IMO drives forward net-zero agenda

By Oscar Pearce on April 23, 2024

Click to learn more. The IMO’s Maritime Environmental Protection Committee has made promising steps towards its goal of decarbonising the shipping sector. Source: IMO.

At a recent meeting of its Maritime Environmental Protection Committee (MEPC 81) in London, the IMO has taken significant strides towards implementing its IMO’s GHG reduction targets. The IMO is seeking to implement a fuel standard targeting net-zero emissions by 2050, with a pricing mechanism to drive compliance.

Strong majorities behind well-to-wake, flexibility measures

The ongoing progression of the IMO’s fuel standard and pricing mechanism received strong support at MEPC 81 and ISWG-GHG 16 (Intersessional Working Group on Reduction of GHG Emissions from Ships, held at the same time). This support was reflected in unanimous endorsement of the outline for Chapter 5 of Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL), which will contain the fuel standard and pricing mechanism.

A growing number of countries are also converging in their views on specific scheme design details.

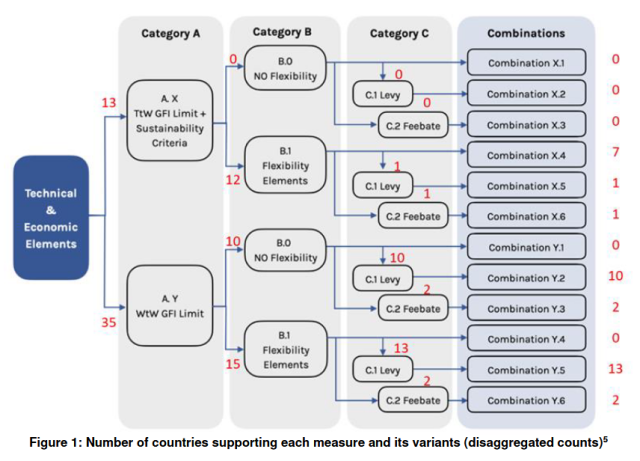

Click to expand. Countries’ preferences on the design of the IMO’s fuel standard and pricing mechanism (UMAS, Mar 2024).

Well-to-wake appeared to be the preferred emissions boundary following MEPC 80, and this preference is now shared by 35 countries represented on the MEPC. There are still 13 countries favouring an adjusted tank-to-wake approach (i.e., tank-to-wake initially followed by a slow phase-in of well-to-wake). It was decided that the adjusted tank-to-wake approach will go through a comprehensive impact analysis (CIA), but the majority in favour of well-to-wake is a clear signal.

A similarly compelling majority (31 countries) supports incorporating flexibility elements. Specific details remain unclear: for example, ships could report emissions individually and then trade, or report average emissions levels as a fleet. Likewise, the yet unresolved pricing mechanism (discussed below) will influence the nature of these flexibility elements. Nonetheless, this is a signal that a degree of flexibility may be granted to enable a dynamic and efficient transition.

Lastly, many finer details of the emissions accounting methodology are being resolved by a Correspondence Group composed of delegates from member countries and NGOs. In the lead-up to ISWG-GHG 16, this group has, among other things, made progress towards a consensus on default emissions intensity calculations.

Key debates moving forward

The pricing mechanism, as the primary compliance incentive, will continue to be a crucial topic of discussion. There is near certainty that such a mechanism will be included in the final decarbonisation scheme: after MEPC 81, IMO Secretary-General Arsenio Dominguez said, “We will have a pricing mechanism … of that, I have no doubt.”

But, whereas there were clear majorities for lifecycle analysis preferences, opinion remains divided on the precise nature of the pricing mechanism. 14 countries favour a credit trading mechanism without a further levy. 18 countries prefer the abandonment of trading and flexibility, and instead want a simple levy on GHG emissions. Finally, 16 countries support flexibility and trading but advocated for an additional universal GHG pricing mechanism.

A related question is what to do with funds generated by a pricing mechanism. The need for a just and equitable transition is generally accepted, suggesting that funds will be used in a redistributive and developmental capacity – potentially with a focus on the small island developing states included in the IMO’s membership. The debate over precisely how that support will be divided (and used) will be an important matter for future MEPC meetings.

Finally, the topic of onboard carbon capture and storage received some attention at the meetings but will need to be returned to in future.

Consequences for industry

The steady progress made in MEPC 81 and ISWG-GHG 16 clearly affirms that the IMO’s GHG reduction targets are not symbolic. Instead, strong progress has already been made, along with agreement on a relatively ambitious timeline for the years ahead, targeting adoption of policy measures by the end of 2025.

Alternative fuel producers and the shipping industry can therefore confidently plan a transition on the IMO’s timeline. As UMAS concluded:

One risk management strategy is to ‘wait and see’ so that decisions are only made when certainty has arrived. However, this is not risk-free as at the same point when the fate of fossil fuel technology becomes absolutely clear, and/or the opportunity for zero emissions technology becomes absolutely clear, opportunities to manage risks related to asset disposal values and to take future market share opportunities will have already been passed over. The meeting’s generally progressive outcome, and politically collaborative spirit, evidences that the risks of ‘wait and see’ have further increased.

From An overview of the discussions from IMO MEPC 81, (UMAS, Mar 2024).

For further analysis of these meetings and the path ahead, see the IMO’s summary of MEPC 81 and ISWG-GHG 16, along with UMAS’ corresponding analysis here and here, respectively.