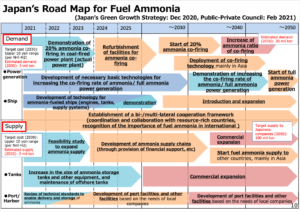

Japan’s Road Map for Fuel Ammonia

By Trevor Brown on February 25, 2021

This month, the Japanese Ministry for Economy, Trade, and Industry (METI) began promoting an updated Road Map for Fuel Ammonia, focused on the use of ammonia in thermal power plants and as a shipping fuel. By 2030, Japan expects to import 3 million tons of clean ammonia, with demand rising to 30 million tons by 2050. To secure these volumes, Japanese companies are now making investments up and down the supply chain.

These are ambitious numbers, matching Japan’s recent commitment to reach net-zero emissions, but still they miss the big picture. The broader economic opportunity arrives when Japanese companies export their fuel ammonia technologies, decarbonizing coal-fired power plants across Asia, and then supply the fuel to these newly sustainable shipping and electricity sectors. By 2050, the METI Road Map expects Japanese trading companies to supply the wider region with 100 million tons per year of clean ammonia.

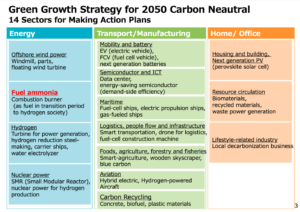

Fuel Ammonia in Japan’s Green Growth Strategy

These numbers come from METI’s Green Growth Strategy, which we wrote about last month. Fuel Ammonia is one of fourteen “sectors for making action plans,” supported by METI’s Ammonia Energy Council, established in October 2020, which includes the companies JERA, IHI Corporation, Mitsubishi Heavy Industries (MHI), and JGC Corporation, among others.

It is no surprise, therefore, that these companies are now making wide-ranging supply chain investments. As one media outlet reported:

METI is urging Japanese companies to gain medium- to long-term access to fuel ammonia through investing in overseas upstream natural gas assets and renewable power sources.

Argus Media, Japan targets 3mn t/yr of ammonia fuel use by 2030, February 8, 2021

JERA cooperates with Petronas

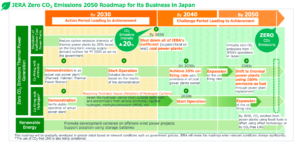

As we wrote here in October, JERA has its own road map to reach net zero emissions by 2050, which calls for 20% ammonia co-firing this decade, and 100% ammonia combustion in 2050.

Last year, the power producer joined a consortium with IHI Corporation, Marubeni and Woodside Energy to study the feasibility of coal co-combustion and ammonia supply. Now, JERA is making further moves in the ammonia supply chain, signing an MOU with Petronas “concerning cooperation in the decarbonization sector.”

Collaboration between a variety of leading companies is essential in order to establish supply chains for green fuels such as ammonia and hydrogen that are key to zero CO2 emission thermal power generation.

JERA and PETRONAS have built a good relationship through the sale and purchase of LNG over nearly 40 years. Because PETRONAS is one of the leading ammonia producers in Asia, and is considering the production of green ammonia and hydrogen, JERA believes there are many businesses in the LNG and decarbonization sectors in which the two companies can collaborate.

JERA press release, JERA and PETRONAS Conclude MOU on Cooperation in the Decarbonization Sector, February 10, 2021

As reported in the Nikkei, this collaboration is focused on building green ammonia capacity:

The two have agreed to use renewable energy, like hydropower, to manufacture ammonia without releasing CO2. Further details on the production site, as well as production capacity, will be determined at a later date.

Nikkei Asia, Japan’s Jera to produce ammonia for power with Malaysia’s Petronas, February 8, 2020

Petronas, the national oil company of Malaysia, already produces ammonia from natural gas feedstocks, with an annual ammonia capacity of around 2.5 million tons. But, like JERA and so many others, Petronas recently announced its own plan (“aspiration”) to reach “net zero carbon emissions by 2050” — which will necessitate the full decarbonization of its ammonia manufacturing base.

Today, PETRONAS is already producing blue hydrogen as a by-product from its facilities and will be exploring the commercial production of green hydrogen in the near future. Coupled with its inherent geographical advantage, expanding renewables portfolio, strong partnerships with customers and continued focus on Research & Development (R&D) of electrolyser technology, PETRONAS is well-poised to be a competitive low-carbon and green hydrogen solutions provider.

Petronas press release, PETRONAS And JERA Elevate Partnership To Realise A Decarbonised World, February 9, 2021

MHI invests in clean ammonia supply chain

MHI has been particularly active in recent months, investing in at least three different supply technologies.

In Australia, MHI announced in November its investment in The Hydrogen Utility (H2U), “to export locally produced green hydrogen and green ammonia to Japan and other destinations.” MHI will also provide engineering and equipment to H2U’s ~40MW-scale pilot project, the Eyre Peninsula Gateway in South Australia, which expects to “commence commercial production of green hydrogen and ammonia towards the end of 2022.”

The same month, in the US, MHI announced an investment in Monolith Materials, to “strengthen and diversify MHI Group’s hydrogen value chain through innovative technological addition.” Monolith is building its first clean ammonia plant in Nebraska, with a capacity of a 275,000 tons per year, using its methane pyrolysis process.

As the importance of hydrogen to realizing a decarbonized society gains popularity, especially in Europe, the United States, and Japan, various clean hydrogen production technologies and supporting processes are required to make that vision a reality … MHI Group is taking a proactive approach to creating and investing in technologies to meet this global demand.

MHI press release, Mitsubishi Heavy Industries Invests in Monolith Materials, November 30, 2020

And earlier this month, MHI announced another methane pyrolysis investment, in the Series A financing round for the start-up C-Zero.

C-Zero’s drop-in decarbonization technology … will allow industrial natural gas consumers to avoid producing CO2 in applications like electrical generation, process heating and the production of commodity chemicals like hydrogen and ammonia …

With the investment, MHI continues to strengthen and diversify the hydrogen value chain, advancing both strategic initiatives for its energy transition business and its commitment to making continued progress toward global carbon neutrality goals. MHI joins a consortium of investors, including Breakthrough Energy Ventures, Eni Next and AP Ventures.

“MHI is committed to expanding the hydrogen value chain from production to utilization …” said Yoshihiro Shiraiwa, MHIA President.

MHI press release, MHI Invests in C-Zero, a U.S. Hard Tech Startup, to Accelerate Efforts to Produce Clean Hydrogen from Natural Gas, February 10, 2020

JGC, Sumitomo, Iwatani, and IHI take Queensland

In November 2020, Stanwell Corporation and Iwatani Corporation announced their collaboration to develop a “renewable hydrogen export facility” in Gladstone, making Queensland “a green hydrogen production and export powerhouse.” (A diversified commodity trading company, Iwatani is already “Japan’s largest hydrogen supplier.”)

Also in Gladstone, JGC Corporation, which built a green ammonia demonstration plant in Koriyama in 2018, announced last month that it is working with Sumitomo on the engineering of a local-market-scale hydrogen plant using solar power. The demonstration plant will have a hydrogen capacity of 250-300 tons per year (“with plans to scale up production”) and will be operational by 2023.

“The JGC Group is making extensive efforts to expand the use of hydrogen energy … and ammonia, which is expected to be one of the most promising hydrogen energy carriers …

“In addition, we are proposing a hydrogen production system that will produce hydrogen from synthetic gas made from waste plastics, in order to continue to contribute to the realisation of a hydrogen society in Japan and abroad.”

In Queensland, Gladstone may produce hydrogen by 2023 as Sumitomo ramps up, January 29, 2021

And this month, the Queensland Government announced a collaboration between IHI Corporation (which, among other things, is collaborating with JERA on ammonia combustion technologies) and local state-owned power producer CS Energy.

The two companies will assess the feasibility of establishing a renewable hydrogen demonstration plant next to CS Energy’s Kogan Creek Power Station on Queensland’s Western Downs … which includes the co-location of a solar farm, battery, hydrogen electrolyser and a hydrogen fuel cell at the Kogan Creek Power Station.

Queensland Government announcement, Queensland collaborates with Japan on green hydrogen plant, February 2, 2020

Competitive advantage for national industries

Japan’s strategy is about more than just securing fuel supply.

Five years ago, I wrote about the relatively-unknown Japanese R&D program called SIP Energy Carriers. Since then, this ambitious program has become hugely influential — and we are now watching its participants assert their competitive advantage through global investments and partnerships.

As I wrote in November 2016:

To understand the motivation and impressive pace of development of the Japanese ‘Energy Carriers’ project, it is important to recognize the commercial advantage of being the first-mover in developing low-carbon technologies. (This is, perhaps, an especially important point to make, given this week’s election of the future President Trump and his potential impact on clean energy research, development, and deployment in the US.) …

The ‘Energy Carriers’ program is not some decades-long R&D project without near-term prospects for commercialization. It is specifically designed to accelerate technologies into deployment, creating a competitive advantage for its national industries in a changing global energy economy. Providing national energy security … is only the first step. The real opportunity comes … when the commercial exploitation of these technologies will allow “Japanese hydrogen relevant industries [to] play an active role in the global market.”

While the … opportunity for the displacement of fossil fuels in the Japanese market is certainly large, the addressable global market – into which Japan will then export its technologies and expertise – will be vast.

Ammonia Energy, Low-carbon ammonia synthesis: Japan’s ‘Energy Carriers’, November 11, 2016

Five years later, while the US still lacks a hydrogen strategy, the expansion of the Japanese hydrogen-ammonia industry into global markets is entirely visible. And now we have a definition of “vast” — a regional electricity and shipping fuel market of 100 million tons of clean ammonia by 2050.