Rapid Long-Term Growth Projected for Fuel Cells

By Stephen H. Crolius on February 21, 2019

Last month the Fuji-Keizai Group released its latest biennial review of the global market for fuel cells, “Future Outlook for Fuel Cell-Related Technology and Market in 2018.” This is at least the third iteration of the report, and comparison across the different editions shows how expectations have evolved. The report features both polymer electrolyte and solid oxide fuel cells (PEFCs and SOFCs). Although not mentioned in the report, a number of groups are working on direct ammonia versions of both technologies.

The release was the subject of a story posted by the on-line news service Smart Japan. An English-language version of the report does not appear to be available yet. According to its Web site, “the Fuji-Keizai Group is a leading information provider on industry and market not only in Japan but also in industrialized and emerging economies throughout the world.”

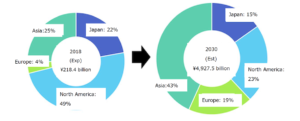

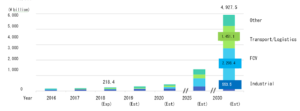

The report projects that the annual global market for fuel cells will grow from ¥218 billion in 2018 to ¥4,928 billion in 2030 (USD$2.0 billion to USD$44.4 billion), a blistering 130% compound annual growth rate (CAGR). (Note that a 100% CAGR means that market size doubles every year.)

Leading this growth are fuel cell vehicles which, courtesy of Toyota, Honda, and Hyundai, represented a real but tiny market in 2018. The category is expected to grow over the next 12 years to ¥2,208 billion (USD$19.0 billion). If the price per fuel cell were order-of-magnitude ¥1,000,000 (USD$9,009), that would mean sales of 2.2 million fuel cell vehicles. Approximately 90 million light vehicles were sold globally in 2018. Ammonia could be used either as a method of transporting hydrogen to fueling stations or as a fuel for the alkaline version of the PEFC.

The second largest contributor to the 2030 market is fuel cells for transport and logistics (i.e., those that will power trucks, buses, forklifts, etc.). Global sales of fuel cells in this category are projected to reach ¥1,452 billion (USD$13.1 billion). The key factors in this growth are plans for and introductions of fuel cell-powered trucks and buses in North America and Asia, with major contributions from China, where Fuji-Keizai projects ¥49,000 billion (USD$440 billion) in sales of fuel cell trucks and buses in 2030.

2030 sales for Fuji-Keizai’s “Other” category, which includes residential, portable, and back-up fuel cells, are projected at ¥715 billion (USD$6.4 billion). If the entire amount were devoted to residential fuel cells (known as Ene-Farms in Japan), and the value of the fuel cell were $4,000, unit sales in 2030 would be 1.6 million. (The Japanese Government is hoping that the country will have more than a million Ene-Farms in place by the end of 2020.)

The smallest category in Fuji-Keizai’s 2030 projection is Industrial, with projected revenues of ¥554 billion (USD$5.0 billion). The category includes power systems for data centers, factories, and logistics facilities. Industrial happens to be the largest category in 2018 with sales of approximately ¥90 billion (USD$0.8 billion). But while its expected growth is robust, it is just not as robust as that of the other categories.

The two earlier Fuji-Keizai reports provide similar breakdowns through the same end-point year (2030), which allows market numbers to be lined up and compared. The general trend is down. With one major exception, the category-by-category numbers for the end point projected in 2016 were lower than the end point numbers from 2014. Ditto for 2018 vs. 2016. End point sales in the fuel cell vehicle category, for example, were projected in 2014 at ¥4,220 billion (USD$38.0 billion); ¥2,631 billion (USD$23.7 billion) in 2016; and ¥2,208 billion (USD$19.9 billion) in 2018. The Transport and Logistics category is the major exception, rising from an end point projection in 2014 of ¥260 billion (USD$2.3 billion) to ¥1,451 billion (USD$13.1 billion) from the perspective of 2018.

Of course “sooner and bigger” is better than “later and smaller,” but the trend for at least one parameter provides grounds for cautious optimism. The growth curve in each of the three reports is just that, a curve, and not an upwardly inclined straight line. The curve is convex, with a “zone of inflection” where a gradually up-sloping trend gives way to a dramatically up-sloping trend. In the 2014 report, the zone of inflection was centered on the year 2018. In the 2016 report, the inflection point had moved to 2019. In the 2018 report, it moved again, to 2021. On the one hand, the inflection point keeps receding into the future, but on the other, it is closer to the present now than it was in 2014.

One could argue that, as the zone of inflection goes for fuel cells, so it goes for the whole of the sustainable energy economy of the future. Fuel cells exemplify many of the challenges of the sustainable energy economy: they are objectively better than legacy technologies on important dimensions such as energy efficiency and noxious emissions, but they are more costly and will remain so for an indeterminate period. Hence, Fuji-Keizai says, “In major countries, technical support [government subsidies] for the spread target of 2025 or 2030 continues, and promotion of fuel cell system is promoted for diversification of energy and realization of low carbon society.” But at a certain point, the company says, “system costs will be reduced as the market expands for each application, and it seems that industrial autonomy that does not rely on subsidies will be realized in the future.” Seen in this light, fuel cell market inflection in the early 2020s, driven by or at least associated with a competitive economic case, is a positive projection indeed.

Cameo image courtesy of IHI Corporation.