Korean Register Sees Ammonia as Preferred Alternative Maritime Fuel

By Stephen H. Crolius on February 06, 2020

Last week the classification society Korean Register of Shipping (KR) released Forecasting the Alternative Marine Fuel: Ammonia, a “technical document on the characteristics and the current status of ammonia as ship fuel.” One hesitates to take the title too literally, but the report really does forecast that ammonia will be the alternative marine fuel. Over the last year, a number of maritime transport stakeholders – engine producers, government agencies, other classification societies – have identified ammonia as a promising means of industry decarbonization. But as it joins the group, KR makes a notably explicit and complete case in ammonia’s favor.

Topic number one in KR’s evaluation is “economic efficiency,” which includes costs across the value chain from sourcing of feedstocks to delivery of finished goods. In a quantitative comparison of carbon-neutral fuels including biodiesel, biogas, hydrogen, and methanol, KR finds ammonia to be the most “rational fuel when considering the entire production and transport processes.”

Topic two is the ammonia industry’s ability to produce enough carbon-neutral fuel to meet the maritime sector’s needs. The answer here is yes: “Considering the increasing trend of power generation with renewable energy and the synergy of offshore wind power generation with the supply of fuel to ships [a reference to the ZEEDS concept, which KR describes at length], the supply of ammonia fuel to ships is sufficiently feasible.”

Topic three is the question of whether ammonia fuel can achieve an acceptable level of safety in the maritime context. KR observes that ammonia has long had a substantial footprint in the shipping sector, most obviously as a cargo, but also via its use in on-board refrigeration systems and as a reagent in selective catalytic reduction (SCR) emission control systems. KR concludes that “there are rules and methods to handle ammonia safely inside ships,” and that “therefore, using ammonia as a fuel for ships is expected to be sufficiently feasible through the revision” of the International Maritime Organization’s IGF and IGC safety codes.

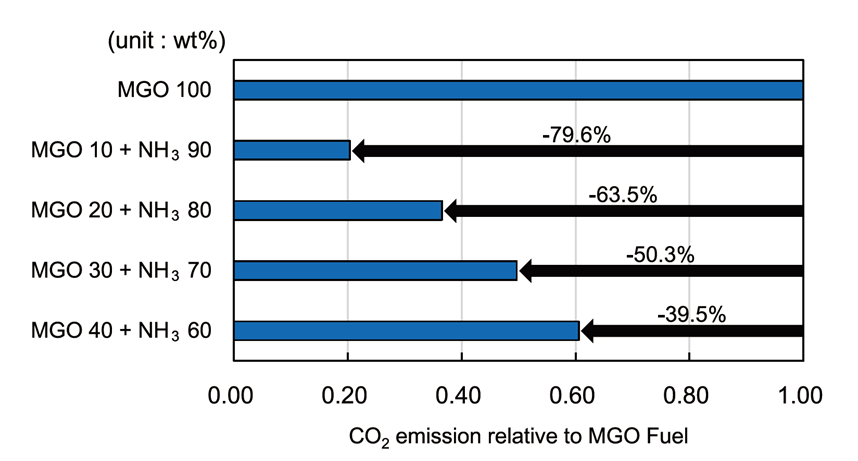

Sprinkled throughout the report are the building blocks of a practical transition to ammonia power. The starting point is the observation that “it would be easy to develop the ammonia engine” based on the “current two-stroke [compression ignition] engines” that are “widely used in large ships.” (Reference is made to MAN Energy Solution’s program to do just that based on its existing LGIP engine.) Although it is possible to burn ammonia in a diesel engine, the required compression ratio is more than twice as a high as that of a conventional compression ignition engine. More feasible is to make ammonia part of a dual-fuel system, in which the second fuel acts as a combustion initiator to compensate for ammonia’s relatively high auto-ignition temperature. Highlighting the fact that petroleum-derived fuels are well suited for this role, KR describes a progression that starts with a blend of 60% ammonia and 40% marine gas oil (MGO), and over a period of years graduates to 90% ammonia. “As such,” KR says, “the shipping companies can select fuel flexibly while meeting the [IMO GHG] regulation.” One advantage KR sees in this approach is that it relies initially on the existing fuel production and distribution infrastructure, lessening the risk of supply issues. KR also observes that other non-fossil fuels could play the combustion initiator role, including biodiesel and dimethyl ether.

Included in KR’s first chapter is a discussion of the “technical and commercial feasibility study of ships using ammonia fuel” that was conducted by Korea’s own Daewoo Shipbuilding and Marine Engineering (DSME). The exercise found that ammonia could be “sufficiently competitive” when “the IMO’s emission regulation becomes stricter.”

Is a Korean consensus emerging around the use of ammonia as a maritime fuel? DSME was a focus of a September 2019 Ammonia Energy article on ammonia shipbuilding in South Korea and, only last week, we reported that Samsung Heavy Industries was part of a coalition to develop “an ammonia tanker.” If so, a Korean bloc supported by the country’s major shipbuilders, shipping companies, and relevant government agencies could wield an outsize influence in the global maritime sector. Remarkable things have happened in the Korean economy over the last 30 years when the country’s major stakeholders have aligned. This pattern could be repeated to the benefit of all nations if ammonia fuel proves to be an effective rallying point.