Scaling clean ammonia: a World Bank perspective

By Geofrey Njovu on November 26, 2023

As the dust settles after our 2023 annual conference in Atlanta, USA, we’ll take some time over the next few weeks to review the highlights and key takeaways. Our three-day gathering kicked off with a keynote speech by Dolf Gielen, Senior Energy Economist at the World Bank. The address laid out the World Bank’s strategy for low-carbon ammonia, including their active projects and perspectives on standards and certification.

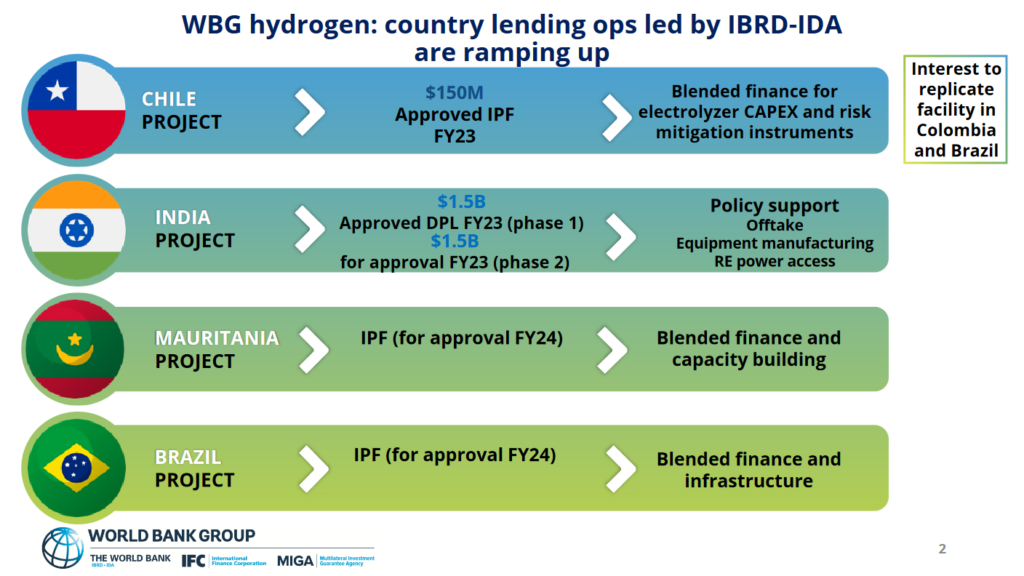

The World Bank is ramping up funding for hydrogen projects, with current loans totaling upwards of $3 billion. Key beneficiaries of this include projects in Chile, India, Mauritania, and Brazil. The Bank expects renewable and CCS to make up two-thirds and one-third respectively of clean ammonia projects. More detail is contained in its latest report on “Scaling Hydrogen Financing for Development” in collaboration with OECD, Global Infrastructure Facility and the Hydrogen Council. The report’s official launch took place last week.

The keynote and follow up discussions highlighted that – to get low-carbon ammonia off the ground – financing costs must be reduced. These constitute a major risk to all planned and ongoing projects. Other key risks include long-term offtake uncertainty, price and demand uncertainty. Financing cost risks are concentrated around the FEED and pre-FID phases of projects, requiring extra effort & attention from organisations such as the Bank to ensure progress.

The current landscape: small % of projects are under construction or reached “FID-plus”

In its new report, the World Bank forecasts that 40 million tonnes per year of clean hydrogen production will be operating by 2030, requiring some $2 trillion in investment. 20 million tonnes of this production capacity is planned in emerging markets and developing countries (EMDCs) – about 100 NEOMs-worth of projects! Globally, just 7% of announced hydrogen projects have reached the “FID-plus” stage. And – where clean ammonia is concerned – under construction projects account for just 1% of the ammonia demand forecast for 2030. Sizeable gaps need to be addressed in the next few years.

Risk reduction: innovation & supply chain development

As well as increased investment in the right locations, technical innovation and establishing a stable “end-to-end” supply chain should be part of the solution. Doing this would increase the number of projects reaching FID. Furthermore, actions should be taken that will enable end-users to pay the premium for getting the “green molecule”, whatever the origin.

Uniform standards and certification

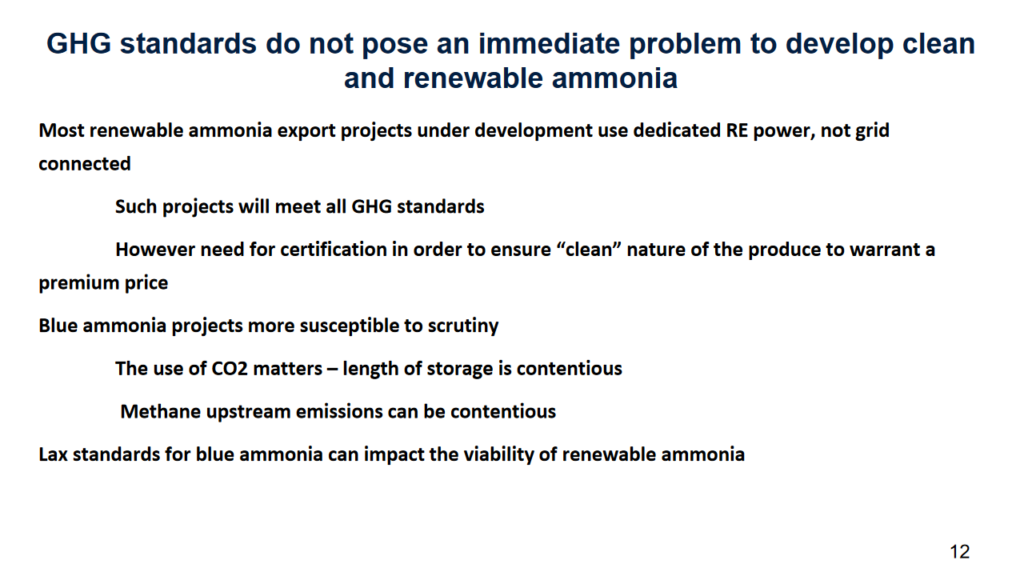

On standards, inter-jurisdictional certification will be critical for a global clean ammonia supply chain. Existing regional standards and certifications such as the EU’s CertifHy, Australia’s H2GO and UK RGGO (among others) have limitations including varying emission thresholds, inconsistent reporting boundaries and definitions, which makes market-to-market comparisons difficult.

Uniform certification will be particularly important for regions such as the EU, which plans to import 10 million tonnes of its renewable hydrogen/ammonia needs. It was highlighted that – in the case of carbon capture-based projects – downstream treatments of the captured CO2 should be thoroughly accounted for i.e., permanent sequestration vs utilisation.

Overall, the keynote highlighted project ambitions, existing supply and demand centres and offered action points necessary to meet production targets for clean ammonia projects. Technological innovation, established supply chains and harmonised standards and certification were highlighted as key features of a successful clean ammonia industry. You can access the speaker slides, as well as the new report from the World Bank.