Trinidad & Tobago: future production pathways for the world’s largest ammonia exporter

By Kevin Rouwenhorst on February 11, 2025

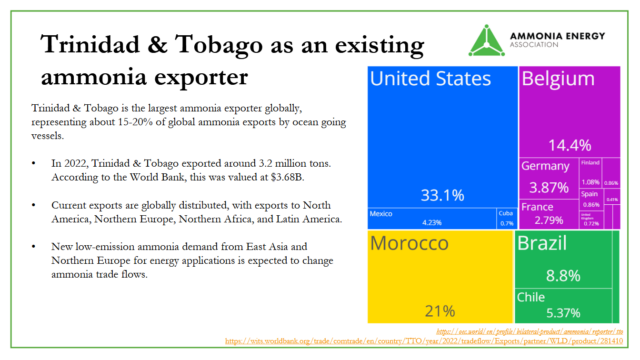

Click to enlarge. Trinidad & Tobago as an ammonia exporter, with destination countries. From Kevin Rouwenhorst, January 2025 Project Features introduction.

In our January episode of Project Features, Dale Ramlakhan from the Energy Chamber of Trinidad & Tobago, and Marina Simonova from Argus Media discussed ammonia production in Trinidad & Tobago, as well as the trade and decarbonization of the ammonia. The recording is available on the AEA’s website, and you can also download the speaker presentations.

The global demand for ammonia is currently around 200 million tons. Of that, between 17-20 million tons is traded internationally via ocean going vessels. Trinidad & Tobago is the largest net ammonia exporter globally, with 3.2-3.6 million tons exported in 2022, valued at $3.65 billion. Point Lisas in Trinidad & Tobago is the largest ammonia supply hub in terms of gross ammonia capacity (5.67 million tons per year), surpassing other major ammonia production hubs like Donaldsonville in the United States, Mesaieed in Saudi Arabia, and Togliatti in Russia (all with 4-plus million tons per year installed ammonia capacity).

As seen above, the typical export destinations from Trinidad & Tobago include North America, Europe, northern Africa, and Latin America, with some exports to East Asia. Some of the ammonia importers aim to decarbonize ammonia supply, such as countries in Europe with the Carbon Border Adjustment Mechanism (CBAM). Countries such as Morocco aim to replace fossil ammonia imports with local ammonia production from water electrolysis coupled to renewables. Ammonia will also find new applications (such as maritime fuel or power generation) spearheaded by locations such as Europe and East Asia. This will further change the profile of global ammonia trade flows in the coming years. To keep their status, key current exporters like Trinidad & Tobago have some choices to make.

The role of Trinidad & Tobago in the evolving ammonia market

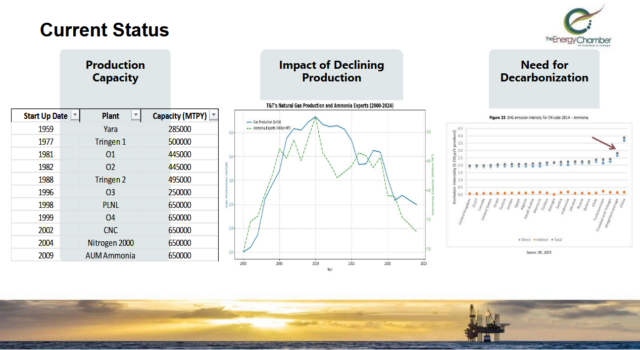

Click to enlarge. Installed ammonia production capacity, declining ammonia production, and the need for decarbonization in Trinidad & Tobago. From Dale Ramlakhan, Ammonia Sector in Trinidad and Tobago: A Path to Sustainability (Jan 2025).

Of the 17-20 million tons of ammonia transported by ocean going vessels, Trinidad & Tobago takes up around 15-20% of the global market. Decreasing gas supplies are now an issue for Trinidad & Tobago. Ammonia plants operating rates have decreased in recent years, to about 80% of installed capacity in 2024. Ammonia exports decreased from 4.6 million tons in 2019 to 3.6 million tons in 2024.

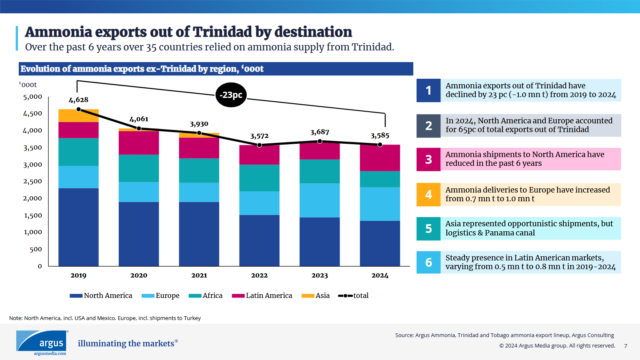

Historically, ammonia exports from Trinidad & Tobago were focused on the United States, but export locations have diversified in recent years. In 2024, North America and Europe accounted for about 65% of ammonia export from Trinidad & Tobago. This majority of trade being “west of the Suez Canal” is due to the cost of freight. Transport of ammonia from Trinidad & Tobago to the US Gulf Coast is estimated to cost USD 31-35 per ton with a MGC (Midsize Gas Carrier), with costs for transport to Europe and Morocco at around USD 50 per ton and USD 40-45 per ton. For reference, transport to South Korea is estimated to cost around USD 120 per ton. Total ammonia imports to the United States declined from 1.6 million tons in 2019 to 0.9 million tons in 2024. With various newbuild ammonia plants planned in the US Gulf Coast , that market share is no longer guaranteed.

Decarbonization of ammonia production in Trinidad & Tobago

Click to expand. Ammonia exports from Trinidad & Tobago, from Marina Simonova, Trinidad’s role in the evolving global ammonia market: new risks or opportunities? (Jan 2025).

The first ammonia plant in Trinidad & Tobago began operations in 1959, producing 250,000 tons per year. Then, gas feedstock was a byproduct from the oil industry. In the 1970s, the Point Lisas Industrial Estate was established, using the abundant gas resources now available, providing the necessary infrastructure for world-scale ammonia plants. The total installed ammonia production capacity is 5.67 million tons per year at Point Lisas, divided over 11 plants, with the last built in 2009. Around 17-20% of the gas in Trinidad & Tobago is used for ammonia production, with LNG export accounting for about 40-45% of the gas use.

As mentioned, the gas supply has been in decline since 2010, and the decarbonization of ammonia supply in Trinidad & Tobago is required to meet emerging low-emission ammonia markets. In this context, a roadmap for decarbonization of hydrogen and ammonia production was released in 2022, led by KBR, the Inter-American Development Bank and Trinidad’s National Energy Corporation.

As a result of this roadmap, various ammonia decarbonization initiatives are ongoing, including a carbon capture and storage (CCS) project, which received support from the Green Climate Fund (GCF) of the United Nations Framework Convention on Climate Change (UNFCCC). Universities and oil & gas producers perform research on the wells for potential CCS in deep saline formations.

Trinidad & Tobago reports greenhouse gas emissions (direct and indirect) of around 2.4 ton CO2 per ton ammonia, according to the European Union (based on CBAM). This puts Trinidad & Tobago at a relatively high current carbon intensity compared to other global producers, so there is an imperative to decarbonize. Europe is an important export market for Trinidad & Tobago, with CBAM formally starting from January 2026. Thus, any emissions beyond the free allowances benchmark will be taxed in the EU Emission Trading System (ETS), which has traded in the range €60-100 per ton in recent years. Free allowances in Europe equate to around 1.53 ton CO2 per ton ammonia in 2026, declining to zero in 2034.

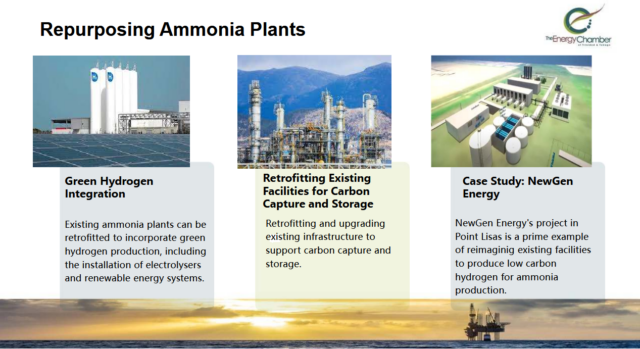

Click to enlarge. Repurposing ammonia plants in Trinidad & Tobago: options. From Dale Ramlakhan, Ammonia Sector in Trinidad and Tobago: A Path to Sustainability (Jan 2025).

Owing to the reduced utilization rates of the ammonia plants, supplementing these with electrolysis-based hydrogen feedstock is being considered. Most ammonia plants in Trinidad & Tobago can take 20-30% of external hydrogen injection, without major capital expenditures to the existing infrastructure.

The first retrofit project in this category is the NewGen Energy Project, which aims to produce around 2.2 tons of electrolytic hydrogen per hour from 130 MW of electricity, equivalent to about 108,500 tons of ammonia per year. Tringen, which is co-owned by Yara, will use the electrolytic hydrogen in its ammonia plant. The NewGen Energy Project aims to reduce CO2 emissions by 165,000 tons per year.

About 30 MW of the electricity will be supplied by solar PV, from a 92 MW solar energy project to be commissioned in 2025. The remaining 100 MW will be supplied by a retrofit of gas turbines, from single cycle gas turbines to combined cycle gas turbines. Trinidad & Tobago currently operates single cycle gas turbines, which typically have a gas to electricity efficiency of 35-42% (on a lower heating value basis). Steam is generated as a byproduct, which can be utilized to generate additional electricity in a steam turbine, increasing the overall gas to electricity efficiency to 55-60% in a so-called combined cycle gas turbine.

A total 400,000 tons of electrolytic hydrogen per year is required to achieve full operational rate in all ammonia plants in Trinidad & Tobago, equivalent to 2 million tons of ammonia per year. As Trinidad & Tobago is an island nation, on-land electricity generation via solar PV and wind is not scalable to the multi-GW requirements. Therefore, offshore wind is proposed, with a target for 2 GW of wind energy capacity by 2035, which is supported by European countries.

Trinidad & Tobago has the infrastructure and human capital in place, particularly since ammonia has been produced there since 1959. Some workforce reskilling will be required to transition to renewable hydrogen and offshore wind. This economic diversification from just oil & gas to also renewable energy allows Trinidad & Tobago to position itself as a Green Energy Hub, with job creation in the new sector.