Hydrogen Fueling Station Development in Japan

By Stephen H. Crolius on February 03, 2017

Two announcements – focused on very different approaches for supplying hydrogen as a transportation fuel – shine a light on Japan’s approach to creating a national hydrogen energy economy.

On January 24, the American company Air Products and Chemicals, Inc. issued a press release about the launch of the Shikaoi Hydrogen Farm fueling station in Hokkaido, Japan. The station will be supplied by hydrogen derived from agricultural wastes via anaerobic digestion and Air Products’ biogas purification and steam methane reforming (SMR) technologies. The project was undertaken by a consortium that includes the Japanese companies Nippon Steel and Sumikin Pipeline & Engineering, Air Water, Inc., and Kajima Corporation.

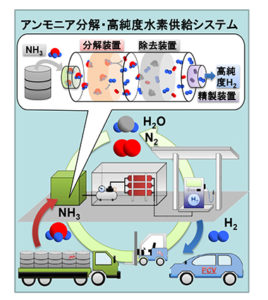

Six months earlier, on July 19, 2016, the Japan Science and Technology Agency (JST) announced that another consortium – this one led by Hiroshima University and including Showa Denko, Taiyo Nichi Company, Toyota Industries and the National Institute of Advanced Industrial Science and Technology – had succeeded in developing “viable technology to produce high-purity hydrogen [from an] ammonia hydrogen station.”

Japan’s approach to remaking its energy sector is top-down, with hydrogen assigned a major role in the Fourth Strategic Energy Plan, and oversight of critical Plan elements delegated to a variety of governmental ministries and agencies. But it is also bottom-up in its recognition that the optimal configuration of energy systems cannot be dictated from above but must be discovered and developed by decentralized groups variously cooperating and competing with each other. These two announcements illustrate the bottom-up advocacy for technologies that will likely find a balance of coexistence and competition.

The Hiroshima University group set out with three goals. First was the development of a “highly active, highly durable ammonia decomposition catalyst.” Second was an “ammonia removal material” that can radically reduce the concentration of residual ammonia in the decomposition product while also showing an acceptable useful life. Third was a “purification technology capable of achieving 99.97% hydrogen purity.”

Hiroshima University scientists addressed the first challenge with a ruthenium-magnesium-oxide catalyst. Toyota and Showa Denko addressed the second challenge with a bisulfate-based system that has high capture rates and excellent thermal regeneration performance. Taiyo Nippon Sanso Corporation addressed the third challenge with a purification method that can segregate hydrogen from nitrogen and other impurities. The final product meets the international standard for fuel-cell hydrogen purity with an ammonia concentration of less than 0.1 parts per million. This result, according to the JST announcement, is “a major evolution of the technology for the use of hydrogen fuel in fuel cell vehicles.”

The Hiroshima University project was sponsored by the Cross-Ministerial Strategic Innovation Promotion Program (SIP) under the Government of Japan Cabinet Office, with specific management by the Japan Science and Technology Agency.

The Shikaoi Hydrogen Farm is the culmination of a multi-decade process of developing energy facilities adapted to Japan’s northern island of Hokkaido. Anaerobic digestion of dairy farm wastes has been demonstrated on the island since the 1970s. A next-generation plant based on accumulated experience went into operation in 2007. Its feedstock is collected from local farms and transported to the digesters by vacuum truck. According to an analysis performed in 2010, the biogas plant operates at a profit, largely on the strength of disposal fees charged to participating farmers and sales of generated electricity. The fueling station interface was built in 2016 under a five-year program sponsored by the Ministry of the Environment.

The plant sells electricity at ¥9 ($0.08) per kWh. The value for the biogas implied by this figure is ¥1,042 ($9.14) per thousand MJ. (A net gas-to-electricity energy conversion efficiency of 40% is assumed.) According to figures compiled by the United States Department of Energy (USDOE), the cost of hydrogen produced from methane feedstock via SMR at distributed plants is approximately $3.80 per kilogram when natural gas is priced at that level. (American readers may want to keep in mind that a kilogram of hydrogen embodies essentially the same amount of energy as a gallon of gasoline.) This means that the hydrogen dispensed at the Shikaoi Hydrogen Farm can be sold at approximately the current price of Japanese gasoline (¥127 per liter-equivalent or $4.23 per gasoline-gallon-equivalent).

This is clearly a success story. Yet a major factor underlying the Shikaoi Hydrogen Farm’s positive economics is the shortness of the energy supply chain. The vacuum trucks travel only a few tens of kilometers in transporting the feedstock to the plant. Hydrogen is then produced and dispensed without the need for further transportation. When on-site SMR using a locally sourced, sustainable feedstock is not possible, hydrogen fueling station economics become more challenging.

This point is illustrated by a December 2015 California Energy Commission report on the first 49 hydrogen fueling stations constructed in the state with the Commission’s financial assistance. Air Products is by far the largest player in California’s hydrogen fueling program – by all accounts one of the world’s most ambitious – serving as either the lead developer or the technology provider for 30 stations. The hydrogen production method used for 29 of these 30 stations is not on-site SMR. It is gaseous hydrogen delivery. (The 30th station uses pipeline delivery.)

The Commission report states that the levelized cost of hydrogen for the Air Products’ gaseous delivery stations ranges from $12.40 to $13.00 per kilogram. If Japanese hydrogen were priced at this level, drivers would pay approximately ¥400 per gasoline-liter-equivalent, a 3.2X multiple of the current price of Japanese gasoline that outstrips even the higher energy efficiency of fuel cells vs. internal combustion engines (deemed to be 2.5 times more efficient by the state of California).

A significant increment of this excess cost comes from operating the gaseous delivery vehicles. Using industry figures, it can be calculated that a class 8 truck equipped to carry 27,000 kilograms of ammonia in a 300 psi pressure tank places a cost burden of $0.02 on each kilogram of the embedded hydrogen for every 100 kilometers traveled. Hydrogen trucks, however, transport their cargo in heavy tubes. Even with the substitution of composites for steel in the latest generation of tubes, according to USDOE figures, the trucks’ maximum payload is only 720 kilograms. This drives the cost per kilogram for each 100 kilometers to $2.35. The cost can go to $5.00 or more for trucks that are older and/or smaller.

Gaseous hydrogen delivery is not the only method used in California. Seven of the 49 California hydrogen stations employ liquid hydrogen delivery and seven employ on-site electrolysis. However, the economic profile for these methods does not differ much from gaseous delivery. The liquid delivery stations have a levelized cost of $9.90 per kilogram. The electrolysis stations have levelized costs between $17.90 and $24.00 per kilogram.

It is clear from these numbers why Japan is looking at energy carriers beyond molecular hydrogen for applications such as transportation fuel. And it is clear why a company such as Toyota, with its strong commitment to fuel-cell vehicles, is playing such an active role in the Hiroshima University consortium.

As reported in a January 11 post on AmmoniaEnergy.org, the U.S. Department of Energy’s REFUEL program is also looking to ammonia-based hydrogen fueling stations as “a viable path to affordable hydrogen refueling stations.”

The next step for the Hiroshima University ammonia-hydrogen station is a full-scale demonstration at Showa Denko’s Kawasaki Plant #3.