Toyota, 7-Eleven to Cooperate on Low-Carbon Convenience Stores

By Stephen H. Crolius on June 28, 2018

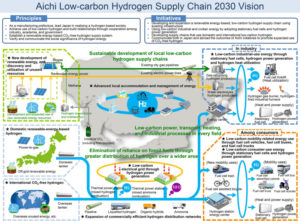

Last month, one Ammonia Energy post discussed Toyota’s participation in a Low-Carbon Hydrogen Project in its home prefecture — including implicit support for ammonia as a hydrogen carrier. Another post discussed Japanese manufacturer IHI’s plans to commercialize a small-scale combined heat and power system (micro CHP) based on direct ammonia solid oxide fuel cell technology. Now, according to a June 6 Toyota Motor Corporation press release, Toyota and micro CHP have converged.

The announcement served as the unveiling of a “joint project” by Toyota and the convenience store chain 7-Eleven to develop “next-generation convenience stores aiming to considerably reduce CO2 emissions.” The two companies initially agreed to cooperate in August 2017 on “considerations toward energy conservation and carbon dioxide emission reduction in store distribution and operation.”

7-Eleven was founded in the United States in 1927 but since 1991 has been majority-owned by Japanese investors. A strong majority of the chain’s 64,000 stores are in Asian countries. The 20,000 in Japan dwarf the U.S. population of 8,000 stores.

Distribution.” Shigeki Tomoyama. Toyota Motor Corporation. 6/6/18.

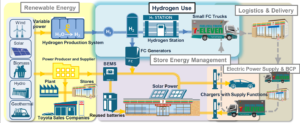

The technological heart of the C-store project is a down-scaled version of the proton exchange membrane / polymer electrolyte (PEM) fuel cell that powers Toyota’s Mirai fuel cell vehicle (FCV). A stationary version of the device, rated at 10 kW instead of the Mirai’s 144 kW, will be installed at selected 7-Eleven stores. It will be paired with a stationary battery that has an energy storage capacity of 10 kWh, or any desired multiple of 10 kWh. The battery systems will incorporate second-life batteries retired from vehicle use.

This initial version of the system is intended to displace a relatively modest portion of a store’s electricity consumption. Convenience stores in the United States have an average electricity draw between 20 and 70 kW, depending on store size and retailing profile. A formal study of convenience store energy consumption in Taiwan found an average electricity draw of 53 kW across 30 stores. These numbers are consistent with the C-store project’s intention “to increase renewable energy use in stores to 20 percent and reduce CO2 emissions by 27 percent compared to FY 2013 by 2030.”

The system will be controlled by a building energy management system (BEMS). The BEMS will monitor “the power consumption situation of the store” and manage the outputs of the fuel cell and energy storage “with the optimum power supply configuration.” The BEMS will also be able to accommodate electricity generated from an on-site photovoltaic array.

(The announcement does not mention the use of byproduct heat from the fuel cells. Given that 50-60% of convenience store electricity consumption is used for refrigeration, project managers may investigate the possibility of applying the byproduct heat to this use via absorption chilling technology.)

EV charging stations in store parking lots will feature both slow-charging (level 2) and fast-charging (CHAdeMO) capabilities. The charging stations will have bidirectional functionality so that “in the event of a disaster, electricity can be supplied from the EV, PHV [plug-in hybrid vehicle, or] FCV connected to the charger in cooperation with the BEMS to the store.” A Toyota presentation on the concept indicates that FCV hydrogen fueling will also be put on offer.

The Toyota press release also announced that the company would unveil fuel cell delivery trucks in the spring of 2019 and that these vehicles “will be introduced in the distribution process” at 7-Eleven. The trucks will have relatively large batteries (235 kWh) to accommodate an intended 200 km range and support for on-board refrigeration while the trucks are parked. They will also include power export capacity, allowing the trucks to power stores in disaster scenarios.

From an ammonia energy perspective, the central question is how hydrogen will be supplied to the stores. A key objective of the project is “to shift energy used in stores to renewable energy and low carbon hydrogen.” Given the short timeline to launch of the first next-gen store (fall 2019), the question of how to supply low-carbon hydrogen is pressing.

Micro CHP units currently in the Japanese market for residential applications (Ene-Farms) run on natural gas, a use case that involves integration of a module for natural gas reforming. The project partners appear to have ruled out this option. For one thing the hydrogen is brown, not green. For another, Toyota’s Mirai fuel cell is not equipped with a natural gas reformation module.

Toyota’s Low-Carbon Hydrogen Project announcement in May acknowledged ammonia as a potential hydrogen carrier, indicating that hydrogen fueling stations could be supplied by ammonia that is converted to hydrogen by an on-site system. However, the first conversion device to reach the market in Japan is likely to be the one that was announced by Sawafuji Corporation, also in May, and this is not scheduled for commercial introduction until 2020.

Given these conditions and constraints, it was all but inevitable that the partners would go with liquid hydrogen as the logistical solution. Confirmation that this is the case comes not from an explicit statement in the press release, but from this sentence: “Boil-off hydrogen from the hydrogen station can also potentially be used.” Boil-off is a phenomenon associated with cryogenic liquids; it would be a factor in the project only if the plan is to supply hydrogen in liquid form.

The near-term plan to employ liquid hydrogen should not obscure the major takeaway from the story: Toyota and 7-Eleven are committed to low-carbon hydrogen in the practical context of their project. The divide between brown hydrogen and green hydrogen is huge. Brown hydrogen (in the form of natural gas) is nearly ubiquitous in Japan. Green hydrogen is essentially non-existent. It will be neither simple nor inexpensive to set up liquid hydrogen storage facilities at 7-Eleven stores (including a method of boil-off management), and the logistics chain to supply them. And whereas the poster accompanying Toyota’s May announcement includes a conceptual depiction of “CO2-free hydrogen” coming from both domestic and international sources, the practical reality of arranging a supply chain of this nature in the near-term is challenging.

In a Kankyo Business article about the C-store project, an unassuming quote appears that, without the foregoing context, would be easy to overlook: “In the future, we will consider efficient energy procurement methods and utilization at both companies.” This would seem to open the door to green ammonia as the hydrogen carrier with the most efficient — and cost-effective — supply chain.