The Evolving Context of Ammonia-Coal Co-Firing

By Stephen H. Crolius on July 18, 2019

Co-firing ammonia in a coal-fueled boiler, a concept under active development in Japan, received positive notice in the International Energy Agency’s recently published report, The Future of Hydrogen.

The IEA summarized the development history of the technology as follows:

In 2017 the Japanese Chugoku Electric Power Corporation successfully demonstrated the cofiring of ammonia and coal, with a 1% share of ammonia (in terms of total energy content) at one of their commercial coal power stations (120 MW). Using ammonia as fuel raises concerns about an increase in NOx emissions, but the demonstration managed to keep them within the usual limits and to avoid any ammonia slip into exhaust gas. Higher blending shares of up to 20% ammonia in energy terms might be feasible with only minor adjustments to a coal power plant. In smaller furnaces with a capacity of 10 MW thermal, blending shares of 20% ammonia have been achieved without problems, and in particular without any slippage of ammonia into exhaust gas.

The Future of Hydrogen, International Energy Agency, June 2019

(More detail on the Japanese efforts can be found in Ammonia Energy stories from April 12, 2018 and September 28, 2017.)

So far serious scrutiny of the co-firing concept is limited to Japan. In the fullness of time, the demand side of the concept may take root in other countries. The supply side, however, could have near-term global relevance. Here is more from the IEA:

By 2030 around 1 250 GW of coal power plants worldwide that are currently in operation or under construction could not only still be in service, but could also still have a remaining lifetime of at least 20 years. Co-firing with a 20% share of ammonia could reduce the 6 GtCO2/yr annual emissions of these coal plants by 1.2 GtCO2, provided that the ammonia was produced from low-carbon hydrogen. Reaching a 20% blending share would result in an annual ammonia demand of 670 Mt, more than three times today’s global ammonia production.

The Future of Hydrogen, International Energy Agency, June 2019

The pro rata Japanese share of the notional 670 million tonnes of ammonia demand would be approximately 35 million tonnes. This means that implementation of a co-firing strategy in Japan alone would increase global demand for ammonia by approximately 20%. To be clear, we are talking about 35 million tonnes of annual demand for ammonia with a certified carbon footprint below a very low (but as-yet undetermined) threshold. For an industry that is currently working toward implementation of hard, at-scale assets that will demonstrate the technical ability to produce green ammonia (the green ammonia initiative at Yara’s Pilbara plant in Australia is a prominent example), a demand signal of this nature could be the starting gun that launches ammonia into the energy transition.

Economic Context

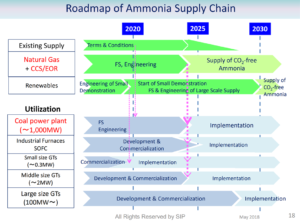

What are the prospects of Japan starting down this path of demand creation in earnest? The Ammonia Roadmap published last year by the country’s Strategic Innovation Promotion Program Energy Carriers initiative calls for engineering and feasibility studies through the first part of the 2020s. If the plan unfolds as projected, commercialization would occur sometime before 2025.

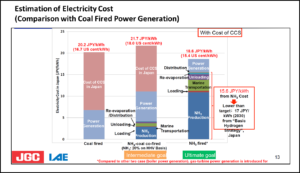

But for that to happen, a major economic challenge must be overcome. The Japanese engineering company JGC shared relevant facts and figures at the 2018 NH3 Energy Topical Conference in a presentation entitled “Cost Evaluation Study on Low Carbon Ammonia and Coal Co-Fired Power Generation.” According to JGC, the current levelized cost of electricity from coal-fired generation in Japan is approximately JPY ¥6.5 (USD $0.054 at the then-prevailing exchange rate) per kWh, while the levelized cost of coal-generated electricity with domestic CCS is projected at JPY ¥20.2 (USD $0.167). This cost difference raises one of the most daunting issues of the global energy transition: how much political will will be required to lead a national population through a major increase in the cost of a staple energy commodity, and how can such political will be mustered?

Adding the ammonia co-firing concept into the mix makes the economic challenge more daunting still. Under JGC’s scenario, the ammonia for co-firing is produced in the United Arab Emirates in conjunction with full capture of CO2 from both “fuel” and “feedstock” phases of production. When the resulting ammonia is imported and applied at a 20% co-firing rate, the electricity cost rises to JPY ¥21.7 (USD $0.180) per kWh.

The obvious question raised by this circumstance is, if both processes yield low-carbon electricity, but the one with ammonia costs more, why bother with ammonia? The answer is shown in the third cost bar on the relevant presentation slide. Electricity produced by burning imported green ammonia in a gas turbine is projected to have a lower cost position than either of the other two options: JPY ¥18.6 (USD $0.154). One imagines that the two scenarios on the left are presented as thought experiments rather than practical stepping stones. An alternative path might involve co-firing coal with green ammonia (without any domestic CCS) for some proportion of the useful life remaining for some proportion of Japan’s fleet of coal-fired generating stations, with electric-sector capacity replacements and additions taking the form of ammonia-fired gas turbines.

Regulatory Context

The latter path may well have support in the right places. A well-informed observer in Japan recently told Ammonia Energy that the Japanese “electric utility industry is very much interested in [the co-firing] application of ammonia.” Why would this be the case? It may be corporate concern about the climate and/or a sense of duty to help create the Hydrogen Society. But reporting in the Japanese press over the last several months reveals that another dynamic may be at play.

The strands are woven together in a story published on February 5, 2019 in the Nikkei Business Daily. (Headline: “For JERA, a path opens for renewable energy as coal-fired thermal power faces unprofitable backwinds”). The story’s jumping-off point is the rapid-fire cancellation “since the end of 2018” of planned investments in coal-fired generating capacity across several Japanese prefectures. In Chiba Prefecture, for example (part of the greater Tokyo region) Chugoku Electric Power and JFE Steel have canceled plans involving 1 GW of coal-fired generating capacity.

The story goes on to explain that the economic and risk profiles of coal-fired generation in Japan have shifted seismically since 2015 when many of the now-canceled plans were originally conceived. At the time, according to an industry source, the plan was to “conquer the [Tokyo] metropolitan area’s [electricity market] liberalization competition by supplying large-scale coal-fired power and cheap electricity.” This was based on an anticipated cost of JPY ¥12.3 (USD $0.102) per kWh for coal and JPY ¥13.7 (USD $0.113) for natural gas. (The figures are from the Ministry of Economy, Trade and Industry. The story implies that they are estimates for the levelized cost of electricity from newly constructed capacity.)

In 2016, the Japanese government adopted new energy efficiency standards for electricity generation. One effect for companies using coal was the need to add high-efficiency generating capacity (such as “ultra-supercritical” steam technology) to offset the low efficiencies of legacy capacity. Three years later, a variety of industry players all came to the same conclusion: adding high-efficiency generating capacity fueled by coal would produce electricity at a higher cost than that produced from natural gas.

Adding to the risk quotient, according to the story, is the emerging sense that coal is a pariah fuel, no longer appropriate for use in a progressive economy. The story mentions the Powering Past Coal Alliance, a 30-nation coalition whose members include the United Kingdom, Denmark, and Canada, and whose mission is to “advance the transition away from unabated coal power generation.” The story points out that “large-scale coal-fired thermal power plants are often involved in long-term project finance such as 15 years, but there may be a possibility that investment can not be recovered due to policy changes . . . within the period. From now on, it will be necessary to make decisions on new construction and rebuilding of coal with great risk.” And indeed, the story continues, “in Japan, financial institutions have begun to discontinue investment in coal-fired power plants in principle, with a focus on institutional investors’ ESG [environment, social, corporate governance] investment.”

To the outside observer, it appears that the energy transition is well and truly underway in the Japanese electricity sector. Plausible stages of evolution toward substantial decarbonization have been mapped. Ammonia has been tagged for a significant role in the end state. But it also appears that the practical steps that will lead from the status quo to the end state remain works in progress, with much more work to be done than progress so far completed. In this context, the ammonia-coal co-firing concept may be the key to the future.