Saudi Arabia ships low-carbon ammonia to Japan

By Trevor Brown on October 08, 2020

Last week, Saudi Aramco and the IEEJ attracted significant media attention when they announced that the first “blue” ammonia has been shipped to Japan. Aramco’s celebration of this shipment of 40 tons of ammonia (not 40 thousand or 40 million, just 40 tons) raises many questions, but makes three things clear.

First, projects to demonstrate the carbon footprint of specific batches of low-carbon ammonia are now underway, and these case studies will inform the design of an international low-carbon ammonia certification scheme.

Second, there is an urgent need to establish definitions across the industry, or risk losing credibility.

Third, Aramco (absolutely the most profitable company in the world, with over a hundred oil and gas fields and almost 300 trillion scf of natural gas reserves) has sent a clear signal that it intends to make and sell ammonia as a decarbonized energy commodity.

Aramco and the Institute of Energy Economics, Japan (IEEJ), in partnership with SABIC, have successfully demonstrated the production and shipment of blue ammonia from Saudi Arabia to Japan … for use in zero-carbon power generation …

Ahmad O. Al-Khowaiter, Aramco’s Chief Technology Officer, said … “This world’s first demonstration represents an exciting opportunity for Aramco to showcase the potential of hydrocarbons as a reliable and affordable source of low-carbon hydrogen and ammonia.“

Saudi Aramco announcement, World’s first blue ammonia shipment opens new route to a sustainable future, September 27, 2020

Low-Carbon Ammonia Pathways

Renewable energy advocates may not be delighted by this announcement of fossil-based ammonia energy, especially following the news in July 2020 that NEOM will begin producing 1.2 million tons per year of green ammonia in Saudi Arabia by 2025. NEOM’s announcement showed that large-scale 100% renewable fuel production was feasible and that, therefore, we are not dependent upon fossil fuels — even in the short term.

Nonetheless, some key, early customers for low-carbon ammonia — beginning with electric power producers in Japan — believe that blue ammonia offers the lowest-cost production pathway that can scale to the necessary volumes to start the low-carbon ammonia market.

“Green ammonia” generally means: made using renewable energy (in NEOM’s case, wind and solar). “Blue ammonia” generally means: made using fossil fuels, but with reduced carbon emissions (in Aramco’s case, CCS-EOR and CCU).

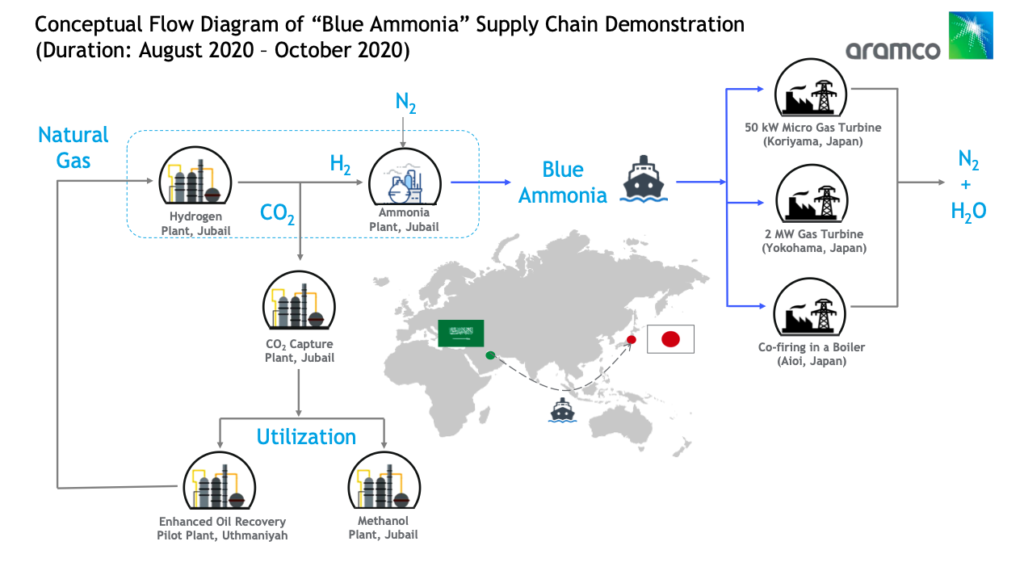

Aramco’s demonstration employs two different pathways to reduce direct atmospheric emissions of carbon dioxide from ammonia production: carbon sequestration for enhanced oil recovery (CCS-EOR) and carbon utilization (CCU) in methanol production.

The Saudi-Japan blue ammonia supply network demonstration spanned the full value chain; including the conversion of hydrocarbons to hydrogen and then to ammonia, as well as the capture of associated carbon dioxide (CO2) emissions. It overcame challenges associated with the shipping of blue ammonia to Japan for use in power plants, with 30 tons of CO2 captured during the process designated for use in methanol production at SABIC’s Ibn-Sina facility and another 20 tons of captured CO2 being used for Enhanced Oil Recovery (EOR) at Aramco’s Uthmaniyah field.

This milestone highlights one of several pathways within the concept of a global Circular Carbon Economy (CCE), a framework in which CO2 emissions are reduced, removed, recycled and reused – as opposed to being released into the atmosphere.

The Institute of Energy Economics, Japan announcement, World’s first blue ammonia shipment opens new route to a sustainable future, September 27, 2020

I am compelled to point out that, by definition, the “circular economy” also requires an end to extraction. If we reduce, remove, recycle, and reuse carbon but continue to extract more fossil fuels, we aren’t describing a circle but a spiral.

Supply Chain of Low-Carbon Ammonia

The industry coalition behind this demonstration includes SABIC (Aramco’s ammonia and methanol producing subsidiary) and Mitsubishi Corporation, who are “overseeing the transport logistics.” Their partners are JGC Corporation, Mitsubishi Heavy Industries Engineering, Ltd., Mitsubishi Shipbuilding Co., Ltd. and UBE Industries, Ltd.

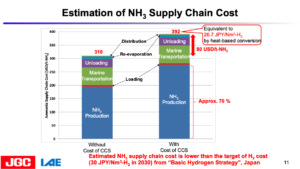

At the 2018 NH3 Fuel Conference, JGC Corporation gave a presentation about a similar project, in which they had studied the technical and economic feasibility of importing low-carbon ammonia from the UAE, produced using CCS, for power generation in Japan.

The economic analysis presented in that study (Cost Evaluation Study on CO2-Free Ammonia and Coal Co-Fired Power Generation Integrated with Cost of CCS) is extremely relevant to the business model that Aramco is promoting here.

The Importance of Definitions

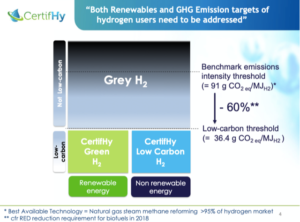

CertifHy is probably the leading low-carbon hydrogen certification scheme, developed over the last few years in the EU. According to its definitions, “low-carbon hydrogen” must have a carbon intensity less than 36.4 gCO2e/MJ.H2, which represents a 60% reduction from the baseline: steam methane reforming (SMR) without carbon capture.

CertifHy separates “low-carbon hydrogen” into two categories: renewable and non-renewable. This enables hydrogen producers to meet two specific demands within the EU: demand for GHG reductions (low-carbon) and demand for renewables (renewable versus non-renewable).

While Aramco’s announcement contains few numbers, it is in the right ballpark to meet CertifHy’s definition of “non-renewable low-carbon.” Production of 40 tons of ammonia would normally emit around 80 tons of CO2. By removing 50 tons of CO2 from its carbon footprint, Aramco is delivering ammonia with more than 60% CO2 reduction.

The fact that these tons of CO2 are not ultimately sequestered creates complicated issues for a certification scheme. In CCS-EOR, any sequestered CO2 likely causes approximately equal atmospheric carbon emissions from the additional oil extracted. In methanol production, all the CO2 will likely be released to the atmosphere when the methanol is burnt as fuel (moreover, it isn’t clear from Aramco’s announcement how CO2 from ammonia production enters the methanol production process or why: SABIC’s Ibn Sina facility is a million ton per year natural gas-based methanol plant: it has little need for additional CO2).

From an accounting perspective, nonetheless, these emissions have been removed from the ammonia.

Beyond green and blue

This raises a significant challenge: can a low-carbon ammonia certification scheme enable sustainability to be valued according to production pathway (in addition to carbon intensity)?

For example, some forms of biomass are more sustainable than others, especially at volume, but all are renewable. Some customers would welcome nuclear ammonia over fossil ammonia, but both are non-renewable. If a hybrid ammonia plant (an existing plant with an electrolyzer added on) sells two kinds of ammonia, renewable and non-renewable, might not a customer prefer to buy from a 100% renewable ammonia plant instead? (Would these plants have the same cost structure for their renewable ammonia?) Geologic sequestration (CCS) delivers greater climate benefits that enhanced oil recovery (CCS-EOR) but ammonia produced using either method could have the same carbon footprint.

As we establish the design of an international certification scheme for low-carbon ammonia, there will be tremendous value in moving beyond the simplistic, binary definitions of renewable and non-renewable.