Preparing the Netherlands for ammonia imports: new roadmap published

By Julian Atchison on February 22, 2024

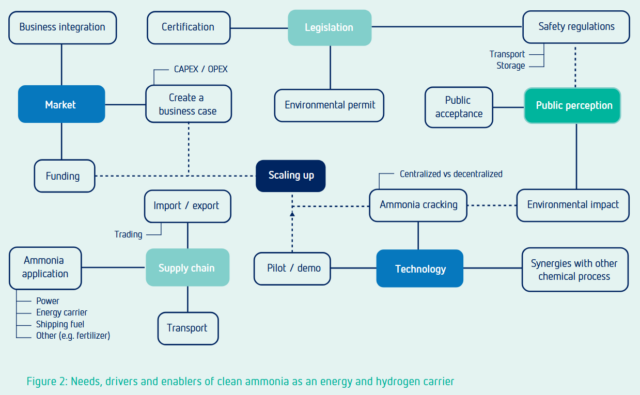

Click to enlarge. Key drivers and enablers for ammonia imports. Fig 2 from Clean Ammonia Roadmap (ISPT, Jan 2024).

A new roadmap from the Institute for Sustainable Process Technology (ISPT) has set out the requirements for dramatically increased ammonia imports into the Netherlands by 2030. Extra infrastructure, updated regulatory frameworks, new safety procedures and careful community consultation will be required to realise the combined production and import of up to 25 million tons per year in the Antwerpen-Rotterdam-Rijn-Ruhr area (ARRRA). A ramp-up in ammonia bunkering capacity after the end of this decade could then see demand in the ARRRA as high as 90 million tons per year by 2050 (representing nearly a quarter of global marine ammonia fuel demand). In order to achieve this, the report authors set out a number of key drivers and enablers.

Public acceptance

Moving beyond a positive public perception of ammonia, local communities need to be able to accept the increased presence of ammonia and associated infrastructure. As is already the case with existing ammonia facilities, new plants will require the strictest safety standards and a well-trained workforce. With such an increase in ammonia imports, careful consideration is also needed of the increased number of new ammonia “users”. Luckily, a wealth of existing knowledge on ammonia exists, and can assist this push:

Decades of engagement with ammonia by chemists have led to a comprehensive understanding of its health and safety implications. Existing codes and standards for working with ammonia exist, but they require updates to accommodate the anticipated rise in ammonia’s volume and diverse applications as an energy carrier. Establishing regulations for ammonia’s role in energy and hydrogen transportation is crucial.

Jan-Jaap Nusselder, Lead Sustainability OCI Nitrogen at OCI Global in ISPT’s official press release, 8 Jan 2024

Updated regulatory frameworks

In the Netherlands, there is ongoing work to modernise the PGS 12 guideline for ammonia storage and handling. The joint effort from Dutch government authorities and industry stakeholders is focused on “higher volumes [of ammonia imports], review of scenarios including external impact, full containment tank design and pump type selection, next to the necessary safety measures.”

Work on PGS 12 will be supported by a number of other developments: the EU’s RED III, which sets both a minimum percentage use for alternative fuels (RFNBOs) in transport and various industrial sectors, and a methodology for calculating the lifecycle emissions of renewable hydrogen; assessing the impacts from the transport of hydrogen carriers using the Dutch Environmental Law (Omgevingswet); and a host of market mechanisms – the EU Hydrogen Bank, H2Global, IPCEI and even the Renewable Fuel Units scheme in the Netherlands.

Pipelines needed

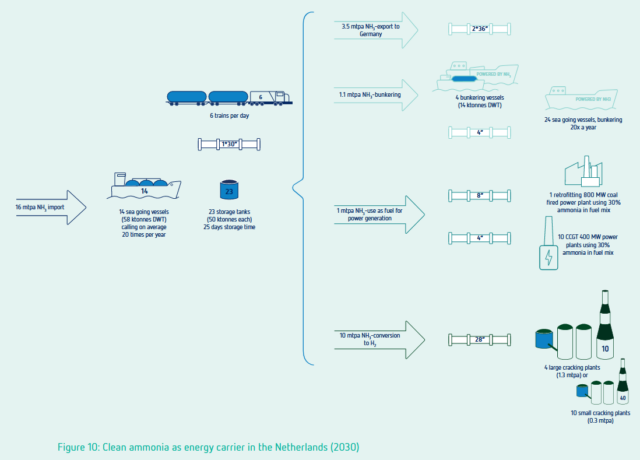

Click to enlarge. Ammonia as an energy carrier in the Netherlands (2030), with an emphasis on pipeline transport and distribution. Fig 10 from Clean Ammonia Roadmap (ISPT, Jan 2024)

For safety reasons, the roadmap sees ammonia pipeline transport as the “preferred modality”. Europe’s current 201 km of ammonia pipelines (ranging in length from 1.5 to 74 km) will need to be extended to “handle increased ammonia imports and distribution”, particularly links between Rotterdam and Germany’s industrial hinterland. One of ISPT’s next projects will be an assessment of ammonia pipeline safety requirements, and what regulatory updates will be required.

The roadmap is part of ISPT’s Clean Ammonia Platform program, and was prepared in collaboration with a number of notable industry partners, including Duiker Clean Technologies, Horisont Energi, Koole Terminals, OCI Global, Shell, E.ON, and the Port of Rotterdam. You can download a pdf of the full report here.