Impact of pre-certification on project finance

By Geofrey Njovu on November 26, 2023

Following the keynote address from Dolf Gielen of the World Bank on the first day of the AEA’s 2023 annual conference, a panel discussion explored the relationship between pre-certification, offtake, and project finance. Moderated by AEA EVP Vibeke Rasmussen, the panel featured Ed Davis from the Loan Program Office (LPO) at the US Department of Energy, Tomoaki Ichida from Mitsui OSK Lines, Oleksiy Tatarenko from RMI, and Dolf Gielen from the World Bank.

Certification: breaking the impasse

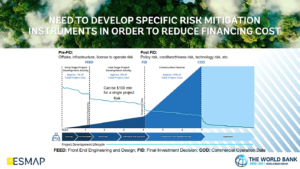

Click to enlarge. Levels of risk associated with each stage of project development. Long-term offtake is essential for de-risking projects for investors, encouraging more investment for new projects. From Dolf Gielen, Global Ammonia Certification As Enabler for Accelerated Investment and Financing (Nov 2023).

The AEA’s certification system will enable project developers to “pre-certify” an ammonia plant during the design and engineering stage, in advance of financial close. Certification can provide assurance that the delivered product will meet the requirements of prospective offtakers, as well as supporting bankability for the under-development project. Although project development and offtake typically have a chicken and egg relationship, certification represents a potential way to break through the impasse.

Unified certification: unlocking project funding

Click to expand. The bridge to bankability for projects, with certification to play a critical role in early development stages. From Ed Davis, The Path: How An Application Becomes A Loan (Nov 2023).

The panelists agreed that a unified, unambiguous certification system, including a single method for emissions calculations across different jurisdictions, will enable funding bodies like the LPO & the World Bank to assess applications more easily. Converged certification standards will also encourage long-term offtakers to get involved earlier in project development, de-risking the process and encouraging additional investment. On the theme of unified standards, it was suggested in discussion that establishing green corridors between different regions of supply/demand would help align standards – and these do not have to be limited to maritime corridors.

Maritime ammonia: certification key all along the supply chain

Click to enlarge. The maritime supply chain, with multiple downstream and upstream opportunities for certification to facilitate the uptake of ammonia as a maritime fuel. From Tomoaki Ichida, Ammonia insights from maritime industry (Nov 2023).

In the complicated maritime fuel supply chain, there are many opportunities for certification to facilitate the uptake of ammonia fuel. For maritime multinationals like Mitsui OSK Lines (MOL), certification will be critical to achieving fuel transition roadmaps. MOL’s “carbon business” includes upstream interests such as ammonia production, ammonia storage, and liquefied CO2 transportation. Downstream, MOL is exploring power generation and ammonia bunkering. To achieve its target of utilising 2 million tonnes of ammonia fuel per year in 2035 across its fleet – and achieve FID for all these supply chain projects – unified certification is critical for MOL.

Book & claim: matching producers with consumers

Click to enlarge. Demand creation mechanisms, including new “buyer’s alliances” that can potentially bring together producers and consumers of low-carbon ammonia. From Oleksiy Tatarenko, Market Based Demand Creation Mechanisms and Certification (Nov 2023).

To boost offtake on the demand side, a book and claim approach to certification can be used. This allows suppliers offering products with a known carbon footprint to find buyers seeking products of matching credentials. This traceable and scalable approach can help both buyers and producers decarbonise, without uncertain offtake acting as an impediment. Indeed, RMI has supported the development of multiple new buyer’s alliances like the Sustainable Aviation Buyers Alliance (SABA), the Zero Emission Maritime Buyers Alliance (ZEMBA) and the Sustainable Steel Buyers Platform (SSBP).

Overall, the panel agreed that unified, cross-jurisdictional certification will have a positive impact on project financing. It will increase the credibility of projects, increase investor & consumer confidence, and ultimately make long-term offtake more straightforward. Certification schemes like the AEA’s are sorely needed to break the impasse between project development and offtake, and will provide crucial support in the early stages of project development.