Updated PGS-12 code: Preparing for increased ammonia imports to the Netherlands

By Kevin Rouwenhorst on August 16, 2024

In our July episode of Project Features, Mark Stoelinga (Port of Rotterdam), Gert Jan De Geus (OCI Global) and Tamme Mekkes (Chane) joined us to discuss current and future ammonia imports into the Port of Rotterdam, the Netherlands’ updated code for ammonia storage and handling (PGS-12), and the public perception of ammonia. The recording is available on the AEA’s website, and you can also download the speaker presentations.

The updated PGS-12 code

Currently, about 10% of global ammonia production (18-20 million tons annually) is shipped overseas, meaning that significant infrastructure already exists for ammonia storage and handling at a large number of global ports. Regulations, guidelines and industry best practices for large-scale imports also exist, and are in a constant state of revision and updating. To prepare for increased imports to the Port of Rotterdam, the Netherlands’ national code for ammonia storage and handling (PGS-12) has just undergone a lengthy update process, led by a joint public-private working group.

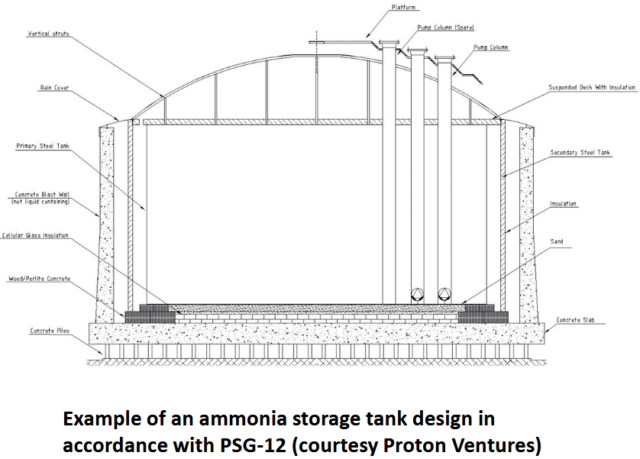

Click to expand. An ammonia tank design according to the updated PGS-12 code. Source: Proton Ventures.

On the infrastructure side, full containment storage tanks are the industry standard for ammonia storage at -33°C, with double integrity. This implies that two containments exist for ammonia (tank-in-tank design), namely the primary containment (the inner tank) and the secondary containment (the outer tank). If the primary containment fails, the entire liquid volume can be contained in the secondary containment. The vapour seal is gas-tight to prevent any ammonia leakages to the outside. Insulation is applied at the outside of the secondary containment.

Some key changes for the PGS-12 code in the Netherlands include: (i) submerged pumps for ammonia loading and unloading over the top of the tank (instead of at the side of the tank), and (ii) a tertiary concrete outer wall to minimize the effect of any external impacts.

Port of Rotterdam: preparing for increased imports of hydrogen and ammonia

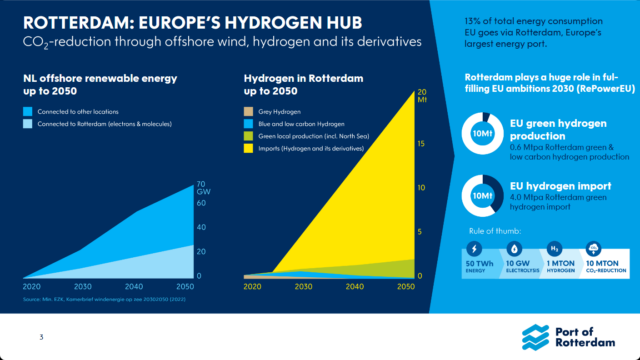

Click to expand. Production and import of hydrogen and hydrogen derivatives at the Port of Rotterdam – ambitions to 2050. From Mark Stoelinga, Rotterdam: Europe’s Hydrogen Hub (July 2024).

The Port of Rotterdam is the largest port in Europe. About 13% of all energy utilized in Europe each year passes through the Port. Part of this energy is transported further inland via pipelines or other transport modalities (such as river barges) to North-Rhine Westphalia in Germany, the southern part of the Netherlands, and Belgium. As we transition away from fossil fuel energy imports, the Port of Rotterdam will play a key role in the imports of low-emission energy into Europe. The Port itself aims to produce about 2 million tons of hydrogen equivalents per year by 2050, with 18 million tons of hydrogen equivalents being imported. Low-emission ammonia has a significant role to play in future hydrogen imports to Rotterdam.

Click to expand. Announced hydrogen terminal projects at the Port of Rotterdam. From Mark Stoelinga, Rotterdam: Europe’s Hydrogen Hub (July 2024).

Many of the intercontinental hydrogen transport projects under development consider ammonia as the preferred transport modality. Therefore, the number of ammonia terminals in the Port of Rotterdam is set to increase to allow for increased import capacities. Currently, only OCI Global operates a terminal. Announced new terminals for ammonia imports include: (1) ACE Terminal, (2) Air Products & Gunvor, (3) GES & Gunvor, (4) VTTI Amplifhy, and (5) Chane. Methanol terminals, liquid hydrogen terminals, and LOHC (liquid organic hydrogen carriers) terminals are also being developed in the Port of Rotterdam to allow for the import of other hydrogen derivatives.

The OCI Terminal Europoort

OCI Global operates a working ammonia terminal in the Port of Rotterdam: the OCI Terminal Europoort. Ammonia is imported to OCI’s terminal in Rotterdam from OCI’s production facilities in the United States and Fertiglobe’s production facilities in the Middle-East. Recently, it was announced that Fertiglobe won H2Global’s first ammonia auction, and will ship renewable ammonia from Ain Sokhna (Egypt) to OCI’s terminal in Rotterdam from 2027.

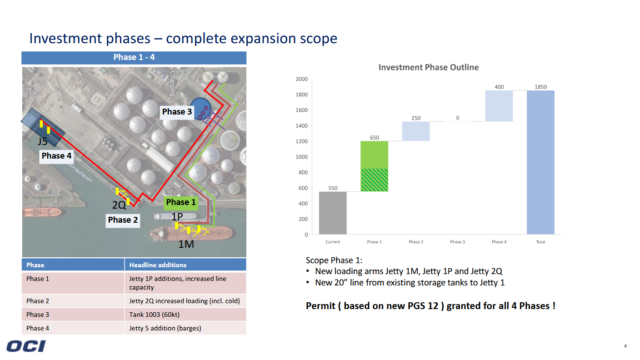

Click to expand. OCI Terminal Europoort expansion scope. From Gert Jan de Geus, OCI & OCI Terminal Europoort B.V. (July 2024).

The OCI Terminal Europoort allows for the import of refrigerated, liquid ammonia by ship. Ammonia is stored in two storage tanks with a capacity of 15,000 tons each. The tanks were built in the late 1960s, andrenovation on the inside of the tanks was completed in 2017, while the renovation on the outside of the tanks was completed in 2022. From Rotterdam, ammonia is further transported via barges, coasters, or railcars. OCI has a fleet of over 300 ammonia rail tank cars in Europe, which is the largest fleet on the continent.

OCI aims to expand its current terminal to increase ammonia throughput, from the current 550,000 tons per year to a capacity of up to 2 million tons per year. Expansion will progress in 4 Phases, and permits for the full project have already been granted.

FID has already been taken for Phase 1, which is new ammonia loading and unloading infrastructure for ships, barges and coasters. At a later stage FID is expected for the next phases, depending on whether the demand for imported ammonia volumes will grow as expected. Phase 2 entails an increased ammonia loading infrastructure for cold ammonia. Phase 3 entails a new 60,000 ton, full containment ammonia storage tank. Phase 4 entails additional barge loading capacity for ammonia transport into Europe. During the permitting application, OCI cooperated with the permitting authorities to set a new best available technology (BAT) reference for ammonia storage tanks, with the requirements and design specifications ultimately being adopted as part of the updated PGS-12 code.

Chane: The Rotterdam NH3 import hub and downstream distribution

Chane is an independent bulk terminal operator for bulk liquids such as vegetable oils, biofuels, chemicals, and fossil hydrocarbons, with 22 terminals in Europe. Chane already operates an ammonia import terminal in Lisbon (Portugal), and has 5 existing terminals in Rotterdam. Chane aims to build an ammonia terminal in Rotterdam at one of its brownfield sites, namely the CTNM terminal. This terminal already has 1.4 million cubic meters of storage capacity. Benefits of using a brownfield site include being fully zoned, easing permitting and allowances.

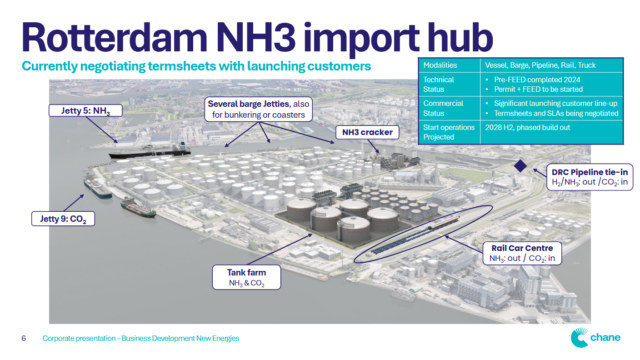

Click to expand. The Chane Rotterdam NH3 import hub. From Tamme Mekkes, Chane NH3 in Rotterdam, NL (July 2024).

Chane aims to build 5 ammonia storage tanks according to the PGS-12 code, each with 60,000 tons of cold ammonia capacity. This is a phased buildout starting from 2028-2029 with 2 or 3 storage tanks, with further buildout driven by customer demand. Various agreements with customers are already in place. Jetties for ships, barges, and coasters are also foreseen at the terminal. Space is also made available for potential railcar loading and for an ammonia cracker. Due to delays in the hydrogen pipeline from the Rotterdam area to the Ruhrgebiet in Germany, the ammonia cracker is not part of the first phase plans.

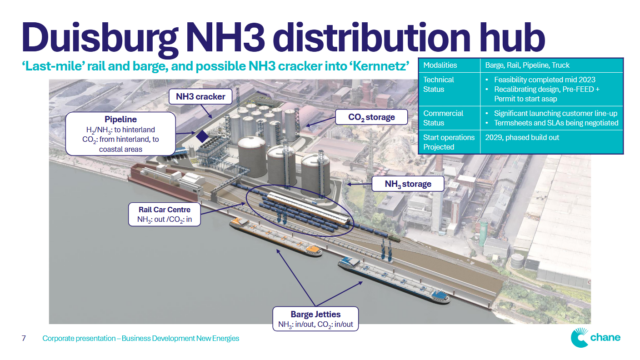

Click to expand. The Chane Duisburg NH3 distribution hub. From Tamme Mekkes, Chane NH3 in Rotterdam, NL (July 2024).

Given that a hydrogen pipeline or ammonia pipeline between Rotterdam and the Ruhrgebiet in Germany is not likely to be realized in the coming few years, Chane is also considering an ammonia distribution hub in Duisburg (Germany). Ammonia will be shipped by barge from Rotterdam to Duisburg, and then be distributed by pipeline, railcars, and barges. Alternatively, an ammonia cracker for hydrogen production can be co-located with the 3 foreseen ammonia storage tanks (20,000 tons capacity each).

Public perception

Public acceptance is key for realizing ammonia infrastructure, especially in populated areas such as Rotterdam. As previous studies in Mexico and the United Kingdom indicate, convincing the public of the necessity of large-scale ammonia imports is difficult without presenting relevant information. In this context, Chane performed a public perception study with an Emeritus Professor from the Erasmus University of Rotterdam. Over 60 face-to-face interviews were held with international industry representatives and government organizations. Two main conclusions were drawn from the study, namely that (1) ammonia could and will likely play an important role in the energy transition, together with other modalities, and (2) clear communication is required regarding the risks of ammonia storage and handling, but also regarding the ability of industry to store and handle ammonia in a safe manner. Joint messaging from all involved organizations (industry, governments, permitting authorities, associations, and academia) is required on the necessity, risks, and ways to mitigate risks for safe storage and handling of ammonia.

The updated PGS-12 code is a prime example of the Dutch “Polder model” wherein industry, government institutions, and permitting authorities worked together toward a design code for ammonia storage tanks, which is safe and acceptable to all parties. Building on these efforts and using joint messaging, development partners will be able to approach local communities to explain the plans, show how ammonia storage and handling can be done safely with the best available technology (BAT), and meet all the requirements included in the modern, updated PGS-12 code.