On the Ground in Japan: Residential Fuel Cells

By Stephen H. Crolius on May 18, 2017

Last week Kaden Watch, a Japanese Web site for appliance news, reported that Tokyo Gas had delivered its 80,000th Ene Farm residential fuel cell system. This small news item, delivered by a niche media outlet, lifts a critical corner of the decidedly “big-tent” story of Japan’s strategy to develop a hydrogen energy economy. How the Ene Farm offering develops is likely to be a major factor in Japan’s ability to sustain its hydrogen vision — and possibly a determinant of the role ammonia could play within it.

But let’s start by zooming all the way out. As reported in February by Chisaki Watanabe in Bloomberg Markets, “Even with [Prime Minister Shinzo] Abe’s backing, hydrogen isn’t expected to play a dominant role as a source of energy in Japan any time soon. The nation’s 2030 power mix, an outlook published by the trade ministry in 2015, makes no mention of hydrogen.” Implication: in spite of the apparent national commitment and evident efforts by highly visible players, there is no guarantee that Japan will achieve a functioning hydrogen economy anytime in the foreseeable future.

For Hydrogen and Fuel Cell Towards Hydrogen Society.” Yoshihiro Shinka, New Energy and Industrial Technology Development Organization (NEDO). November 30, 2015.

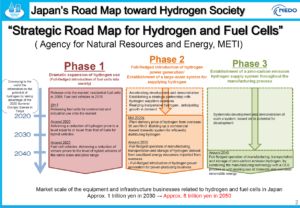

The country’s “Strategic Roadmap for Hydrogen and Fuel Cells,” was adopted in 2014 by the central government’s Cabinet precisely to guide the creation of a functioning hydrogen economy. The Roadmap embodies a strategy that looks surprising at first glance. It might have been expected that the plan would be to build hydrogen supply and demand by focusing public- and private-sector resources on high-volume industrial applications. Such an approach would plausibly develop and refine technologies so that relevant products could be adapted and cost-reduced for unsubsidized offer in consumer applications. However, the Roadmap turns this sequence on its head. In the first of its three phases, the main focus is on building hydrogen demand in consumer-oriented transportation and residential applications. In Phase 2, the focus will shift to industrial applications, including utility-scale power generation. And in phase 3 the focus will be on building the supply of renewable hydrogen.

In this schema, either residential fuel cell (RFC) systems – “energy farms” or “Ene Farm” units, according to a national branding campaign – or fuel-cell vehicles (FCVs) must take off in the marketplace in the near-term if the Roadmap strategy is to succeed.

For FCVs, the trajectory has been less than meteoric. Toyota introduced its FCV, the Mirai, in 2014. As of February this year, it had sold approximately 1,500 units in Japan (with almost none going to consumers). Honda introduced its Clarity FCV in March 2016 but announced that it would limit its first-year production to 200 units. The central government has set a target of 6,000 FCVs operating in Tokyo by the time of the Tokyo Olympics in 2020.

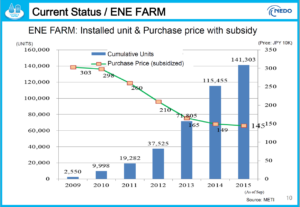

Fortunately, the situation is very different for RFCs. The devices, packaged in enclosures about the size of a refrigerator, convert natural gas into electricity and heat that can be used for hot water and space warming. Their maximum electric output is 700 watts. Panasonic, one of the main producers of the devices, claims 95% total energy efficiency. There is a polymer-electrolyte-membrane (PEM) version that incorporates a reformer to generate pure hydrogen. There is a solid oxide version that presumably can process natural gas without a fuel reformer. Panasonic says that its units yield savings on energy bills of ¥60,000 – ¥70,000 ($531 – $619) per year. Uptake has grown from 2,300 units in 2009, the year of commercial introduction, to 30,000-40,000 units in 2016. The central government has set targets that call for an installed base of 1.4 million units by 2020 and 5.3 million units by 2030. The country currently has about 50 million households.

Economics are critical to consumer acceptance of the Ene Farm product. The price of the units at the time of introduction was ¥2.8 million ($24,800) but a government subsidy of ¥1.4 million ($12,400) brought the net cost to the customer down to ¥1.4 million ($12,400). In the intervening years, the price and the subsidy have come down in lockstep. In February of this year, Tokyo Gas announced a pre-subsidy price “below ¥1.5 million” ($13,300), for a net cost to the consumer of approximately ¥1.2 million ($10,600), assuming the rate of subsidy announced in early 2015 is still in place. This means that a unit purchased today would have a payback period of approximately 18 years. This is at the far extreme of the units’ stated 80,000-hour useful life if they are turned off at night. The central government seems aware of the marginal nature of this value proposition. It has set a price target of ¥0.8 million ($7,100) for 2019, and has expressed the intention to continue its subsidy program for at least the next 50,000-100,000 units.

Toshiba, the other main producer of RFCs, estimates that units fueled with natural gas “can cut a home’s carbon dioxide footprint in half.” This is laudable, but more ambitious targets, involving less fossil energy and more renewable hydrogen, seem to be under consideration. Specifically, Fuel Cell Works reported in 2015 that Japanese researchers are “exploring hydrogen pipelines to support” RFCs. It is not clear what this exploration entails, but considerable work has been done elsewhere in the world to look at the question of pipeline-based transportation of hydrogen.

The good news about “last-mile” hydrogen distribution is that installation of brand-new gaseous fuel infrastructure will probably not be necessary. Hydrogen and the types of steel pipelines used for long-distance transport are a bad combination. Under the wrong conditions, such as high-pressure gas blends with a hydrogen proportion above 15%, hydrogen can embrittle mild steel, causing or propagating cracks and ruptures. The distribution lines used in municipal gas systems, however, operate at low pressure, and those installed over the last few decades tend to be made of polyethylene (PE) instead of steel.

The bad news is that the absence of “showstoppers” does not mean that energy utilities can start transporting even sub-15% mixtures of hydrogen in their natural gas distribution lines in a safe and cost-effective manner. Investigation, often followed by physical intervention, will need to be a applied on a meter-by-meter basis. The situation that pertains in Japan and elsewhere is likely captured by this summary from a British study:

“Steel and iron pipes, which were used prior to 1970, are susceptible to embrittlement if the hydrogen gas pressure is high enough. There is uncertainty about the threshold pressure below which the pipes can be safely used with hydrogen; it will almost certainly vary according to the type of steel or iron, as well as the pipeline microstructure, stress history and the type of welding used . . . Polyethylene pipes are more porous to hydrogen than natural gas so the quantity of gas escaping through the pipeline walls would be higher following conversion. Although leak-tight pipes transporting nitrogen have been found to leak profusely when transporting hydrogen, some EU-focused studies conclude that leakage from gas networks with hydrogen is likely to be small enough to not present a safety hazard . . . “

It is easy to imagine scenarios of transition in which hydrogen is injected into the natural gas supply in gradually increasing amounts, with concurrent refurbishment and upgrading of municipal distribution networks. An endpoint could be hydrogen of sufficient purity that fuel reformer units would no longer be necessary for the units based on PEM fuel cells (leading to a major decrease in the costs and prices of those units).

A different approach could also be envisioned: transition of the distribution system from natural gas to ammonia. Since ammonia does not have material compatibility issues with steel or PE, the investment needed in this case for changes and upgrades is likely to be less. For customers who own solid oxide RFCs, the change could be seamless. The challenge is that ammonia does not lend itself to the gradual and organic transition that the hydrogen approach would allow.

But this is looking a long way down the road. First, over the next three years it’s important for the Ene Farm units to validate the essential Strategic Roadmap. The Bloomberg Markets article contains a telling quote: ‘‘’It’s not until 2020 before we figure out how much we can increase hydrogen power generation,’ said Hiroshi Katayama, deputy director of the hydrogen and fuel cells strategy office at the trade ministry, referring to an ongoing study on hydrogen supply chain. “’There is a lot to do until 2020.’”