On the Ground in Japan: LH2 and MCH Hydrogen Fueling Stations

By Stephen H. Crolius on April 13, 2017

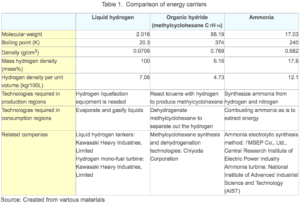

While Japan’s Cross-Ministerial Strategic Innovation Promotion Program (SIP) continues to evaluate liquid hydrogen (LH2), methylcyclohexane (MCH), and ammonia as hydrogen energy carriers, Japanese press reports show that the backers of liquid hydrogen and MCH are building an early lead over ammonia with hydrogen fueling stations based on their favored commodities.

LH2

On March 16, Mainichi Shimbun reported that the diversified industrial gas company Iwatani (annual revenues ¥616 billion / $5.6 billion) has put the finishing touches on Japan’s first “continuous charging” hydrogen station in Tokyo’s Ariake district. Iwatani claims to hold about two thirds of Japan’s delivered industrial hydrogen market (one third of which is delivered in liquid form). The Ariake station employs Linde hydrogen handling technology, including Linde’s “cryo pump” which “efficiently converts liquid hydrogen to high-pressure hydrogen”, according to Linde’s website. The Ariake station’s “continuous charging” feature appears to derive from Linde’s recently developed “ionic compressor” technology, which, according to a Linde press release, “enables higher throughput and enhanced back to back fueling.” The Mainichi story mentioned that, at current stations, drivers of fuel cell vehicles have sometimes been unable to refuel for up ten minutes following the fueling of a previous vehicle because of the time needed to restore compression in the hydrogen dispensing tanks.

MCH

One day earlier, Kyodo News reported that JX Energy had opened a hydrogen fueling station in Yokohama. The station is one of 40 that JX had planned to build primarily in the Tokyo region by the first quarter of 2016 and one of 2,000 that it envisions over the long-term. JX Energy is an operating unit of JX Nippon Oil & Energy Corporation, Japan’s largest oil company.

In an article published by Nikkei Asian Review in 2014, JX was said to be developing “technology that will allow hydrogen to be transported as a liquid at ordinary temperatures and pressures. This would allow volume per shipment to be increased 2.5 times compared with current methods that transport the gas as a pressurized gas. The company could also use current gasoline tanker trucks and ships, reducing investment costs.” The technology in question is apparently the MCH method of hydrogen transport. The essential idea is to produce MCH at the point of energy production by hydrogenating toluene, and then to dehydrogenate the MCH when it arrives at its point of destination. Three H2 molecules can be transported with every molecule of toluene. Scientists at JX Nippon Oil are known to be working on methods of toluene hydrogenation and dehydrogenation, including by electrochemical means. The petrochemical unit of JX Nippon Oil is a manufacturer of toluene.

Comparative Analysis

The Asia Biomass Office (ABO) has prepared a comparative analysis of the SIP energy carriers. The ABO is part of a Japanese non-profit organization that works with stakeholders in the energy sector. The analysis does not draw definitive conclusions, but does mention that ammonia “offers superior transport efficiency” relative to liquid hydrogen “since the hydrogen density per unit volume of ammonia is larger than that of liquid hydrogen.” It also observes that while ammonia technology allows for one-way transport from the site of production to the site of use, the toluene used for the MCH process, “will be returned to the energy producing regions and reused.”

Existential Challenge

And finally, Sankei Biz reported on March 17 that “interest in fuel cell vehicles (FCV) … has not risen and the pace of infrastructure development is slowing. Automobile manufacturers’ mass-production of FCVs does not proceed, and the operating ratio of hydrogen stations that fill the fuel is weak. In this state, achievement of the target of the country of about 40,000 FCVs and 160 hydrogen stations by 2020 is at risk.” The story says that hydrogen stations cost ¥400-600 million ($3.6 – $5.4 million) each, while the Nikkei article states that Iwatani is selling hydrogen at ¥1,100 ($10.00) per kilogram. (A kilogram of hydrogen has essentially the same amount of energy as a gallon of gasoline.) The Nikkei article says that government and corporate stakeholders see “new technologies in production and transport as essential in order to bring costs to under half of current levels.”

The Sankei Biz article makes clear that this cost pressure represents an existential challenge for Japan’s fuel-cell vehicle movement. The cost pressure also creates a heightened context for the breakthrough ammonia-to-hydrogen technology recently announced by Professor Shinji Kambara of Gifu University. As reported in Ammonia Energy News, the technology “is characterized by low cost, low environmental impact, and high efficiency”, and is highly applicable to the challenge of fueling hydrogen-powered vehicles. In Kambara’s mind, the situation is clear: “From now on, hydrogen will be stored as ammonia.”