On the Ground in Japan: 5th Basic Energy Plan, LH2 Investment

By Stephen H. Crolius on July 12, 2018

Japan, widely recognized as a global leader in the development and implementation of ammonia energy, is a fascinating case study for advocates seeking a template for progress. But, as Ammonia Energy has documented in numerous posts over the last two years, even in Japan the path is neither linear, smooth, nor preordained. Two recent developments, one in the public sector and one in the private, illustrate anew the complexity of the evolutionary track the country is negotiating as it strives to create a sustainable energy economy.

Fifth Basic Energy Plan

On the public side, the Japanese Cabinet approved on July 3 the country’s Fifth Basic Energy Plan. The document replaces the previous plan which was adopted in April 2014. According to an article posted by Nippon.com, the plan “sets forth targets for Japan’s energy mix in, as well as addressing issues concerning long-term energy options with the year 2050 as their focus.”

As described in a September 2016 Ammonia Energy post, the Fourth Basic Energy Plan included a Strategy for Hydrogen & Fuel Cells which in turn provided the framework for the Strategic Innovation Promotion Program and the Energy Carriers initiative under which liquid hydrogen, liquid organic hydrides, and ammonia are being explored as methods of storing and transporting hydrogen.

A post on Nippon.com reports that the Fifth Plan is little changed from the Fourth. This appears to be a good news / bad news scenario for Japanese sustainable energy stakeholders. The good news is that the long-term embrace of renewables is confirmed: “The government will aim to make renewable energy Japan’s main source of power by 2050 and a policy to proactively tackle introduction and expansion of renewables.” The bad news is the failure of the Plan’s framers to deepen and extend its conceptual contours:

Many hoped to see incisive debates in meetings of the Ministry of Economy, Trade, and Industry committee that staged these talks. At the outset, however, Economy Minister Sekō Hiroshige expressed the idea that it is not necessary to change the energy policy framework, citing reasons including the lack of major technological changes since the fourth energy basic plan, and the debates lacked vigor. In its final form, the fifth basic plan merely stuck to the content of its predecessor.

“Japan’s Energy Basic Plan Avoids the Problems.” Nippon.com. July 11, 2018.

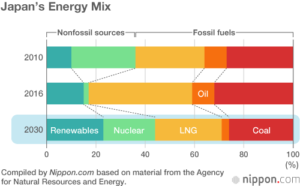

The lack of dynamism is reflected in the Plan’s 2030 targets for energy sourcing, which “have been left unamended, with the energy mix set at 20% to 22% nuclear power, 22% to 24% renewable energy, and 56% thermal power.”

The good news / bad news theme applies as well to the Hydrogen Strategy, which is included within a separate category of “next-generation” technologies. The Plan confirms “a policy of pursuing the feasibility of various other options . . . in addition to renewable energy, nuclear power generation, and thermal generation.” But, “there [is] little concrete discussion along these lines, and these future solutions do not appear in the target energy mix for 2050.”

A July 4 Nikkei Sangyo story on the Fifth Energy Plan (“Challenges to Nurture New Energy Basic Plan, Nuclear Expansion; Renewable Energy Dissemination Is Also Difficult”) did note the role that hydrogen (presumably in the form of an energy carrier) can play in supporting renewable electricity generation. Since renewable output “varies depending on weather and time zone . . . it is necessary to pursue combinations with new technologies such as high performance storage batteries and adjustment of output using hydrogen.”

Investment in Liquid Hydrogen

The Fifth Energy Plan presumably manifests enough continuity with the Fourth to allow private-sector players to invest in alternative energy technologies with confidence. That appears to be the case for a group of companies teaming in support of liquid hydrogen. As Ammonia Energy reported in September 2017, shipbuilder Kawasaki Heavy Industries, industrial gas company Iwatani, and electric utility Electric Power Development Company (which operates under the name J Power ) have been working with parties in Australia on a scheme to transport hydrogen from Australia in specially built liquid hydrogen tankers. The hydrogen would be derived from Australian lignite (“brown coal”) via a gasification process that would allow byproduct carbon dioxide to be sequestered in offshore oil fields.

A June 28 Nikkei Sangyo story (“Four Companies in Experiment to Utilize Hydrogen-Rich Coal”) reports that a new member of the group, trading company Marubeni, will take the lead to “build the supply chain for commercialization.” Along with a fifth company, Australian electric and gas utility AGL Energy, the partners announced plans to spend ¥35 billion ($315 million) on the project. The Nikkei Sangyo reports that the “Governments of Japan and Australia will also support the demonstration project by paying subsidies.” J Power will take the lead in constructing gasification facilities in Australia, while Kawasaki and Iwatani will build a “collection point for liquefied hydrogen” in Kobe City in Japan.

Construction is scheduled to begin in 2019. The transport of LH2 will commence in 2020 or 2021. Then, “if the demonstration project is going smoothly, commercial production will start at about 1 trillion yen” ($9 billion) in the 2030s.

Perhaps by the time of the Sixth Basic Energy Plan (which can be expected in 2021 or 2022), the Japanese Cabinet will take stock of the “technological changes” that have accrued in the field of hydrogen energy, including the comparative cases of LH2, liquid organic hydrides, and ammonia as hydrogen carriers, and commit to expanded and accelerated investment in technologies that can truly advance the Hydrogen Society.