The view from Japan: 2025 shaping as a pivotal year for ammonia energy

By Julian Atchison on February 26, 2025

At the Clean Fuel Ammonia Association’s 6th international symposium this February, progress for ammonia energy in Japan was on full display. Imports of low-emission ammonia fuel have been proposed for more than a decade to meet Japan’s decarbonisation needs, but in 2025 the pieces are rapidly assembling to enable and accelerate these arrivals.

METI: two lots of financial support due this year

Japan’s METI is expected to announce the first recipients of CfD subsidies for fuel ammonia imports soon, with the scheme to be rolled out on a project-by-project basis.

Two significant lots of funding are due to be announced by the Ministry of Economy, Trade and Industry (METI) this year, under the Green Transformation scheme. GX (as the scheme is known) is a cross-sectoral, economy-wide decarbonisation effort, with a total of $1 trillion in government investment over the coming decade.

Of this, around $51 billion is earmarked for hydrogen and ammonia investments, with the bulk going towards a long-term contracts for difference (CfD) scheme that subsidises the increased cost of these new fuels.

These contracts will be based on the delivery of low-emissions ammonia to Japan by an overseas producer, in annual lots, over a multi-year timeframe – similar to H2Global’s market-making instrument. The first production projects to receive CfD subsidies are expected to be announced shortly, with METI indicating that the scheme will be rolled out on a project-by-project basis. Imports to Japan will need to commence by 2030.

But METI will also look to support development of crucial import enablers, particularly infrastructure.

Import infrastructure

Over the next decade, METI will give support for the development of:

…about three large-scale hydrogen/ammonia clusters, mainly in metropolitan regions, and about five medium-scale hydrogen/ammonia clusters that will take advantage of their [existing] industrial characteristics.

From Overview of Basic Hydrogen Strategy (METI, June 2023)

At Ammonia Energy we have been tracking plans to retrofit existing Japanese industrial hubs to allow for expanded ammonia imports. These include two examples where import infrastructure developers are looking to match handling capacities with the volume of ammonia being produced overseas: the Namikata LNG terminal, which (via project partners) is linked to ExxonMobil’s Baytown ammonia project in Texas; and Idemitu’s Tokuyama complex, which is linked to Proman’s Lake Charles ammonia project in Louisiana.

Click to learn more. Idemitsu is leading plans for re-development of its Tokuyama complex to handle large volumes of ammonia imports. Source: Idemitsu Kosan.

Both terminals are looking at handling volumes of over one million tons per year of ammonia, matching the capacity of the US-based production projects. Both Namikata and Tokuyama sit within the Chogoku region of Japan, which last June launched a wide-ranging strategy for industrial decarbonisation.

Other examples include proposed ammonia supply & distribution hubs in Hokkaido and Fukushima, with both initiatives led by IHI Corporation. The first cluster projects to receive METI subsidies will be announced later this year, with the winners likely to be based at existing industrial sites.

Commercialising power generation technologies

Click to enlarge. Progress on IHI’s 2 MW, ammonia-fired gas turbine, including long-term durability tests. From Toshihiro Fujimori, Gas turbine technology development for fuel ammonia (Nov 2024).

Now, Ammonia Energy is definitely your go-to for all updates on ammonia-fired power generation, but seeing progress in real life is something else! Visiting IHI Corporation’s Yokohama R&D headquarters, the author was able to walk up and touch the 2 MW test turbine for ammonia, and get a sense of the footprint of an ammonia turbine installed for power generation (including fuel storage and supply, exhaust aftertreatment and venting). As explained at the AEA’s 2023 annual conference, long-term durability testing of an installed 2 MW turbine has been ongoing since July 2024 at IHI Aioi facility, with a view to further demonstrations, and then commercial availability, in the next few years.

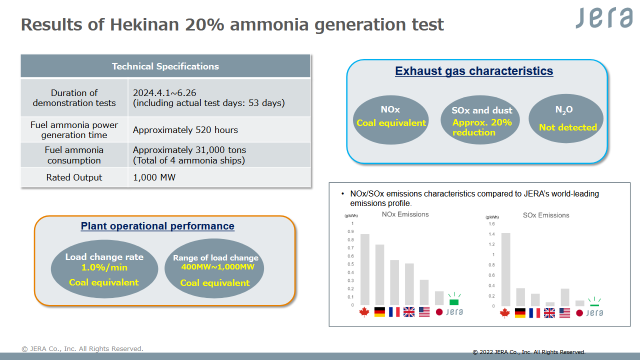

Click to enlarge. Results from the 20% coal co-firing trial at the Hekinan power plant. From Naoki Tsutsumi, JERA’s Decarbonization Initiatives: Hydrogen and Ammonia as an Alternative Sustainable Fuel (Nov 2024).

IHI is also JERA’s partner in ammonia coal co-firing efforts at the Hekinan power plant, and 20% co-firing trials produced excellent results last year. Work is now underway to commercialise co-firing, expand the fuel substitution above 20%, and potentially apply the retrofits to an additional unit at Hekinan. IHI’s testing of marine engines is also well-advanced.

Maritime fuel: more players joining the fray

Mitsui O.S.K. Lines is a regular feature at Ammonia Energy, having already adopted ammonia fuel as a key part of its long-term decarbonisation strategy. But 2025 has already seen new players showcase their progress in Japan.

Click to learn more. NYK Line’s Sakigake tugboat began commercial operations on ammonia fuel in August 2024. Source: NYK Line.

NYK Line’s demonstration of the retrofitted Sakigake tugboat in August last year completed a remarkable journey – with Japan’s first LNG-powered vessel becoming its first ammonia-powered vessel. NYK Line’s net-zero by 2050 strategy includes ammonia fuel. As well as the Sakigake, mid-sized ammonia gas carriers are due to hit the water in 2026. Upscale of ammonia-fueled vessel deployment is scheduled to start in 2035. Recently, NYK received AiP for a new ammonia-fueled ammonia bunkering vessel design.

From the marine engine side, MAN ES is following up its development progress in Europe with progress in Japan, where local partner Mitsui E&S has begun commercial testing of a large-bore 2-stroke ammonia engine.