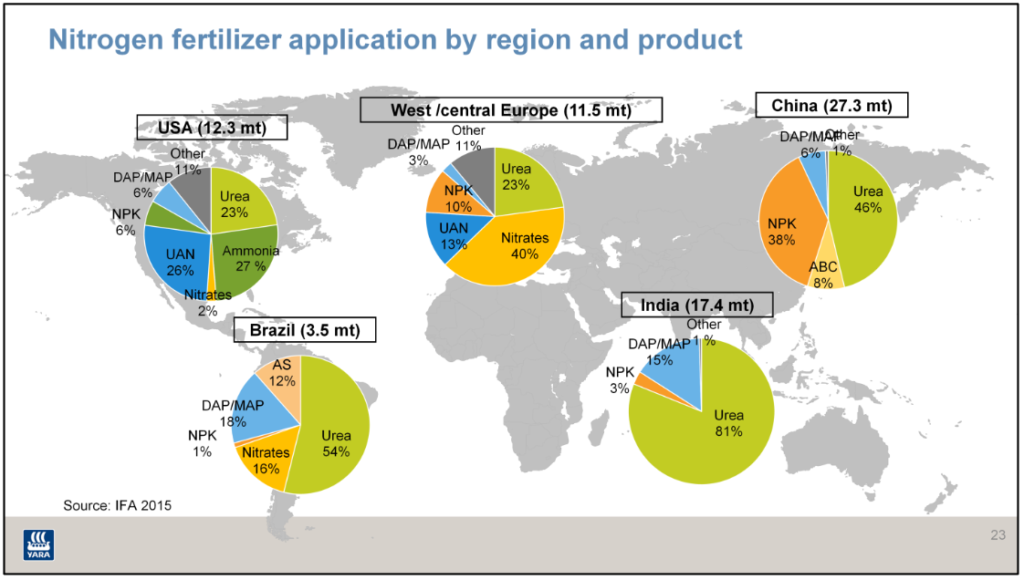

I’m occasionally surprised to see business models for green ammonia plants that assume there could be cash flow from sales of ammonia around the world – this relies on the false assumption that ammonia is a common fertilizer for which there is a ready market. Ammonia is not a common fertilizer, although it is the precursor to almost all nitrogen fertilizers: only in the US is ammonia widely used as a direct fertilizer. To sell fertilizer outside the US, ammonia plants must upgrade their ammonia to another product.

Urea is made by reacting ammonia with CO2, the byproduct of fossil-derived ammonia production. On average, 2 tons of CO2 are produced for every ton of ammonia; about two-thirds of this is ‘process gas’ which is an easily-collected stream of high-purity CO2 (the other third of ammonia plant emissions come from fuel combustion, which can be very expensive to capture). Moving and storing CO2 can also be expensive, so there are almost no stand-alone urea plants: integrated ammonia-urea complexes co-locate CO2 production and CO2 consumption.

Like ammonia, urea is a molecule with fascinating history. And like ammonia, urea is omnipresent; a basic metabolic product, we excrete it daily in urine. It was first synthesized in 1828, providing proof that an organic molecule could be created in a laboratory from inorganic materials – thus refuting the vitalist doctrine, which (in my words) used to hold that life could not be replicated by science.

In 1913, when Haber and Bosch scaled-up their ammonia process to industrial scale, they were producing a lot of byproduct CO2 for which there was little market. It is perhaps no great surprise that Carl Bosch saw an opportunity in that: the Bosch-Meiser urea process was developed in 1922, and this remains the basic process underpinning the technology in today’s urea plants.

The carbon in urea

The Haber-Bosch process for ammonia synthesis is famously referred to as the “bellwether reaction in heterogeneous catalysis” (bellwether means: leader, predictor, indicator of future trends). Similarly, urea production could be described as the bellwether process for carbon capture and utilization.

I first wrote about urea’s carbon problem almost exactly three years ago, when I demonstrated that urea production is not carbon sequestration. Since then, the fertilizer industry has undertaken a certain amount of useful life-cycle analysis, most notably with Fertilizer Europe’s Carbon Footprint Calculator.

The class of fertilizers called nitrates could replace urea because green ammonia would be used to produce green nitrates – they contain no carbon – but also because they release less N2O (a far more powerful greenhouse gas than CO2) after being applied to the field.

Different fertilizer types have different carbon footprints. Urea emits less CO2 during production than nitrates [simply because the CO2 is contained within the product, not emitted], but upon spreading the situation is reversed since urea releases the CO2 contained in its molecule. Urea also often releases more N2O during farming. The life cycle carbon footprint is therefore higher for urea than for nitrates.

Yara Fertilizer Industry Handbook, October 2018

Project development within Stamicarbon’s Innovation Agenda

Within its parent company, the Tecnimont Group, Stamicarbon has great allies in its quest to decarbonize nitrogen fertilizers.

Tecnimont itself is one of the big EPC (engineering, procurement, construction) firms that build fertilizer plants; the company has a financing arm so that it can also invest in these plants, to support project development. It’s good sense to keep a close relationship between the EPC firm and the technology licensor (vertical integration), but Stamicarbon’s close relationship with Tecnimont’s other subsidiaries may be just as important to the success of its Innovation Agenda. These include NextChem, a “Green Acceleration Project, Technological initiatives for energy transition,” and KT, Kinetics Technology, which specializes in hydrogen production.

As the technology provider, Stamicarbon will be looking to develop scaled-down versions of its own technologies for nitric acid and nitrate fertilizer production – scaled-down in order to match renewable power inputs or stranded resources. And as its announcement makes explicit, it will need partners to succeed, most obviously in the renewable power and ammonia production sectors.

And that’s why its Innovation Agenda announcement contained a “call to action to all individuals, companies, and organizations who would like to help us reach that goal of food security and sustainable agriculture.”

You can also read the full article at AmmoniaIndustry.com.