Marine Ammonia: panel wrap-up from the 2020 Ammonia Energy Conference

By Julian Atchison on January 07, 2021

What action is needed to unlock the enormous potential of green ammonia as a marine fuel and get the new generation of ammonia-powered vessels on the water? On November 18, 2020, the Ammonia Energy Association (AEA) hosted a panel discussion moderated by Sofia Fürstenberg Stott from Fürstenberg Marine Advisory, as well as panel members Tue Johannessen from the Center for Zero Carbon Shipping, Katharine Palmer from Lloyd’s Register, Rob Stevens from Yara International, and Kazumasa Taruishi from NYK Energy Transport as part of the recent Ammonia Energy Conference.

All panelists agreed that the challenge is steep: relatively high fuel costs in the short-term, lack of regulatory structures, taxes and certification schemes, lack of infrastructure and high upstream CapEx costs all make it difficult for the first movers. But, collaboration, partnership, whole-of-value-chain analysis and a willingness from the sector to seriously engage with its emissions reduction commitments are all reasons to be optimistic. When polled on how many ammonia-powered vessels they thought would be on the water by the end of this decade, the audience and panelists agreed on the highest option available: 30 vessels. This represents not only the level of fuel consumption needed to make ammonia viable as a marine fuel, but a rapid development on par with the growth of LNG-fueled vessels.

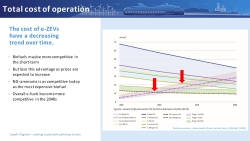

Katharine Palmer outlined what the current business case for ammonia as a marine fuel looks like. There’s a whole range of low and zero-carbon fuels emerging, and Lloyd’s Register is performing careful analysis of the techno-economic situation, the political acceptability and the social acceptability of all these options. Ammonia leads the pack for a number of reasons:

- Though biofuels are currently cost-competitive, by 2030 they will lose their advantage over electrofuels like ammonia,

- Ammonia is less energy-intensive to produce than other e-fuels and cheaper to store (especially compared to hydrogen),

- Ammonia is already shipped globally in large volumes and via a large number of ports, so technological challenges related to on-board safety and bunkering should be straightforward to mitigate,

- And, most importantly, ammonia doesn’t contain carbon! This has huge upside from an emissions regulation perspective, and means the costs and difficulties associated with sourcing carbon for biofuel and e-fuel alternatives are avoided.

Since the discussion about ammonia as a marine fuel started three years ago the sector has already come so far, with multiple approvals in place for ammonia-fueled vessels and industry partners demonstrating a willingness to collaborate and solve big challenges. Obstacles still remain, however. Katharine reminded us that lifecycle GHG emissions for ammonia will need to be carefully regulated to inspire confidence in the low or zero-carbon bona fides of the fuel. And – at least in the short term – a carbon price or levy is needed to close the gap between e-fuels and contemporary options. The onset of a local/global carbon price or levy was also chosen by our audience as the most effective enabler of green ammonia as a maritime fuel in an audience poll during the session.

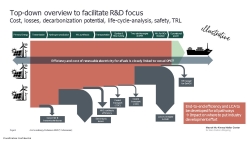

From a technical perspective, Tue Johannessen was eager to stress the importance of a whole-of-value-chain approach to driving down costs and mitigating obstacles. The scope of the challenge is huge – the marine sector needs 550Mt of ammonia per year to replace its use of heavy fuel oils across some 70,000 vessels (current global production for users across all sectors is currently 180Mt per year). The end-to-end efficiency of the marine ammonia fuel chain is not currently sufficient for deep-sea shipping, with only 30-35% of energy available once we’ve moved through renewable-driven electrolysis, ammonia synthesis, transport, engine loss and De-NOx processes. But improving just a couple of these process steps — for example replacing low-temperature electrolysis with high-temperature alternatives, or internal combustion engines with SOFCs — would yield huge benefit. Just a 10% improvement in this fuel chain efficiency would mean 20,000 less 10MW offshore wind turbines would be required for marine ammonia production. Tangible rewards are there for those who partner up and collaborate to solve key process challenges.

Two of those potential collaborators were represented on the panel — Rob Stevens from Yara and Kazumasa Taruishi from NYK Energy Transport. With a 25% share in the global traded ammonia market, green ammonia projects on track to be operational in 2023-4 and a commitment to be carbon neutral (including Scope 3 emissions from their agricultural customers) by 2050, Yara is well-positioned to improve gaps in the value chain. Using grey and “light grey” ammonia as a de-risked starting point, Yara aims to play a major role in driving the global hydrogen and ammonia economies. For Rob, sharing risks between partners to ease the transition and bring the costs of a decarbonised pathway closer to contemporary marine fuel pathways is key. A localised or regional carbon price – say in the EU – would help kick start green ammonia but is unsustainable on its own in the long term. And while a global carbon pricing scheme is excellent in principle, it’s difficult in practice and unlikely to happen. In Rob’s view regulatory and pricing schemes should be intensive first up before settling into a mixture of “carrot and stick” measures.

NYK Energy Transport currently operates 800 ocean-going vessels, relying solely on fossil fuels. Though the challenge is steep, they are committed to IMO’s 2050 GHG emission reduction targets and believe hydrogen and ammonia will do the bulk of the decarbonisation work. Kazumasa sees a suite of decarbonisation solutions working for the marine sector by the 2030s: ammonia combustion for ocean-going, long-distance container vessels and hydrogen fuel cells for coastal, short and medium-distance vessels like cargo ships and passenger ferries. Since 2015 NYK have been developing LNG as a transition marine fuel until a cost competitive, proven alternative emerges, and Kazumasa sees this as a good omen for developing ammonia-powered vessels: matching cargo and fuel has worked very well for LNG vessels and crews used to transporting highly toxic cargoes like ammonia will be best placed to work with ammonia as a marine fuel. For Kazumasa, the challenges for taking up ammonia as a marine fuel are two-fold:

- Technical (minimising pilot fuel use, minimising NOx and developing ammonia-fueled auxiliary generators for on-board power), and

- Commercial (ammonia fuel tanks 3x the size of heavy fuel oil tanks, bunkering infrastructure, safety and fuel costs).

But, new R&D projects and a sense of purpose in the international shipping community leave Kazumasa – and the other panelists – confident that the first ammonia-fueled vessels will hit the water well before 2030.

If you wish to view the archived video of the marine ammonia panel discussion, please register for the conference to access all session recordings. You can also browse and download all of the Ammonia Energy Conference 2020 presentations.